filmov

tv

Kaizen: How to target and achieve 30-35% compound annual net return

Показать описание

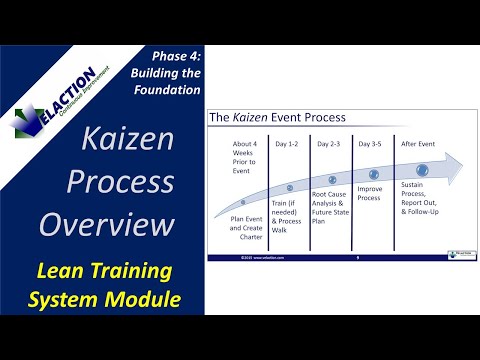

Chapters:

00:00 - Intro

00:25 - The need for “multi-modal” approach. Strong outperformance of benchmark Top 40: 214% net return since July 2010 launch, vs. 93% gross.

06:19 - Research, Portfolio construction & management, Risk Management. Macro meets very detailed micro analysis to identify stocks with best momentum.

12:12 - 2nd level of risk: Getting the sectors right. Markets sell-offs: when fund managers rejoice.

14:45 - Kaizen’s portfolio management philosophy. “Gain is commensurate with risk. Risk varies inversely with Knowledge”.

26:35 - Kaizen’s outlook and macro themes. “Real money” in macro driven shorts going forward. Why South Africa’s drifit to the left could be a boon for investors.

Kaizen Asset Management runs a South African multi-strategy fund, investing in a diversified portfolio of securities, commodities, derivatives, gilts and cash. The core focus is long-short equities, with alternative assets classes used predominantly for hedging of risk and / or speculation.

Mark Witten, a CFA charterholder with an MBA and a BComm (Honours) cum laude, is Managing Director of Kaizen. In this Opalesque.TV BACKSTAGE video he explains the factors that are behind his fund’s strong outperformance of the benchmark : 214% net return since fund launch in July 2010 versus a gross gain of 93% of the JSE Top 40 Index. A “multi-modal” concentrated approach on top 20 ideas, together with specific portfolio and risk management frameworks, make Kaizen very unique. The fund uses three buckets - fundamental, trading & opportunities - and also develops “mini portfolios”. Hear Witten speak about:

- Idiosyncratic drivers of the South African Markets

- Macro as the first level of risk: Effective hedging with derivatives

- 2nd level of risk: Why it’s important to get the sectors right

- What should managers do in a market sell-off?

- What Mark Witten learned being a chef in his family’s restaurants

- Why a strong team needs debates more than a “yes”-culture

- Why South Africa’s drift to the left could be a boon for investors

- Outlook and macro themes: make sure to make good money on the short side

Mark O. Witten is a CFA charterholder with an MBA and a BComm (Honours) cum laude, in Law and Finance. He started my career at RMB Asset Management in 2000 before joining Goldman Sachs Asset Management in London. Witten also completed a masters credit at London School of Economics before backpacking thorugh the USA, Fiji and Australia. After completing an MBA at UCT's GSB, he moved to Johannesburg and joined Peregrine Capital as an analyst, covering the construction, energy and infrastructure sectors. He then re moving to Praesidium Capital in 2008 as a Fund Manager. Prior to setting up Kaizen, he spent a year with ex-Peregrine Capital director Shane Watkins in 2009 assisting him to establish Silk Road Fund Managers in Cape Town.

00:00 - Intro

00:25 - The need for “multi-modal” approach. Strong outperformance of benchmark Top 40: 214% net return since July 2010 launch, vs. 93% gross.

06:19 - Research, Portfolio construction & management, Risk Management. Macro meets very detailed micro analysis to identify stocks with best momentum.

12:12 - 2nd level of risk: Getting the sectors right. Markets sell-offs: when fund managers rejoice.

14:45 - Kaizen’s portfolio management philosophy. “Gain is commensurate with risk. Risk varies inversely with Knowledge”.

26:35 - Kaizen’s outlook and macro themes. “Real money” in macro driven shorts going forward. Why South Africa’s drifit to the left could be a boon for investors.

Kaizen Asset Management runs a South African multi-strategy fund, investing in a diversified portfolio of securities, commodities, derivatives, gilts and cash. The core focus is long-short equities, with alternative assets classes used predominantly for hedging of risk and / or speculation.

Mark Witten, a CFA charterholder with an MBA and a BComm (Honours) cum laude, is Managing Director of Kaizen. In this Opalesque.TV BACKSTAGE video he explains the factors that are behind his fund’s strong outperformance of the benchmark : 214% net return since fund launch in July 2010 versus a gross gain of 93% of the JSE Top 40 Index. A “multi-modal” concentrated approach on top 20 ideas, together with specific portfolio and risk management frameworks, make Kaizen very unique. The fund uses three buckets - fundamental, trading & opportunities - and also develops “mini portfolios”. Hear Witten speak about:

- Idiosyncratic drivers of the South African Markets

- Macro as the first level of risk: Effective hedging with derivatives

- 2nd level of risk: Why it’s important to get the sectors right

- What should managers do in a market sell-off?

- What Mark Witten learned being a chef in his family’s restaurants

- Why a strong team needs debates more than a “yes”-culture

- Why South Africa’s drift to the left could be a boon for investors

- Outlook and macro themes: make sure to make good money on the short side

Mark O. Witten is a CFA charterholder with an MBA and a BComm (Honours) cum laude, in Law and Finance. He started my career at RMB Asset Management in 2000 before joining Goldman Sachs Asset Management in London. Witten also completed a masters credit at London School of Economics before backpacking thorugh the USA, Fiji and Australia. After completing an MBA at UCT's GSB, he moved to Johannesburg and joined Peregrine Capital as an analyst, covering the construction, energy and infrastructure sectors. He then re moving to Praesidium Capital in 2008 as a Fund Manager. Prior to setting up Kaizen, he spent a year with ex-Peregrine Capital director Shane Watkins in 2009 assisting him to establish Silk Road Fund Managers in Cape Town.

Комментарии

0:11:48

0:11:48

0:34:42

0:34:42

0:01:25

0:01:25

0:03:23

0:03:23

0:03:47

0:03:47

0:05:42

0:05:42

0:14:46

0:14:46

0:02:58

0:02:58

0:13:55

0:13:55

0:14:31

0:14:31

0:31:50

0:31:50

0:16:56

0:16:56

0:06:04

0:06:04

0:04:15

0:04:15

0:03:55

0:03:55

0:05:20

0:05:20

0:18:48

0:18:48

0:06:29

0:06:29

0:04:00

0:04:00

0:08:44

0:08:44

0:21:01

0:21:01

0:33:25

0:33:25

0:08:13

0:08:13

0:17:58

0:17:58