filmov

tv

The 3 Big Pension Mistakes Retirees Make (Real world examples)

Показать описание

Financial Planning

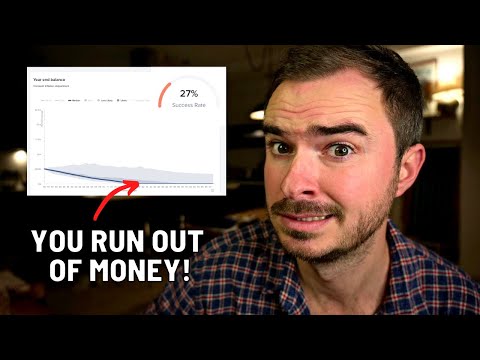

Taking pension benefits when you reach 55 may be the worst financial mistake of your life.

Over the last few months, lots of you have been getting in touch asking for help with your financial planning. Most of you have been making simple mistakes that are easy to fix, but there are some mistakes that I cannot help you with. These are the 3 Big Pension Mistakes that I’ve seen people make, I want you to know about them so you don't fall into the same traps.

DISCLAIMER:

This channel is for education purposes only and does not constitute financial advice - James is not responsible for investment actions taken by viewers. Please seek out a regulated advisor if you require assistance (whilst James is a financial adviser, he does not provide advice through this Youtube Channel, which is not affiliated with his employer).

James Shack™ property of James Shackell

Copyright © James Shackell 2021. All rights reserved.

The author asserts their moral right under the Copyright, Designs and Patents Act 1988 to be identified as the author of this channel and any video published on it.

0:00 Intro

1:38 Pensions Recap

3:24 Mistake Number 1

6:36 Mistake Number 2

08:18 Mistake Number 3

Taking pension benefits when you reach 55 may be the worst financial mistake of your life.

Over the last few months, lots of you have been getting in touch asking for help with your financial planning. Most of you have been making simple mistakes that are easy to fix, but there are some mistakes that I cannot help you with. These are the 3 Big Pension Mistakes that I’ve seen people make, I want you to know about them so you don't fall into the same traps.

DISCLAIMER:

This channel is for education purposes only and does not constitute financial advice - James is not responsible for investment actions taken by viewers. Please seek out a regulated advisor if you require assistance (whilst James is a financial adviser, he does not provide advice through this Youtube Channel, which is not affiliated with his employer).

James Shack™ property of James Shackell

Copyright © James Shackell 2021. All rights reserved.

The author asserts their moral right under the Copyright, Designs and Patents Act 1988 to be identified as the author of this channel and any video published on it.

0:00 Intro

1:38 Pensions Recap

3:24 Mistake Number 1

6:36 Mistake Number 2

08:18 Mistake Number 3

Комментарии

0:14:15

0:14:15

0:10:22

0:10:22

0:14:08

0:14:08

0:17:10

0:17:10

0:12:21

0:12:21

0:08:46

0:08:46

0:16:01

0:16:01

0:15:52

0:15:52

0:14:21

0:14:21

0:07:42

0:07:42

0:12:04

0:12:04

0:09:43

0:09:43

0:07:54

0:07:54

0:12:50

0:12:50

0:13:06

0:13:06

0:20:01

0:20:01

0:12:48

0:12:48

0:10:57

0:10:57

0:10:52

0:10:52

0:08:20

0:08:20

0:03:24

0:03:24

0:01:00

0:01:00

0:03:33

0:03:33

0:05:22

0:05:22