filmov

tv

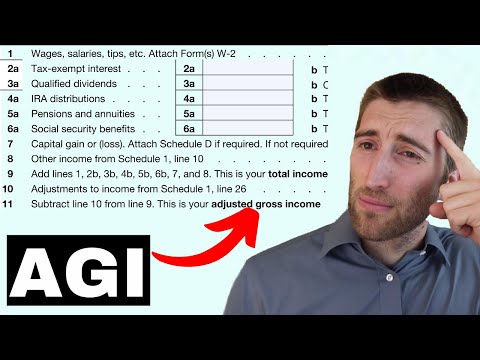

What is Adjusted Gross Income? (and why is it important?)

Показать описание

Arguably, the most important figure on your tax return is your Adjusted Gross Income (AGI). AGI determines eligibility for a wide range of tax deductions and credits. In this video, you'll have a brief look into what goes into computing this pivotal figure. And if you need your AGI to e-file your current year's return, this video will show you where to find it.

2023 UPDATE:

The Adjustment for Educator Expenses has been increased to $300 ($600 if married filing jointly and both are educators) for 2022.

Schedule 1 has been significantly altered and expanded, with Adjustments listed on page 2 of the form. Line items have been added for many additional "miscellaneous adjustments."

The Tuition and Fees Deduction is no longer available.

Resources and additional information:

For additional information of Student Loan Interest and Tuition and Fees Deductions:

The Tax Geek on The Site Formerly Known as Twitter: @taxgeekusa

Intro and background music: “Bluesy Vibes” - Doug Maxwell - YouTube Audio Library

DISCLAIMER:

The information presented in this video is for informational and educational purposes only, and is not intended to render tax advice for specific situations. If you have questions about your specific tax situation, please consult the resources linked above or consult with a qualified tax professional in your community.

The information contained in this video is based on tax law and IRS regulations as of the date of publication, and may be subject to change.

2023 UPDATE:

The Adjustment for Educator Expenses has been increased to $300 ($600 if married filing jointly and both are educators) for 2022.

Schedule 1 has been significantly altered and expanded, with Adjustments listed on page 2 of the form. Line items have been added for many additional "miscellaneous adjustments."

The Tuition and Fees Deduction is no longer available.

Resources and additional information:

For additional information of Student Loan Interest and Tuition and Fees Deductions:

The Tax Geek on The Site Formerly Known as Twitter: @taxgeekusa

Intro and background music: “Bluesy Vibes” - Doug Maxwell - YouTube Audio Library

DISCLAIMER:

The information presented in this video is for informational and educational purposes only, and is not intended to render tax advice for specific situations. If you have questions about your specific tax situation, please consult the resources linked above or consult with a qualified tax professional in your community.

The information contained in this video is based on tax law and IRS regulations as of the date of publication, and may be subject to change.

Комментарии

0:04:23

0:04:23

0:07:46

0:07:46

0:06:37

0:06:37

0:01:24

0:01:24

0:00:45

0:00:45

0:08:08

0:08:08

0:01:03

0:01:03

0:01:04

0:01:04

0:37:58

0:37:58

0:02:09

0:02:09

0:07:29

0:07:29

0:02:38

0:02:38

0:09:29

0:09:29

0:08:21

0:08:21

0:06:37

0:06:37

0:00:42

0:00:42

0:03:06

0:03:06

0:00:56

0:00:56

0:07:28

0:07:28

0:03:22

0:03:22

0:04:26

0:04:26

0:02:24

0:02:24

0:01:47

0:01:47

0:06:27

0:06:27