filmov

tv

Financial Statement Analysis #6: Ratio Analysis - Market Value Measures

Показать описание

In this financial statement analysis lesson we cover ratios know as market value measures. Market value measures need the stock price to be calculated therefore they are useful for publicly traded companies. The ratios we cover are market to book ratio, book value, the pe ratio or P/E ratios or price to earnings ratio, the eps or earnings per share, enterprise value, market capitalization and enterprise value multiple.

Financial Statement Analysis #6: Ratio Analysis - Market Value Measures

FINANCIAL RATIOS: How to Analyze Financial Statements

FA 52 - Financial Ratio Calculations and Analysis

Financial ratio analysis

Ratio Analysis | Financial Statement Analysis

How To Analyze Financial Statements For A Corporation. 4 Types of Financial Analyses

Session 6: Financial Ratios

Liquidity Ratio | Problem 6 | Financial Statement Analysis | Principles of Finance

Drafting and Interpreting Financial Statements: AAT Sample Assessment 1 - Task 6 (of 7)

Learn Ratio Analysis in 15 Minutes | Tricks and Formula | Types Of Ratio Analysis | Assignment Prime

Topic 6 - Financial statement analysis

Financial Statement Analysis (Current Ratio)

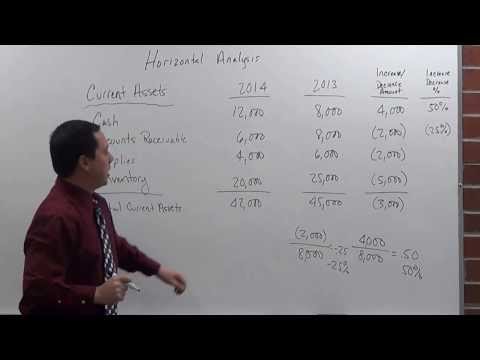

Horizontal Analysis

[#5] Trend Analysis | Financial Statement Analysis | Solved Problem | Techniques of Analysis

#5 Ratio Analysis | Problem solved-5 | Financial Accounting | Mangalore University| 6th Semester

INTERPRETATION OF FINANCIAL STATEMENTS (ACCOUNTING RATIOS) - PART 3

Financial Statement Analysis #5: Ratio Analysis - Profitability Measures

[FABM2] Lesson 040 - Financial Statements Analysis (Ratio Analysis and Interpretation)

How to do Financial Analysis of a Company ?

Financial Management; Financial Statement & Ratio Analysis

Financial Statements Analysis

TESLA Financial Report 2020: Financial Statements and Financial Ratio Analysis by Paul Borosky, MBA.

Debt To Equity Ratio | Problem 6 | Financial Statement Analysis | Principles of Finance | Finance

Working Capital Turnover Ratio | Problem 6 | Financial Statement Analysis | Principles of Finance

Комментарии

0:06:10

0:06:10

0:23:57

0:23:57

0:36:25

0:36:25

0:10:09

0:10:09

0:06:41

0:06:41

0:23:55

0:23:55

0:18:12

0:18:12

0:04:56

0:04:56

0:04:56

0:04:56

0:05:30

0:05:30

1:02:54

1:02:54

0:05:05

0:05:05

0:06:26

0:06:26

![[#5] Trend Analysis](https://i.ytimg.com/vi/BiSsmmOZsVI/hqdefault.jpg) 0:08:23

0:08:23

0:09:54

0:09:54

0:35:01

0:35:01

0:03:53

0:03:53

![[FABM2] Lesson 040](https://i.ytimg.com/vi/KXz25rTVFHI/hqdefault.jpg) 0:44:16

0:44:16

0:35:54

0:35:54

0:24:53

0:24:53

2:11:54

2:11:54

0:08:56

0:08:56

0:05:25

0:05:25

0:04:11

0:04:11