filmov

tv

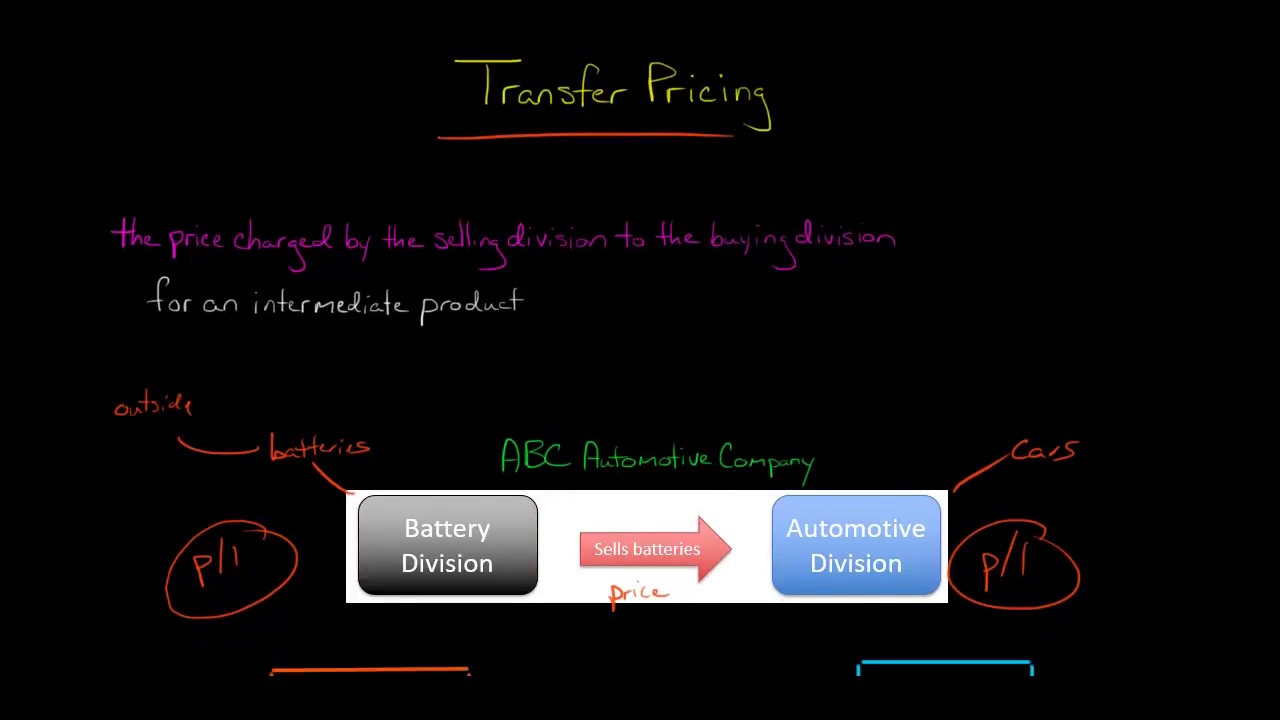

Transfer Pricing

Показать описание

This video introduces the concept of transfer pricing.

A transfer price is the price charged by the selling division to the buying division for an intermediate product within the same firm. Companies use transfer prices for internal purposes (to coordinate transfers within the firm) and for external purposes (reporting to tax authorities). For internal purposes, companies typically used market-based transfer pricing, cost-based transfer pricing, or negotiated transfer pricing. Companies may use a different transfer price for internal decision-making than the transfer price they report to tax authorities; if they do this, it is known as decoupling. However, most tax authorities require that companies report the transfer price as the price that would have been charged in an arm's length transaction. Even so, transfer pricing is the source of significant disputes as firms attempt to use transfer pricing to minimize their tax liability.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

A transfer price is the price charged by the selling division to the buying division for an intermediate product within the same firm. Companies use transfer prices for internal purposes (to coordinate transfers within the firm) and for external purposes (reporting to tax authorities). For internal purposes, companies typically used market-based transfer pricing, cost-based transfer pricing, or negotiated transfer pricing. Companies may use a different transfer price for internal decision-making than the transfer price they report to tax authorities; if they do this, it is known as decoupling. However, most tax authorities require that companies report the transfer price as the price that would have been charged in an arm's length transaction. Even so, transfer pricing is the source of significant disputes as firms attempt to use transfer pricing to minimize their tax liability.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:06:47

0:06:47

0:03:32

0:03:32

0:06:58

0:06:58

0:18:46

0:18:46

0:05:00

0:05:00

0:20:59

0:20:59

0:26:20

0:26:20

0:03:21

0:03:21

1:13:26

1:13:26

0:10:14

0:10:14

0:18:41

0:18:41

0:02:46

0:02:46

2:30:59

2:30:59

1:25:11

1:25:11

0:30:50

0:30:50

0:24:15

0:24:15

0:08:17

0:08:17

0:27:36

0:27:36

0:10:17

0:10:17

0:03:45

0:03:45

0:55:57

0:55:57

1:40:08

1:40:08

0:09:32

0:09:32

0:24:04

0:24:04