filmov

tv

🤔 GSTR 2A vs GSTR 2B | How to Claim Correct ITC in GST

Показать описание

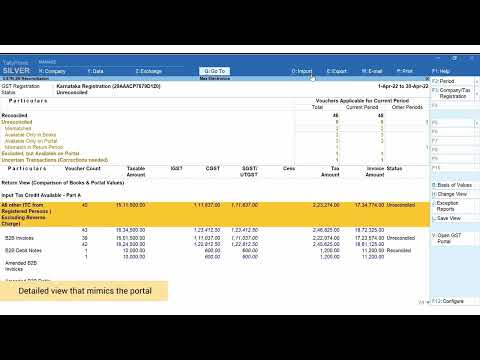

📍In this video we are going to discuss about GSTR 2A and GSTR 2B and how to claim correct ITC in GST.

👨🏻🎓Enroll to our practical course in TDS, ITR & GST Filing

👉Create your account

👉Proceed for payment

👉After payment you can access your complete course

👉Get Certificate after course completion

🤔What is GSTR 2A?

GSTR 2A is an auto populated statement generated on the basis of GSTR 1 data of suppliers. It is a dynamic return means the value and figure could change in future. For example- Mr. R has received an invoice in March 2021 and at the time of reconciling of GSTR 2A with the books he found one invoice of Mr. S is not reflecting in GSTR 2A of March 2021. Mr. R follow up for the missing invoice on 15-April-2021 and Mr. S communicate that he will file his GSTR 1 on 16-April-2021 and the same invoice shall be reflected in GSTR 2A of Mr. R on 16-April-2021.

🤔What is the problem with GSTR 2A?

From Nov 2020 onward government try to implement the automated structure of GSTR 3B where the outward and inward liability can be auto computed, detail of outward data can be easily fetched from GSTR 1, however inward and ITC data cannot be taken from GSTR 2A due to its dynamic nature. Hence a new return was required which shall be Fixed and thus the new return introduced named GSTR 2B to serve the purpose.

🤔What is GSTR 2B

GSTR 2B is a static statement of available ITC for the taxpayer generated on the basis of GSTR 1, GSTR 5 and GSTR 6 filed by recipient’s counter parties up to 13th of the succeeding month for which the statement is being generated. Unlike GSTR 2A where invoices are reflected even when invoices are uploaded and saved in these returns GSTR 1, GSTR 5 and GSTR 6, the statement GSTR 2B will have invoices only when the respective return is filed. The statement will clearly show input tax credit available and not available for every document filed by any supplier for a recipient. For example, for the month of Mar 2021, the statement will be generated on 14th April 2021. This means the data will be considered until the 13th of the next month always. GSTR 2B Cycle – 14th of a month to 13th of following month

🤔Which statement shall we use for ITC calculation?

As of now GST portal use GSTR 2B for auto populating the ITC figures in Table 4 of GSTR 3B, however these figures are editable. Now let’s understand the provisions and rules of GST for find a better solution.

Sec 16(2)(a) – Taxpayer must be in possession of a Tax Invoice

Sec 16(2) (aa) - the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37 under this Act, or such other tax paying documents as may be prescribed, he has received the goods or services or both. (inserted by FA 2021).

Rule 36 (4) Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, shall not exceed 5 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded furnished in FORM GSTR-1 or using the invoice furnishing facility.

✅Conclusion

Hence both GSTR 2A and GSTR 2B are valid returns, however for auto populated GSTR 3B a fixed return was required for ITC and thus portal pull the data from GSTR 2B. However, a return filed on the basis of GSTR 2A shall also valid under the provisions of law. Hence as per GST provisions, Taxpayer may use any return for ITC, however important point is that taxpayer need to maintain a consistency in Returns.

📍For Consultancy and query please contact below

📞9718097735 (CA Rajat Garg)

Cheers Folks

Thanks for Watching :)

-Team Fintaxpro

Disclaimer- Although all provisions, notifications, updates and live demo are analyzed in-depth by our team before presenting to public. We hereby provide our point of view only and tax matter are always subject to frequent changes hence advisory is only for the benefit of general public. Hence neither Fintaxpro Advisory LLP nor its designated partner are liable for any consequence arises on the basis of You Tube videos.

#GSTR2A #GSTR2B #ITC #Automated3B #fintaxpro #CorrectITC

👨🏻🎓Enroll to our practical course in TDS, ITR & GST Filing

👉Create your account

👉Proceed for payment

👉After payment you can access your complete course

👉Get Certificate after course completion

🤔What is GSTR 2A?

GSTR 2A is an auto populated statement generated on the basis of GSTR 1 data of suppliers. It is a dynamic return means the value and figure could change in future. For example- Mr. R has received an invoice in March 2021 and at the time of reconciling of GSTR 2A with the books he found one invoice of Mr. S is not reflecting in GSTR 2A of March 2021. Mr. R follow up for the missing invoice on 15-April-2021 and Mr. S communicate that he will file his GSTR 1 on 16-April-2021 and the same invoice shall be reflected in GSTR 2A of Mr. R on 16-April-2021.

🤔What is the problem with GSTR 2A?

From Nov 2020 onward government try to implement the automated structure of GSTR 3B where the outward and inward liability can be auto computed, detail of outward data can be easily fetched from GSTR 1, however inward and ITC data cannot be taken from GSTR 2A due to its dynamic nature. Hence a new return was required which shall be Fixed and thus the new return introduced named GSTR 2B to serve the purpose.

🤔What is GSTR 2B

GSTR 2B is a static statement of available ITC for the taxpayer generated on the basis of GSTR 1, GSTR 5 and GSTR 6 filed by recipient’s counter parties up to 13th of the succeeding month for which the statement is being generated. Unlike GSTR 2A where invoices are reflected even when invoices are uploaded and saved in these returns GSTR 1, GSTR 5 and GSTR 6, the statement GSTR 2B will have invoices only when the respective return is filed. The statement will clearly show input tax credit available and not available for every document filed by any supplier for a recipient. For example, for the month of Mar 2021, the statement will be generated on 14th April 2021. This means the data will be considered until the 13th of the next month always. GSTR 2B Cycle – 14th of a month to 13th of following month

🤔Which statement shall we use for ITC calculation?

As of now GST portal use GSTR 2B for auto populating the ITC figures in Table 4 of GSTR 3B, however these figures are editable. Now let’s understand the provisions and rules of GST for find a better solution.

Sec 16(2)(a) – Taxpayer must be in possession of a Tax Invoice

Sec 16(2) (aa) - the details of the invoice or debit note referred to in clause (a) has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37 under this Act, or such other tax paying documents as may be prescribed, he has received the goods or services or both. (inserted by FA 2021).

Rule 36 (4) Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been furnished by the suppliers under sub-section (1) of section 37, shall not exceed 5 per cent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded furnished in FORM GSTR-1 or using the invoice furnishing facility.

✅Conclusion

Hence both GSTR 2A and GSTR 2B are valid returns, however for auto populated GSTR 3B a fixed return was required for ITC and thus portal pull the data from GSTR 2B. However, a return filed on the basis of GSTR 2A shall also valid under the provisions of law. Hence as per GST provisions, Taxpayer may use any return for ITC, however important point is that taxpayer need to maintain a consistency in Returns.

📍For Consultancy and query please contact below

📞9718097735 (CA Rajat Garg)

Cheers Folks

Thanks for Watching :)

-Team Fintaxpro

Disclaimer- Although all provisions, notifications, updates and live demo are analyzed in-depth by our team before presenting to public. We hereby provide our point of view only and tax matter are always subject to frequent changes hence advisory is only for the benefit of general public. Hence neither Fintaxpro Advisory LLP nor its designated partner are liable for any consequence arises on the basis of You Tube videos.

#GSTR2A #GSTR2B #ITC #Automated3B #fintaxpro #CorrectITC

Комментарии

0:07:00

0:07:00

0:12:44

0:12:44

0:13:30

0:13:30

0:08:01

0:08:01

0:02:54

0:02:54

0:05:42

0:05:42

0:00:52

0:00:52

0:15:03

0:15:03

0:06:14

0:06:14

0:05:19

0:05:19

0:17:18

0:17:18

0:16:28

0:16:28

0:00:51

0:00:51

0:01:30

0:01:30

0:01:01

0:01:01

0:23:32

0:23:32

0:00:59

0:00:59

0:08:32

0:08:32

0:09:57

0:09:57

0:06:41

0:06:41

0:02:15

0:02:15

0:01:01

0:01:01

0:00:28

0:00:28

0:07:54

0:07:54