filmov

tv

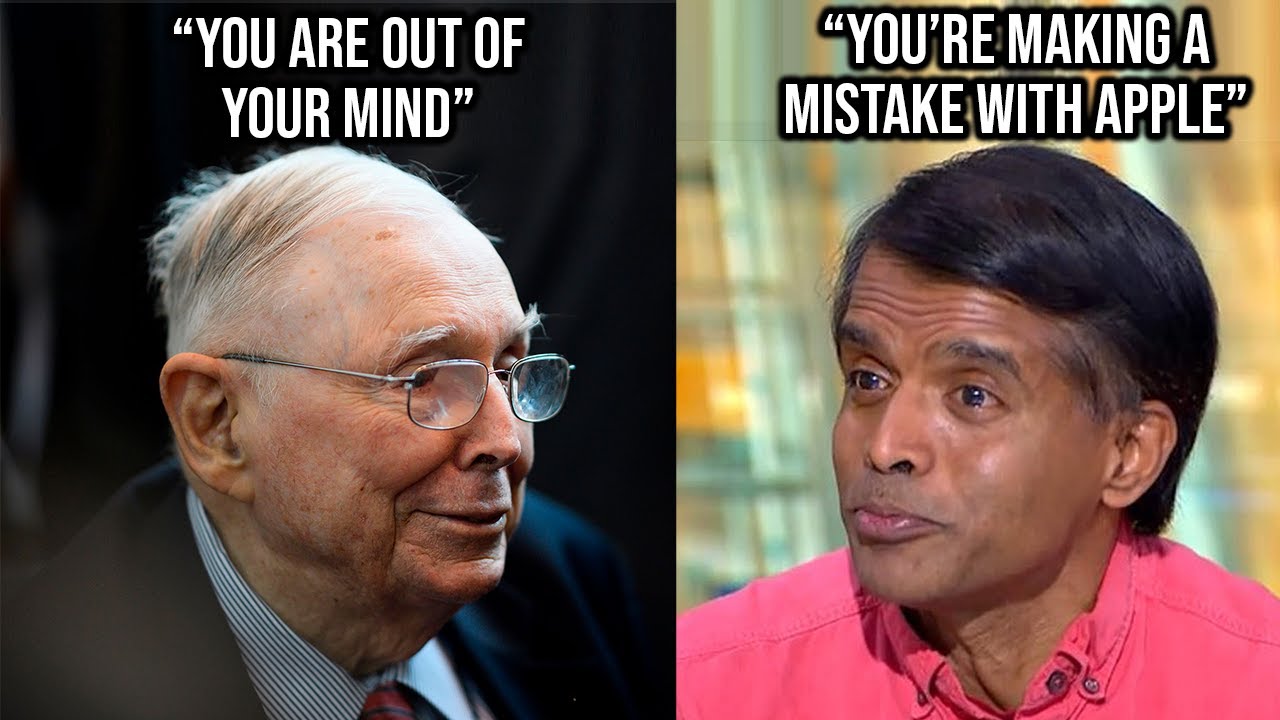

Aswath Damodaran Confronts Buffett & Munger On Their Portfolio

Показать описание

Socials

___

DISCLAIMER: It's important to note that I am not a financial adviser and you should do your own research when picking stocks to invest in. These are just some of my viewpoints, by no means would I recommend watching one YouTube video and then immediately buying that stock. This video was made for educational and entertainment purposes only. Consult your financial adviser.

Aswath Damodaran Confronts Buffett & Munger On Their Portfolio

'Cathie Wood Delusion' | Damodaran's Take on Macro Markets 💡

Warren Buffett on the SPAC bubble

In Future 6-7 Large Bank Will Dominate Says Aswath Damodaran Talking About The Banking Crisis

Robert Kiyosaki Confronts Warren Buffett On His Investments

Charlie Munger being honest (and right) #stocks #warrenbuffet #charliemunger #investment #apple

Aswath Damodaran Sends WARNING To Nvidia Stock Owners

Warren Buffett: How I Do Market Valuation in Investment

From Jobs to Cook: Apple's Journey with Damodaran 🚀 #shorts #stevejobs #timcook

Aswath Damodaran on BAD Advices that Retail Investors Get ALL THE TIME! STOP DOING THIS!

there are only two newspaper in the US that have succesful internet model | warren buffett #shorts

Munger admits he missed out the chances with Google

Banks Shouldn’t Be Lending Money To Young Companies Says Aswath Damodaran

Netflix, Amazon, and Facebook User VALUE by Aswath Damodaran | OTT | Social media | E-commerce

Warren Buffett: Why Companies Perform Stock Buybacks

Who is your Teacher? #bitcoin #crypto #buffet #ekcrypto #money #debt

charlie are you gonna write a book? | warren buffett #shorts

Professor Aswath Damodaran | Gold as an Investment

Warren Buffett on How Interest Rates Affect Valuation? | BRK 1994【C:W.B Ep.12】

Warren Buffett - Gem on Determining the Value of a Business

Valuation Guru Aswath Damodaran On The Inertia & Indifference In The Indian System

#shorts Prof. Aswath Damodaran | Netflix Business is Broken

Warren Buffet : 2 rules for investing and 1 personality trait. That's all you need !!!

📈Aswath Damodaran explains what Nvidia is really worth📈

Комментарии

0:08:39

0:08:39

0:00:55

0:00:55

0:06:35

0:06:35

0:00:37

0:00:37

0:07:50

0:07:50

0:00:27

0:00:27

0:12:24

0:12:24

0:04:57

0:04:57

0:00:31

0:00:31

0:04:01

0:04:01

0:00:40

0:00:40

0:00:45

0:00:45

0:00:32

0:00:32

0:00:56

0:00:56

0:00:58

0:00:58

0:00:50

0:00:50

0:00:56

0:00:56

0:07:06

0:07:06

0:02:53

0:02:53

0:00:57

0:00:57

0:02:26

0:02:26

0:00:29

0:00:29

0:00:59

0:00:59

0:01:01

0:01:01