filmov

tv

Why the Debt Snowball Method Doesn't Work: How to Pay Off Credit Card Debt FAST

Показать описание

Want to learn how to pay off debt FAST? Don’t pay off debt using the debt snowball…instead, try this game-changing debt payoff plan.

If you’re paying off debt, you may have heard that the snowball method is the way to go…but that isn’t completely true. The Dave Ramsey snowball method may not be the best pay to pay off credit card debt. In this video, I’m showing you how to pay off debt fast without getting discouraged and losing momentum.

-----

----

✨FREE RESOURCES✨

RELATED VIDEOS:

COME SAY HI!

-----

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Dow Janes or any third party service provider to buy or sell any securities or other financial instruments.

#DowJanes #PersonalFinance #PayOffDebt #DebtSnowball

If you’re paying off debt, you may have heard that the snowball method is the way to go…but that isn’t completely true. The Dave Ramsey snowball method may not be the best pay to pay off credit card debt. In this video, I’m showing you how to pay off debt fast without getting discouraged and losing momentum.

-----

----

✨FREE RESOURCES✨

RELATED VIDEOS:

COME SAY HI!

-----

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Dow Janes or any third party service provider to buy or sell any securities or other financial instruments.

#DowJanes #PersonalFinance #PayOffDebt #DebtSnowball

Pay Off Debt Using the Debt Snowball

Debt Snowball Explained for Beginners | How to Pay Off Debt | Debt Payoff | Budget for Beginners

Why the Debt Snowball Method Doesn't Work: How to Pay Off Credit Card Debt FAST

Debt Snowball Vs Debt Avalanche | Which is the Best Debt Payoff Strategy?

Does Dave Ramsey's Debt Snowball Method Actually Work?

Why The Debt Snowball Method Actually Works!

The Debt Snowball Method: Why it Works!

Should I Do The Debt Snowball or Avalanche Method?

'I had a DEBT of $800,000 Dollars' | How to Pay off your Debts | Robert Kiyosaki

How To Pay Off Debt (Debt Snowball vs Debt Avalanche)

Best Way to Pay Off Debt Fast (That Actually Works)

The Debt Snowball Method Explained

The Best Way to Pay Off Debt: The Debt Snowball Method Explained!

HOW TO PAY OFF DEBT FAST USING THE SNOWBALL METHOD

Why The Debt Snowball Method Actually Works!

My First Debt Snowball Payment | Detailed Balances| Debt Payoff Journey!

How to Make a Debt Snowball Spreadsheet in Excel and Google Sheets

Pay Off Debt Fast in 2023! | DEBT SNOWBALL METHOD | CASH BUDGETING FOR BEGINNERS | CASH STUFFING

How To Pay Off Debt | DO NOT use Dave Ramsey's Debt Snowball

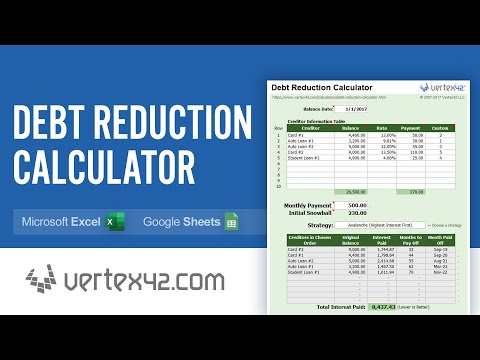

Debt Reduction Calculator Tutorial - Use a Debt Snowball to Pay Off Debt

Debt Snowball vs. Debt Avalanche | Debt Paydown Strategy

How to Payoff Debt Using the Debt Snowball Method | FAQ | Beginner Budgeting Tips

How to use the debt snowball method | how to pay off credit card debt FAST

How To Set Priorites In The Debt Snowball

Комментарии

0:07:54

0:07:54

0:15:45

0:15:45

0:06:14

0:06:14

0:10:14

0:10:14

0:08:08

0:08:08

0:00:24

0:00:24

0:12:47

0:12:47

0:03:42

0:03:42

0:08:25

0:08:25

0:08:19

0:08:19

0:10:46

0:10:46

0:05:33

0:05:33

0:08:02

0:08:02

0:16:36

0:16:36

0:00:27

0:00:27

0:09:07

0:09:07

0:10:06

0:10:06

0:14:51

0:14:51

0:10:26

0:10:26

0:05:18

0:05:18

0:07:36

0:07:36

0:08:10

0:08:10

0:00:39

0:00:39

0:03:24

0:03:24