filmov

tv

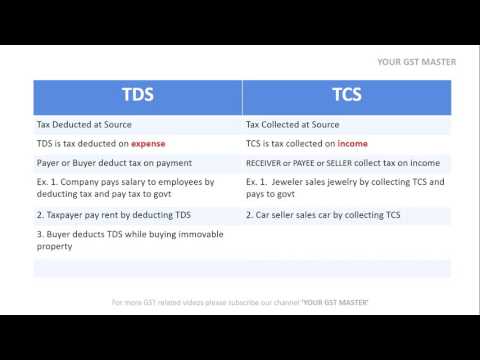

Different Between TDS & TCS || What is TDS & TCS #tds #tcs

Показать описание

Different Between TDS & TCS || What is TDS & TCS #tds #tcs

What is TDS

TDS क्या होता है ?

Tax Deduction at Source

All About TDS Rates

#TCS

#taxcollectedatsource

#taxcollectionatsource

#section206cofincometax

#provisionsoftaxcollectionatsource

#tcs

#tcsprovisions

#taxcollectionatsourceincometax

#taxcollectedatsource

#whatistcs

TDS Refund Process

What is tax deducted at source?

What is TDS?

What is form 26 AS?

What is form 16?

what is form 16A?

Difference between form 16 and form 16 A?

Difference between form 26 AS and form 16/16 A?

How TDS works?

How to avail TDS refund?

TDS refund kaise liya jata hai?

TDS on FD interest

TDS on salary

TDS on contracts

TDS on rental Income

TDS and income tax relation

Benefit of TDS

Why TDS is deducted?

TDS kyu deduct kiya jata hai?

all information about tcs

tcs on tendu leaves

tcs on scrap

tcs kya hota hai 2021

what is tcs 2021

tcs on car purchase

tcs on bus truck purchase

TCS on education fees

tcs on alcohal

tcs on timber wood

tcs and income tax relation

Benefit of tcs

Why tcs is collected?

All about TCS

.

#tcs

#taxcollectedatsource

#taxdeductedatsource

#TCS

#taxcollectedatsource

#taxcollectionatsource

#section206cofincometax

#provisionsoftaxcollectionatsource

#tcs

#tcsprovisions

#taxcollectionatsourceincometax

#taxcollectedatsource

#whatistcs

#tds

#tdsreturn

#tdscertificate

#tdsrefund

#tdsreturnfiling

#tdsratechart

#tdsupdate

#fy2223

#ay2324

.

you can Follow us on :

Write us-

Visit -

FACEBOOK -

TWITTER -

LINKEDIN-

YOUTUBE-

INSTAGRAM -

TELEGRAM-

#CASumitSharma

#SumitSharma

#CA

#Income

#IncomeTax

#IncomeTaxReturn

#IncomeTaxNotice

#IncomeTaxDepartment

#SaveTax

#HowToSaveTax

#NewRules

#hindi

#GST

#sumit

#Legal

#AY2223

#FY2122

Don’t Forget To Like , Comment , Share & Subscribe ...

[ THANKS FOR WATCHING THIS VIDEO ]

DISCLAIMER ********

This video is merely a general guide meant for learning purposes only. All the instructions, references, content or documents are for educational purposes only and do not constitute legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video, you're suggested to seek the advice of your financial, legal, tax or professional advisors as to the risks involved may be obtained and necessary due diligence, etc may be done at your end.

What is TDS

TDS क्या होता है ?

Tax Deduction at Source

All About TDS Rates

#TCS

#taxcollectedatsource

#taxcollectionatsource

#section206cofincometax

#provisionsoftaxcollectionatsource

#tcs

#tcsprovisions

#taxcollectionatsourceincometax

#taxcollectedatsource

#whatistcs

TDS Refund Process

What is tax deducted at source?

What is TDS?

What is form 26 AS?

What is form 16?

what is form 16A?

Difference between form 16 and form 16 A?

Difference between form 26 AS and form 16/16 A?

How TDS works?

How to avail TDS refund?

TDS refund kaise liya jata hai?

TDS on FD interest

TDS on salary

TDS on contracts

TDS on rental Income

TDS and income tax relation

Benefit of TDS

Why TDS is deducted?

TDS kyu deduct kiya jata hai?

all information about tcs

tcs on tendu leaves

tcs on scrap

tcs kya hota hai 2021

what is tcs 2021

tcs on car purchase

tcs on bus truck purchase

TCS on education fees

tcs on alcohal

tcs on timber wood

tcs and income tax relation

Benefit of tcs

Why tcs is collected?

All about TCS

.

#tcs

#taxcollectedatsource

#taxdeductedatsource

#TCS

#taxcollectedatsource

#taxcollectionatsource

#section206cofincometax

#provisionsoftaxcollectionatsource

#tcs

#tcsprovisions

#taxcollectionatsourceincometax

#taxcollectedatsource

#whatistcs

#tds

#tdsreturn

#tdscertificate

#tdsrefund

#tdsreturnfiling

#tdsratechart

#tdsupdate

#fy2223

#ay2324

.

you can Follow us on :

Write us-

Visit -

FACEBOOK -

TWITTER -

LINKEDIN-

YOUTUBE-

INSTAGRAM -

TELEGRAM-

#CASumitSharma

#SumitSharma

#CA

#Income

#IncomeTax

#IncomeTaxReturn

#IncomeTaxNotice

#IncomeTaxDepartment

#SaveTax

#HowToSaveTax

#NewRules

#hindi

#GST

#sumit

#Legal

#AY2223

#FY2122

Don’t Forget To Like , Comment , Share & Subscribe ...

[ THANKS FOR WATCHING THIS VIDEO ]

DISCLAIMER ********

This video is merely a general guide meant for learning purposes only. All the instructions, references, content or documents are for educational purposes only and do not constitute legal advice. We do not accept any liabilities whatsoever for any losses caused directly or indirectly by the use/reliance of any information contained in this video or for any conclusion of the information. Prior to acting upon this video, you're suggested to seek the advice of your financial, legal, tax or professional advisors as to the risks involved may be obtained and necessary due diligence, etc may be done at your end.

Комментарии

0:05:42

0:05:42

0:06:51

0:06:51

0:04:57

0:04:57

0:01:46

0:01:46

0:01:24

0:01:24

0:17:44

0:17:44

0:00:17

0:00:17

0:01:39

0:01:39

0:01:45

0:01:45

0:11:14

0:11:14

0:00:59

0:00:59

0:00:59

0:00:59

0:01:02

0:01:02

0:01:30

0:01:30

0:09:42

0:09:42

0:06:33

0:06:33

0:00:14

0:00:14

0:09:09

0:09:09

0:02:16

0:02:16

0:04:29

0:04:29

0:07:18

0:07:18

0:17:00

0:17:00

0:02:30

0:02:30

0:44:36

0:44:36