filmov

tv

How To Calculate The Future Value Of Money (An Investment) Explained - Time Value Of Money

Показать описание

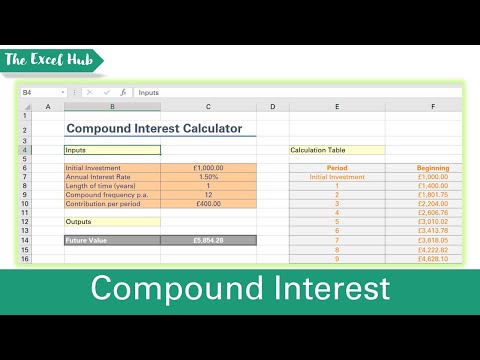

In this video we discuss how to calculate the future value of money, or an investment. We go through the formula for future value and show a few examples going through the calculations

Transcript/notes

The formula for calculating the future value of money is, future value equals, the present value, times the quantity, 1 plus r, divided by n raised to the n times t.

In this formula, present value represents the value today of an amount, r represents the yearly interest rate, n represents the number of compounding periods per year and t represents the time in years.

As an example, let’s say that someone invests $2000 in an account that pays 7.5% interest per year. The interest is compounded quarterly, so 4 times per year. What is the future value amount after 5 years?

Using the formula, we have future value equals, $2000, times the quantity, 1 plus .075, the decimal value of the yearly rate of 7.5%, divided by 4, the number of compounding periods per year, raised to 4, the number of compounding periods per year, times 5, the number of years.

.075 divided by 4 equals .01875, and 4 times 5 equals 20, and we have future value equals, $2000 times the quantity 1 plus .01875 raised to the 20. After the addition in the parenthesis, we have $2000 times 1.01875 raised to the 20. 1.01875 raised to the 20 equals 1.449948. Now we have $2000 times 1.449948, which equals $2899.90 rounded off.

So, the future value of $2000 at a yearly rate of 7.5%, compounded quarterly for 5 years is $2899.90.

And here are a couple of more examples on the screen for you of how to calculate the future value.

Chapters/Timestamps

0:00 Formula for future value of money

0:10 Definitions

0:22 Example problem for future value of money

1:30 More examples

Transcript/notes

The formula for calculating the future value of money is, future value equals, the present value, times the quantity, 1 plus r, divided by n raised to the n times t.

In this formula, present value represents the value today of an amount, r represents the yearly interest rate, n represents the number of compounding periods per year and t represents the time in years.

As an example, let’s say that someone invests $2000 in an account that pays 7.5% interest per year. The interest is compounded quarterly, so 4 times per year. What is the future value amount after 5 years?

Using the formula, we have future value equals, $2000, times the quantity, 1 plus .075, the decimal value of the yearly rate of 7.5%, divided by 4, the number of compounding periods per year, raised to 4, the number of compounding periods per year, times 5, the number of years.

.075 divided by 4 equals .01875, and 4 times 5 equals 20, and we have future value equals, $2000 times the quantity 1 plus .01875 raised to the 20. After the addition in the parenthesis, we have $2000 times 1.01875 raised to the 20. 1.01875 raised to the 20 equals 1.449948. Now we have $2000 times 1.449948, which equals $2899.90 rounded off.

So, the future value of $2000 at a yearly rate of 7.5%, compounded quarterly for 5 years is $2899.90.

And here are a couple of more examples on the screen for you of how to calculate the future value.

Chapters/Timestamps

0:00 Formula for future value of money

0:10 Definitions

0:22 Example problem for future value of money

1:30 More examples

0:00:23

0:00:23

0:04:43

0:04:43

0:10:03

0:10:03

0:03:04

0:03:04

0:12:07

0:12:07

0:00:31

0:00:31

0:04:17

0:04:17

0:09:51

0:09:51

1:53:41

1:53:41

0:01:01

0:01:01

0:06:08

0:06:08

0:04:25

0:04:25

0:10:42

0:10:42

0:03:25

0:03:25

0:06:59

0:06:59

0:13:33

0:13:33

0:05:10

0:05:10

0:12:17

0:12:17

0:08:07

0:08:07

0:06:02

0:06:02

0:00:15

0:00:15

0:11:40

0:11:40

0:00:26

0:00:26

0:02:25

0:02:25