filmov

tv

Banks (FRM Part 1 2025 – Book 3 – Financial Markets and Products – Chapter 1)

Показать описание

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading, you should be able to:

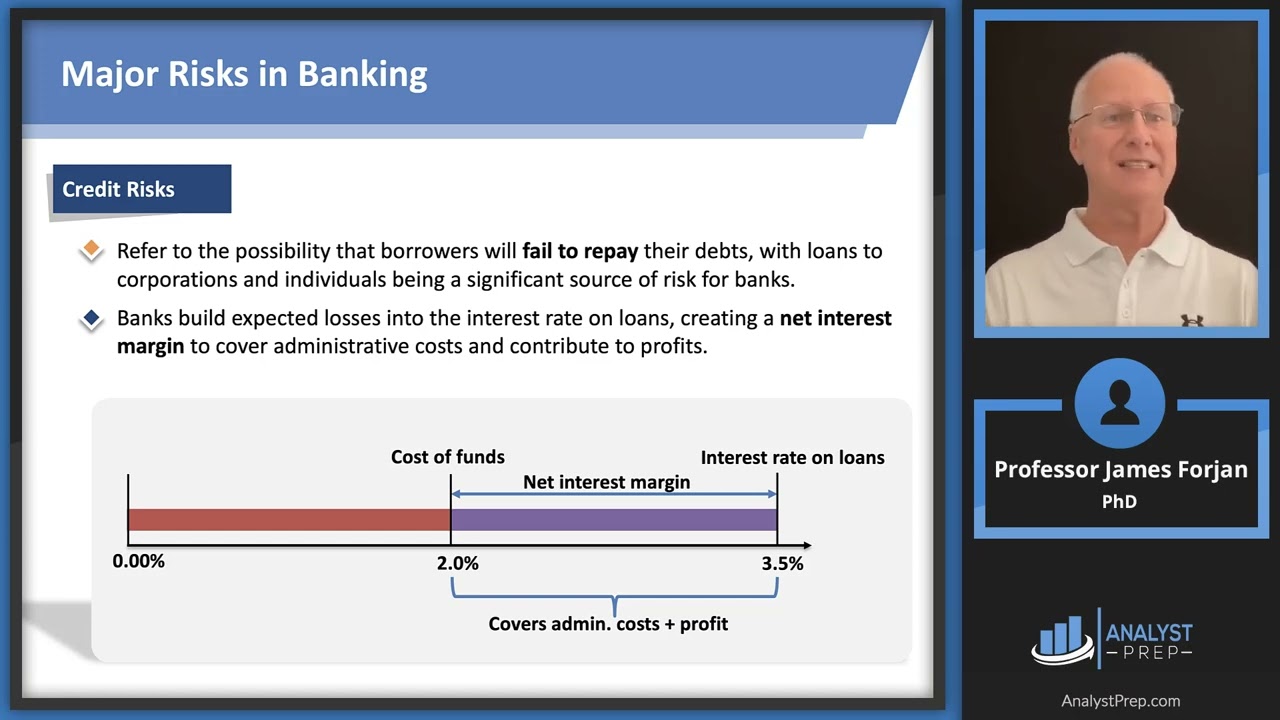

- Identify the major risks faced by banks and explain ways in which these risks can arise.

- Distinguish between economic capital and regulatory capital.

- Summarize the Basel committee regulations for regulatory capital and their motivations.

- Explain how deposit insurance gives rise to a moral hazard problem.

- Describe investment banking financing arrangements, including private placement, public offering, best efforts, firm commitment, and Dutch auction approaches.

- Describe the potential conflicts of interest among commercial banking, securities services, and investment banking divisions of a bank, and recommend solutions to these conflict of interest problems.

- Describe the distinctions between the banking book and the trading book of a bank.

- Explain the originate-to-distribute banking model and discuss its benefits and drawbacks.

0:00 Introduction

2:37 Types of Banks

3:36 Major Risks in Banking

18:39 Regulatory vs. Economic Capital

25:48 BCBS Regulatory Capital Guidelines

28:30 Motivations behind Basel Committee Regulations

29:41 What is Deposit Insurance?

32:38 Deposit Insurance and Moral Hazard

34:10 Banking financing Arrangements

45:49 Conflicts of Interest in Banking

51:21 Banking Book vs. Trading Book

52:48 The Originate-to-Distribute Banking Model

Комментарии

0:58:12

0:58:12

0:22:01

0:22:01

0:25:34

0:25:34

0:33:24

0:33:24

0:08:42

0:08:42

0:12:53

0:12:53

0:23:14

0:23:14

0:11:20

0:11:20

0:06:18

0:06:18

0:51:31

0:51:31

0:00:11

0:00:11

0:30:46

0:30:46

0:09:20

0:09:20

0:42:52

0:42:52

0:00:50

0:00:50

0:00:27

0:00:27

0:08:27

0:08:27

0:48:30

0:48:30

0:29:49

0:29:49

0:38:31

0:38:31

0:44:30

0:44:30

0:00:39

0:00:39

0:00:43

0:00:43

0:00:45

0:00:45