filmov

tv

Investing Like a Millionaire | Dave Ramsey's Greatest Hits

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

Investing Like a Millionaire | Dave Ramsey's Greatest Hits

I Asked Wall Street Millionaires For Investing Advice

How to Be a Millionaire on a Low Salary

If I Wanted to Become a Millionaire In 2024, I'd Do This

Here's How The Rich Invest Their Money

How to become a millionaire by investing in the S&P500

How I Will Become a Millionaire by 32

THE MINDSET OF A BILLIONAIRE - Ray Dalio Billionaire Investors Advice

Top Successful Enriching Secrets to Propel your Business and Investments! 118/200

How to Become a Millionaire on a Low Salary

How To Manage Your Money Like A Millionaire Does (5 PROVEN WAYS)

7 Principles For Teenagers To Become Millionaires

How To Live Like The Rich On A Budget - How To Invest Like A Millionaire Ep.3

How to Invest Like a Millionaire

Wanna Invest Like a Millionaire? Strategies Revealed (with Naftali Horowitz) | KOSHER MONEY Ep 23

15 Secrets Only Billionaires Know

The Young Millionaire Decision

Think Like a Millionaire

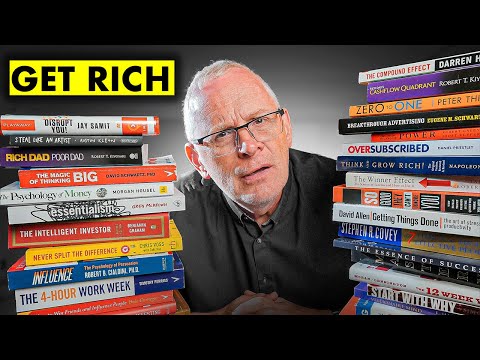

After I Read 40 Books on Money - Here's What Will Make You Rich

How To Become A Millionaire Through Real Estate Investing (Newbies!)

How I Became A Millionaire On Low Income

HOW REAL MILLIONAIRES ROLL 💰 #shorts

3 Advice From A Millionaire

How To Invest In Stocks As A Beginner - Ali Abdaal

Комментарии

0:46:38

0:46:38

0:08:02

0:08:02

0:11:46

0:11:46

0:14:57

0:14:57

0:11:56

0:11:56

0:00:51

0:00:51

0:08:19

0:08:19

0:11:46

0:11:46

0:00:35

0:00:35

0:10:52

0:10:52

0:08:22

0:08:22

0:16:06

0:16:06

0:11:58

0:11:58

0:13:46

0:13:46

1:12:56

1:12:56

0:25:33

0:25:33

0:00:50

0:00:50

0:00:29

0:00:29

0:19:22

0:19:22

0:10:05

0:10:05

0:20:37

0:20:37

0:00:15

0:00:15

0:00:45

0:00:45

0:00:44

0:00:44