filmov

tv

Introduction to Consolidated Tax Returns [CPA Prep]

Показать описание

Unlock a holistic learning experience tailored to help you pass the CPA exams. Gain access to interactive quizzes, practice exams, and task-based simulations that mirror the real exam experience. Our AI-driven platform adapts to your learning style, providing personalized pathways to master each section of the CPA exam.

🎓 Lesson Overview:

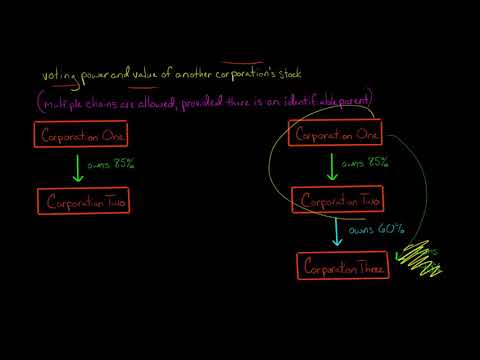

In this lesson, Nick Palazzolo, CPA, breaks down the essentials of consolidated tax returns, illustrating the scenarios in which an affiliated group of corporations would benefit from combining their tax liabilities to file a single tax return instead of separate ones for each entity. He elaborates on the requirements for eligibility, such as the need for a parent corporation and sufficient stock ownership connections among subsidiaries. By using relatable examples, including a hypothetical structure of McDonald's operations in various regions, Nick makes it easier to understand how gains and losses can be offset within a group to lower the overall tax obligation. The session also touches on the idea that while individuals cannot combine returns to maximize deductions, except in marriage, corporations have the opportunity to do so through consolidation if they meet specific affiliation criteria.

🔍 Key Topics Covered:

- Consolidated Tax Returns

- Corporate Tax Filing

- Affiliated Group Tax

- Parent Corporation Tax

💡 Learn More and Elevate Your CPA Exam Preparation:

Our comprehensive course offers a unique blend of AI-driven personalized learning experiences, expert insights, and practical exercises designed to ensure you're fully prepared to conquer the CPA exams.

👉 Begin your journey to becoming a Certified Public Accountant today!

#CPAExam #Accounting #ExamPrepAI

0:18:07

0:18:07

0:05:46

0:05:46

0:03:22

0:03:22

0:05:32

0:05:32

0:02:19

0:02:19

0:02:23

0:02:23

0:07:01

0:07:01

0:14:59

0:14:59

0:13:03

0:13:03

0:10:47

0:10:47

0:06:25

0:06:25

0:10:29

0:10:29

0:08:01

0:08:01

0:45:21

0:45:21

0:03:39

0:03:39

0:13:20

0:13:20

0:14:32

0:14:32

0:03:29

0:03:29

0:13:42

0:13:42

0:01:09

0:01:09

0:13:30

0:13:30

0:10:35

0:10:35

0:00:47

0:00:47

1:48:57

1:48:57