filmov

tv

Tariffs and Protectionism

Показать описание

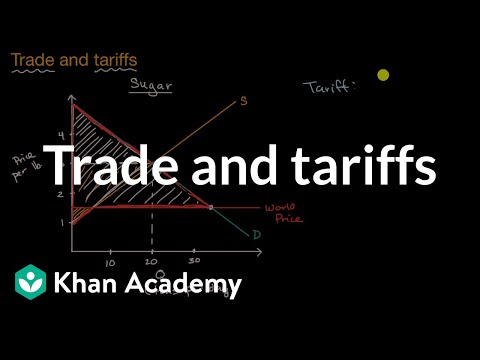

We’ll look at the costs and consequences of tariffs, quotas, and protectionism. How do tariffs affect consumers? What about producers? Who wins and who loses? Find out with this video.

We’ll apply the fundamentals we learned in the supply, demand, and equilibrium section of this course to real-world examples — like that of protectionism in the U.S. sugar industry — to determine lost gains from trade or deadweight loss, the tariff equilibrium vs. the free trade equilibrium, and the value of wasted resources as a result of tariffs.

Help us caption & translate this video!

We’ll apply the fundamentals we learned in the supply, demand, and equilibrium section of this course to real-world examples — like that of protectionism in the U.S. sugar industry — to determine lost gains from trade or deadweight loss, the tariff equilibrium vs. the free trade equilibrium, and the value of wasted resources as a result of tariffs.

Help us caption & translate this video!

Tariffs and Protectionism

Free Trade vs. Protectionism

Tariff - Protectionism

Tariff - Trade Protectionism

Trade and tariffs | APⓇ Microeconomics | Khan Academy

🚧 Exports and Imports | Protectionism, Tariffs and Who Benefits From Them

How President Donald Trump's tariffs & trade wars affect the U.S. | Just The FAQs

Protectionism, tariffs, and trade wars

Former US Ambassador: Trump tariffs continue previous grand bargain with China

How do tariffs work? | CNBC Explains

Protectionist Tariffs

The cost of protectionism: Trump steel tariffs

Are Carbon Tariffs Protectionism or Climate Policy?

Ben Shapiro Breaks Down Tariffs in 3 Minutes

What is Protectionism? | Tariffs, Quotas & Subsidies

Import Quota - Trade Protectionism

Topics in Tariffs and #Protectionism

Trade Protectionism - Ten Examples of Non-Tariff Barriers

The Hawley-Smoot Tariff in Under 5 Minutes - Hasty History

Protectionism in Practice: examining the economic impact of tariffs

Protectionism - Evaluation

China Slams EU Tariffs on EVs as 'Protectionism'

Free Trade vs. Protectionism | Lucas M. Engelhardt

Trade Protectionism Tutorial: Tariffs

Комментарии

0:14:51

0:14:51

0:06:19

0:06:19

0:05:27

0:05:27

0:11:17

0:11:17

0:07:05

0:07:05

0:08:32

0:08:32

0:01:45

0:01:45

0:01:00

0:01:00

0:04:37

0:04:37

0:04:58

0:04:58

0:11:48

0:11:48

0:01:20

0:01:20

0:02:49

0:02:49

0:03:01

0:03:01

0:04:43

0:04:43

0:06:15

0:06:15

2:02:11

2:02:11

0:05:37

0:05:37

0:03:27

0:03:27

0:02:39

0:02:39

0:07:10

0:07:10

0:00:41

0:00:41

0:44:04

0:44:04

0:09:51

0:09:51