filmov

tv

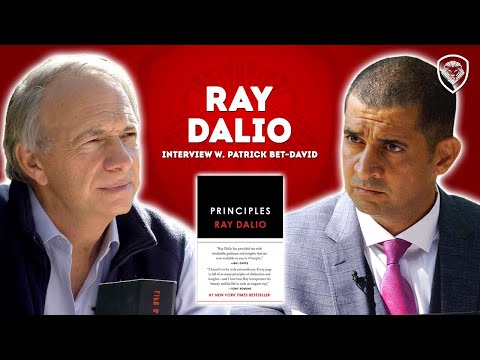

Ray Dalio: The Investing Opportunity of a Generation

Показать описание

(#raydalio ,#investing , #stockmarket)

In a recent interview, Ray Dalio talks about how the investing landscape has changed. Ray Dalio is a billionaire and one of the most highly respected investors in the world. Dalio has been investing for 50 years, meaning he knows a thing or two when it comes to investing. In a recent interview, he talked about a recent shift in the stock market and economy that you need to know about. This shift fundamentally changes the investing landscape. In this video, we are going to answer 3 questions: what exactly Ray Dalio is seeing, why this shift in the stock market and economy is occurring, and, finally, how you can make sure you don’t miss out on this opportunity. But first, make sure to hit that like button and subscribe to the channel because it's my goal to make you a better investor, by studying the world’s greatest investors. Now, let’s listen to what Ray Dalio had to say.

The last 30 years of investing has been defined by extremely low interest rates. However, things have started to change drastically in recent months. The US Federal Reserve has increased interest rates at the fastest rate ever. As of the making of this video, the US federal funds rate, a proxy for interest rates in the economy, sits at 4.6%. This is the highest interest rates have been in over 15 years and likely have even higher to go. In order to find a period of time when interest rates were significantly higher you would have to go all the way back to the late 1980s. For the better part of the last 15 years, not only were interest rates low, they were literally 0%. This shift from 0% interest rates up to a more normalized interest rate environment may not seem like a huge deal to the average person but this change fundamentally alters the investing landscape

Disclosures:

This is a paid endorsement for Open to the Public Investing, Inc., member FINRA & SIPC.

This does not constitute investment advice. Investing involves the risk of loss, including loss of

and investment advisory services offered on Public are provided by Jiko Securities, Inc., a

registered broker-dealer, member FINRA and SIPC. This material is not intended as a

recommendation, offer or solicitation for the purchase or sale of any security or investment

strategy. See FINRA BrokerCheck , Jiko U.S. Treasuries Risk Disclosures and Jiko Securities

Inc. Form CRS . Investments in T-bills: Not FDIC Insured - No Bank Guarantee - May Lose

Value Banking services provided by Jiko Bank, a division of Mid-Central National Bank

* Yield is an annualized 26-week T-bill rate (as of 3/29/23) when held to maturity. Rate is gross

of fees. T-bills are purchased in increments of $100 par value at a discount; any remaining

balance after purchase is held in cash. Risks.

** As compared to the average of the best high-yield savings accounts, compiled by

completeness of information on third-party websites. Open to the Public Investing is not a bank

and does not offer savings accounts. You should contact your bank for current and complete

information about available account types, including applicable interest rates. Risks.

In a recent interview, Ray Dalio talks about how the investing landscape has changed. Ray Dalio is a billionaire and one of the most highly respected investors in the world. Dalio has been investing for 50 years, meaning he knows a thing or two when it comes to investing. In a recent interview, he talked about a recent shift in the stock market and economy that you need to know about. This shift fundamentally changes the investing landscape. In this video, we are going to answer 3 questions: what exactly Ray Dalio is seeing, why this shift in the stock market and economy is occurring, and, finally, how you can make sure you don’t miss out on this opportunity. But first, make sure to hit that like button and subscribe to the channel because it's my goal to make you a better investor, by studying the world’s greatest investors. Now, let’s listen to what Ray Dalio had to say.

The last 30 years of investing has been defined by extremely low interest rates. However, things have started to change drastically in recent months. The US Federal Reserve has increased interest rates at the fastest rate ever. As of the making of this video, the US federal funds rate, a proxy for interest rates in the economy, sits at 4.6%. This is the highest interest rates have been in over 15 years and likely have even higher to go. In order to find a period of time when interest rates were significantly higher you would have to go all the way back to the late 1980s. For the better part of the last 15 years, not only were interest rates low, they were literally 0%. This shift from 0% interest rates up to a more normalized interest rate environment may not seem like a huge deal to the average person but this change fundamentally alters the investing landscape

Disclosures:

This is a paid endorsement for Open to the Public Investing, Inc., member FINRA & SIPC.

This does not constitute investment advice. Investing involves the risk of loss, including loss of

and investment advisory services offered on Public are provided by Jiko Securities, Inc., a

registered broker-dealer, member FINRA and SIPC. This material is not intended as a

recommendation, offer or solicitation for the purchase or sale of any security or investment

strategy. See FINRA BrokerCheck , Jiko U.S. Treasuries Risk Disclosures and Jiko Securities

Inc. Form CRS . Investments in T-bills: Not FDIC Insured - No Bank Guarantee - May Lose

Value Banking services provided by Jiko Bank, a division of Mid-Central National Bank

* Yield is an annualized 26-week T-bill rate (as of 3/29/23) when held to maturity. Rate is gross

of fees. T-bills are purchased in increments of $100 par value at a discount; any remaining

balance after purchase is held in cash. Risks.

** As compared to the average of the best high-yield savings accounts, compiled by

completeness of information on third-party websites. Open to the Public Investing is not a bank

and does not offer savings accounts. You should contact your bank for current and complete

information about available account types, including applicable interest rates. Risks.

Комментарии

0:14:15

0:14:15

0:15:54

0:15:54

0:04:01

0:04:01

0:00:28

0:00:28

0:01:29

0:01:29

1:15:40

1:15:40

0:12:30

0:12:30

0:10:58

0:10:58

0:19:15

0:19:15

0:00:54

0:00:54

0:00:38

0:00:38

1:29:09

1:29:09

0:00:33

0:00:33

1:08:17

1:08:17

0:00:55

0:00:55

0:03:31

0:03:31

0:15:22

0:15:22

0:00:24

0:00:24

0:10:52

0:10:52

0:00:13

0:00:13

0:04:51

0:04:51

0:03:27

0:03:27

0:03:29

0:03:29

0:27:15

0:27:15