filmov

tv

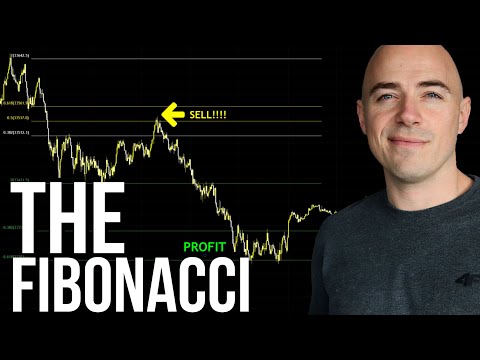

Buy or Sell? Fibonacci Trading Strategy

Показать описание

Mastering Forex Trading: Fibonacci and Moving Average Strategies Unveiled!

Welcome to an insightful journey into the world of Forex trading! In this buy or sell series, we explore two powerful strategies that can elevate your trading game: the Fibonacci Trading Strategy and the Moving Average Trading Strategy. Whether you're a beginner or a seasoned trader, this comprehensive guide will equip you with the knowledge needed to navigate the forex market successfully.

📈 Fibonacci Trading Strategy: Unleashing the Power of Ratios 📉

Unlock the secrets of the Fibonacci Trading Strategy as we dive into the art of utilizing mathematical ratios to predict potential market reversal points. Discover how to apply the Fibonacci retracement tool with precision, gaining insights into market trends and identifying strategic entry and exit points. Learn the nuances of the how to trade Fibonacci tool, and witness firsthand how this strategy can enhance your trading arsenal.

🔄 Moving Average Trading Strategy: Riding the Trend Waves 🔄

Navigate the dynamic world of Forex with the Moving Average Trading Strategy. Explore the intricacies of the moving average exponential indicator, a key component in crafting successful trading strategies. Gain a deep understanding of the moving average crossover strategy, and learn how to identify trend reversals and trade with the market momentum. Uncover the secrets of selecting the best moving average for your trading style, and witness how it can become a reliable ally in your trading journey.

📊 Best Forex Trading Strategy: A Fusion of Fibonacci and Moving Averages 📊

Witness the synergy of two powerful strategies coming together to create the best forex trading strategy. Learn how to seamlessly integrate the Fibonacci and Moving Average strategies to make informed decisions in the forex market. Whether you're a beginner seeking the best forex trading strategy for beginners or an experienced trader looking to refine your approach, this video series is tailored for you.

📈 Scalping Trading Strategy: Mastering the 1-Minute Scalping Approach 📉

For those seeking quick wins, our exploration extends to the scalping trading strategy. Delve into the details of the 1-minute scalping strategy, a technique tested and proven in the market. Learn how to navigate the fast-paced environment, executing precise trades for maximum gains. Discover the ins and outs of a strategy that has been meticulously tested 100 times, ensuring its reliability and effectiveness.

💡 Key Takeaways: Strategies Tested 100 Times for Success 💡

Gain a comprehensive understanding of the Fibonacci Trading Strategy and its application in predicting market reversals.

Master the use of the Fibonacci retracement tool and confidently apply it to your trading toolkit.

Learn the intricacies of the Moving Average Trading Strategy and leverage the power of the moving average exponential indicator.

Explore the effectiveness of the moving average crossover strategy in identifying trend reversals and momentum shifts.

Select the best moving average for your trading style and enhance your decision-making process.

Seamlessly integrate the Fibonacci and Moving Average strategies to create a powerful and well-rounded approach to forex trading.

Explore the nuances of the scalping trading strategy, perfect for traders seeking quick wins in a fast-paced market.

Witness the reliability of the 1-minute scalping strategy, a technique that has been meticulously tested 100 times for optimal performance.

Embark on a transformative journey into the heart of Forex trading. Subscribe now for a front-row seat to the evolution of your trading prowess! 💼📈🚀 #ForexTrading #FibonacciStrategy #MovingAverageStrategy #Scalping #Tested100Times

Welcome to an insightful journey into the world of Forex trading! In this buy or sell series, we explore two powerful strategies that can elevate your trading game: the Fibonacci Trading Strategy and the Moving Average Trading Strategy. Whether you're a beginner or a seasoned trader, this comprehensive guide will equip you with the knowledge needed to navigate the forex market successfully.

📈 Fibonacci Trading Strategy: Unleashing the Power of Ratios 📉

Unlock the secrets of the Fibonacci Trading Strategy as we dive into the art of utilizing mathematical ratios to predict potential market reversal points. Discover how to apply the Fibonacci retracement tool with precision, gaining insights into market trends and identifying strategic entry and exit points. Learn the nuances of the how to trade Fibonacci tool, and witness firsthand how this strategy can enhance your trading arsenal.

🔄 Moving Average Trading Strategy: Riding the Trend Waves 🔄

Navigate the dynamic world of Forex with the Moving Average Trading Strategy. Explore the intricacies of the moving average exponential indicator, a key component in crafting successful trading strategies. Gain a deep understanding of the moving average crossover strategy, and learn how to identify trend reversals and trade with the market momentum. Uncover the secrets of selecting the best moving average for your trading style, and witness how it can become a reliable ally in your trading journey.

📊 Best Forex Trading Strategy: A Fusion of Fibonacci and Moving Averages 📊

Witness the synergy of two powerful strategies coming together to create the best forex trading strategy. Learn how to seamlessly integrate the Fibonacci and Moving Average strategies to make informed decisions in the forex market. Whether you're a beginner seeking the best forex trading strategy for beginners or an experienced trader looking to refine your approach, this video series is tailored for you.

📈 Scalping Trading Strategy: Mastering the 1-Minute Scalping Approach 📉

For those seeking quick wins, our exploration extends to the scalping trading strategy. Delve into the details of the 1-minute scalping strategy, a technique tested and proven in the market. Learn how to navigate the fast-paced environment, executing precise trades for maximum gains. Discover the ins and outs of a strategy that has been meticulously tested 100 times, ensuring its reliability and effectiveness.

💡 Key Takeaways: Strategies Tested 100 Times for Success 💡

Gain a comprehensive understanding of the Fibonacci Trading Strategy and its application in predicting market reversals.

Master the use of the Fibonacci retracement tool and confidently apply it to your trading toolkit.

Learn the intricacies of the Moving Average Trading Strategy and leverage the power of the moving average exponential indicator.

Explore the effectiveness of the moving average crossover strategy in identifying trend reversals and momentum shifts.

Select the best moving average for your trading style and enhance your decision-making process.

Seamlessly integrate the Fibonacci and Moving Average strategies to create a powerful and well-rounded approach to forex trading.

Explore the nuances of the scalping trading strategy, perfect for traders seeking quick wins in a fast-paced market.

Witness the reliability of the 1-minute scalping strategy, a technique that has been meticulously tested 100 times for optimal performance.

Embark on a transformative journey into the heart of Forex trading. Subscribe now for a front-row seat to the evolution of your trading prowess! 💼📈🚀 #ForexTrading #FibonacciStrategy #MovingAverageStrategy #Scalping #Tested100Times

Комментарии

0:03:49

0:03:49

0:01:01

0:01:01

0:09:27

0:09:27

0:01:01

0:01:01

0:00:52

0:00:52

0:08:31

0:08:31

0:00:59

0:00:59

0:01:01

0:01:01

0:51:19

0:51:19

0:19:28

0:19:28

0:19:28

0:19:28

0:15:20

0:15:20

0:14:38

0:14:38

0:12:55

0:12:55

0:09:42

0:09:42

0:09:30

0:09:30

0:00:57

0:00:57

0:01:00

0:01:00

0:09:00

0:09:00

0:00:54

0:00:54

0:27:37

0:27:37

0:11:10

0:11:10

0:18:50

0:18:50

0:00:41

0:00:41