filmov

tv

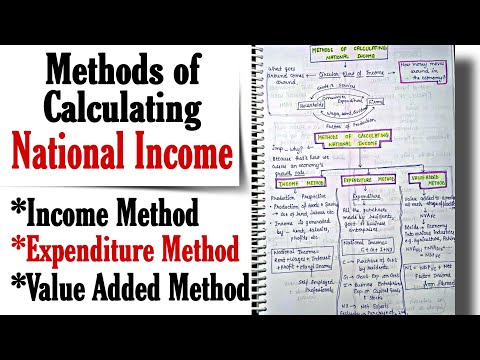

NATIONAL INCOME | 10 MARKS | ONE SHOT REVISION | CLASS 12 MACRO ECONOMICS BOARD EXAM 2025. DONT MISS

Показать описание

ALL CRASH COURSE PDF MATERIALS & QUESTIONS

FREE ACCOUNTS PLAYLIST | CRASH COURSE FOR BOARDS 2025

FREE ECONOMICS PLAYLIST | CRASH COURSE FOR BOARDS 2025

FREE BUSINESS STUDIES PLAYLIST | CRASH COURSE FOR BOARDS 2025

PLAYLIST FOR ACCOUNTS 2025 BOARDS

PLAYLIST FOR ACCOUNTS ONE SHOT SERIES FOR 2025 BOARDS

PLAYLIST FOR ECONOMICS 2025 BOARDS

PLAYLIST FOR BUSINESS STUDIES 2025 BOARDS

Join Our Free WhatsApp channel for Every Chapter Notes Updates Regarding XII BOARDS & CUET

FOLLW THIS COMPLETE PLAYLIST FOR XII ACCOUNTS BOARD EXAM 2024

FOLLW THIS COMPLETE PLAYLIST FOR XII ECONOMICS BOARD EXAM 2024

FOLLW THIS COMPLETE PLAYLIST FOR XII BUSINESS STUDIES BOARD EXAM 2024

Our Telegram Channel Link is

Here you can get free Notes/ PDF and All Important Information

Sunil panda

SPCC application link (ANDROID)

Mobile: 7800365625

FOR IOS USER (APPLE DEVICE)

For Laptop/ desktop user

you can register through your laptop/desktop.

Step 2. Enter Org. code: SPCC then click on verify button

Step 3. Login with your mobile number

Topics Covered.

0:00 - Introduction.

00:59 - Four sectors of an economy.

01:24 - Circle flow of income.

03:33 - Phases of circular flow of Income.

04:10 - Real flow vs money flow.

04:52 - Difference between stock and flow.

08:16 - Types of goods in the economy.

08:25 - Final goods.

10:43 - Types of final goods.

11:30 - Intermediate goods.

16:37 - Some goods may be final goods and intermediate goods.

17:16 - Consumer Goods.

18:35 - Capital goods.

19:42 - Note for capital and producer goods.

20:35 - Difference between final goods and intermediate goods.

22:26 - Question no.1.

24:57 - Three methods to calculate national.

25:37 - Precautions regarding production method.

27:25 - Problem of double counting.

29:44 - Precautions regarding income method.

31:35 - Precautions regarding expenditure method.

33:15 - what is national income?

33:50 - Inclusions in domestic territory.

34:57 - Exclusions in domestic territory.

35:52 - GDP and welfare.

36:30 - Exceptions of GDP welfare.

40:45 - Difference between Real GDP and Nominal GDP.

43:45 - GDP deflator or price index.

44:40 - Components of NFIA.

45:49 - Difference between depreciation and capital loss.

47:11 - All formulae revision.

51:58 - Question no.1.

54:22 - Question no.2.

57:26 - Question no.3.

1:01:15 - Question no.4.

1:03:22 - Question no.5.

1:05:36 - Question no.6.

1:09:21 - Question no.7.

1:15:26 - Question no.8.

HOPE THIS CHANNEL WILL HELP TO SCORE GOOD MARKS

IF YOU FIND IT HELPFUL DO SHARE WITH YOUR CLASS MATES.

BEST WISHES

( SUNIL PANDA )

FREE ACCOUNTS PLAYLIST | CRASH COURSE FOR BOARDS 2025

FREE ECONOMICS PLAYLIST | CRASH COURSE FOR BOARDS 2025

FREE BUSINESS STUDIES PLAYLIST | CRASH COURSE FOR BOARDS 2025

PLAYLIST FOR ACCOUNTS 2025 BOARDS

PLAYLIST FOR ACCOUNTS ONE SHOT SERIES FOR 2025 BOARDS

PLAYLIST FOR ECONOMICS 2025 BOARDS

PLAYLIST FOR BUSINESS STUDIES 2025 BOARDS

Join Our Free WhatsApp channel for Every Chapter Notes Updates Regarding XII BOARDS & CUET

FOLLW THIS COMPLETE PLAYLIST FOR XII ACCOUNTS BOARD EXAM 2024

FOLLW THIS COMPLETE PLAYLIST FOR XII ECONOMICS BOARD EXAM 2024

FOLLW THIS COMPLETE PLAYLIST FOR XII BUSINESS STUDIES BOARD EXAM 2024

Our Telegram Channel Link is

Here you can get free Notes/ PDF and All Important Information

Sunil panda

SPCC application link (ANDROID)

Mobile: 7800365625

FOR IOS USER (APPLE DEVICE)

For Laptop/ desktop user

you can register through your laptop/desktop.

Step 2. Enter Org. code: SPCC then click on verify button

Step 3. Login with your mobile number

Topics Covered.

0:00 - Introduction.

00:59 - Four sectors of an economy.

01:24 - Circle flow of income.

03:33 - Phases of circular flow of Income.

04:10 - Real flow vs money flow.

04:52 - Difference between stock and flow.

08:16 - Types of goods in the economy.

08:25 - Final goods.

10:43 - Types of final goods.

11:30 - Intermediate goods.

16:37 - Some goods may be final goods and intermediate goods.

17:16 - Consumer Goods.

18:35 - Capital goods.

19:42 - Note for capital and producer goods.

20:35 - Difference between final goods and intermediate goods.

22:26 - Question no.1.

24:57 - Three methods to calculate national.

25:37 - Precautions regarding production method.

27:25 - Problem of double counting.

29:44 - Precautions regarding income method.

31:35 - Precautions regarding expenditure method.

33:15 - what is national income?

33:50 - Inclusions in domestic territory.

34:57 - Exclusions in domestic territory.

35:52 - GDP and welfare.

36:30 - Exceptions of GDP welfare.

40:45 - Difference between Real GDP and Nominal GDP.

43:45 - GDP deflator or price index.

44:40 - Components of NFIA.

45:49 - Difference between depreciation and capital loss.

47:11 - All formulae revision.

51:58 - Question no.1.

54:22 - Question no.2.

57:26 - Question no.3.

1:01:15 - Question no.4.

1:03:22 - Question no.5.

1:05:36 - Question no.6.

1:09:21 - Question no.7.

1:15:26 - Question no.8.

HOPE THIS CHANNEL WILL HELP TO SCORE GOOD MARKS

IF YOU FIND IT HELPFUL DO SHARE WITH YOUR CLASS MATES.

BEST WISHES

( SUNIL PANDA )

Комментарии

1:18:28

1:18:28

0:21:57

0:21:57

0:16:24

0:16:24

0:14:19

0:14:19

0:02:37

0:02:37

0:00:23

0:00:23

0:20:57

0:20:57

0:30:08

0:30:08

0:36:06

0:36:06

0:02:26

0:02:26

0:00:16

0:00:16

0:00:16

0:00:16

0:18:19

0:18:19

0:23:28

0:23:28

0:54:10

0:54:10

0:13:35

0:13:35

0:06:44

0:06:44

0:59:07

0:59:07

1:04:41

1:04:41

0:06:26

0:06:26

3:28:12

3:28:12

0:00:21

0:00:21

0:12:56

0:12:56

0:00:45

0:00:45