filmov

tv

Bitcoin Price Prediction Using Machine Learning And Python

Показать описание

Bitcoin Price Prediction Using Machine Learning And Python

Please Subscribe !

⭐Please Subscribe !⭐

⭐Support the channel and/or get the code by becoming a supporter on Patreon:

⭐Websites:

⭐Helpful Programming Books

► Python (Hands-Machine-Learning-Scikit-Learn-TensorFlow):

► Learning Python:

►Head First Python:

► C-Programming :

► Head First Java:

#Bitcoin #MachineLearning #BitcoinPrediction

Please Subscribe !

⭐Please Subscribe !⭐

⭐Support the channel and/or get the code by becoming a supporter on Patreon:

⭐Websites:

⭐Helpful Programming Books

► Python (Hands-Machine-Learning-Scikit-Learn-TensorFlow):

► Learning Python:

►Head First Python:

► C-Programming :

► Head First Java:

#Bitcoin #MachineLearning #BitcoinPrediction

Bitcoin Price Prediction using Machine Learning | Python Final Year Project

Predict Bitcoin Prices With Machine Learning And Python [W/Full Code]

The Greatest Bitcoin Explanation of ALL TIME (in Under 10 Minutes)

Bitcoin Price Prediction Using Machine Learning And Python

Bitcoin Price Prediction Using Machine Learning in Python

Bitcoin Price Prediction using Machine Learning

Bitcoin Price Prediction Using Machine Learning (VAR, XGBoost, Facebook Prophet) - Python Tutorial

Cryptocurrency price prediction using Machine Learning | Data Science Python Project Ideas

BITCOIN PRICE PUMP OR DUMP ? ALTS COIN TO PUMP HARD SOON I CRYPTO NEWS BANGLA I BITCOIN UPADE

Bitcoin Prediction Using Machine Learning | Machine Learning Projects | ML Projects | Simplilearn

Project 46 : Cryptocurrency (Bitcoin) Price Prediction Using Python & Deep Learning | LSTM | Fla...

Bitcoin Price Prediction using Data Science and Machine Learning.

ChatGPT Trading Strategy Made 19527% Profit ( FULL TUTORIAL )

Bitcoin Price Prediction using Machine Learning in Python

BITCOIN PRICE PREDICTION w/ A.I. & MACHINE LEARNING

Bitcoin Price Prediction In 10 Minutes Using Machine Learning

🤖AI BTC Price Prediction. Shocking Results! 100k? $2.6k? (Artificial Intelligence) Free Tool!!

Bitcoin Future Price Prediction Machine Learning Model in Python

Predicting Bitcoin Price using Deep Learning | Bitcoin Price Prediction using Machine learning

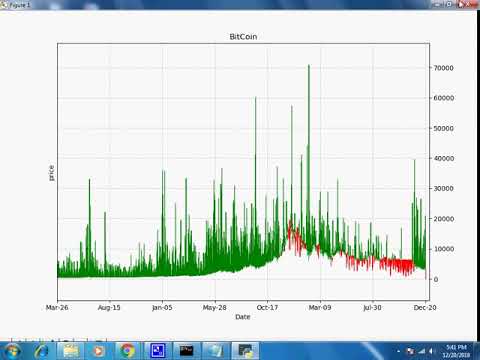

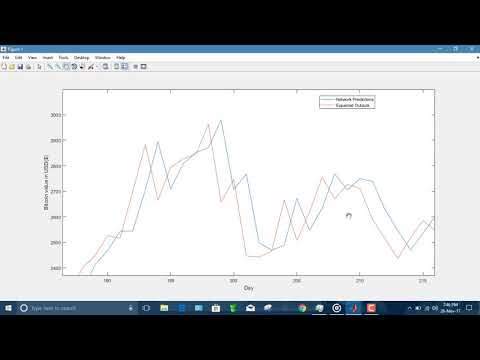

Bitcoin price Prediction using Tensor flow (Python) integrated with MATLAB

Predicting Crypto Prices in Python

Next Best Crypto

BitForecast | Bitcoin Price Prediction using Artificial Intelligence Neural Network

What’s my Bitcoin price prediction? #bitcoin #btc #crypto

Комментарии

0:09:30

0:09:30

0:49:16

0:49:16

0:09:54

0:09:54

0:23:32

0:23:32

0:05:29

0:05:29

0:02:45

0:02:45

0:22:18

0:22:18

0:01:12

0:01:12

0:15:18

0:15:18

0:51:13

0:51:13

1:02:41

1:02:41

1:39:32

1:39:32

0:08:12

0:08:12

0:20:21

0:20:21

0:10:40

0:10:40

0:11:05

0:11:05

0:07:34

0:07:34

0:43:25

0:43:25

0:04:51

0:04:51

0:02:04

0:02:04

0:31:31

0:31:31

0:00:37

0:00:37

0:00:26

0:00:26

0:00:46

0:00:46