filmov

tv

Payback Period | Uneven Cash Inflow | Capital Budgeting |Problems & Solutions | Financial Management

Показать описание

Solved problems illustrating Payback Period - Uneven cash flows.

Procedure for computation of Payback Period

- Compute cumulative Cah inflow( Profit after Tax Before Depreciation)

at the end of each year

- Find out the year in which cumulative cash inflow exceeds the initial investment

-Payback period = Time at which cumulative Cash inflow = Initial investment(calculated on time proportion basis)

Accept - Reject Criterion:

1. If the actual payback period is less than the predetermined payback, the project would be accepted, if not, it would be rejected.

2. The project having the shortest payback may be assigned rank 1, followed in that order so that the project with the longest payback would be ranked last.

Advantages:

- It is simple to understand and easy to calculate.

- It saves cost, it requires lesser time and labour as compared to other methods of capital budgeting.

Disadvantages:

- This method ignores the time value of money.

- It does not measure the true profitability of the project.

Links:

Introduction:

Even Cash Inflows:

#FinancialManagement #CapitalBudgeting

Procedure for computation of Payback Period

- Compute cumulative Cah inflow( Profit after Tax Before Depreciation)

at the end of each year

- Find out the year in which cumulative cash inflow exceeds the initial investment

-Payback period = Time at which cumulative Cash inflow = Initial investment(calculated on time proportion basis)

Accept - Reject Criterion:

1. If the actual payback period is less than the predetermined payback, the project would be accepted, if not, it would be rejected.

2. The project having the shortest payback may be assigned rank 1, followed in that order so that the project with the longest payback would be ranked last.

Advantages:

- It is simple to understand and easy to calculate.

- It saves cost, it requires lesser time and labour as compared to other methods of capital budgeting.

Disadvantages:

- This method ignores the time value of money.

- It does not measure the true profitability of the project.

Links:

Introduction:

Even Cash Inflows:

#FinancialManagement #CapitalBudgeting

Payback period - Example 2 - Uneven cash flow

Payback Period with Uneven Cash Flows

Payback Period | Uneven Cash Inflow | Capital Budgeting |Problems & Solutions | Financial Manage...

Payback Period Calculation: Even and Uneven Cash Flows

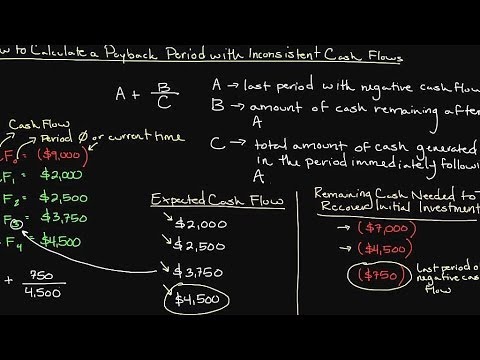

How to Calculate a Payback Period with Inconsistent Cash Flows

M15 payback uneven cash flows

Payback period

Payback period - Example 2 - Uneven cash flow

#2 Payback Period - Investment Decision - Financial Management ~ B.COM / BBA / CMA

PAYBACK PERIOD UNEVEN CASH FLOW AND PAYBACK RECIPROCAL

PAYBACK UNEVEN CASHFLOW

Calculating Payback with uneven cash flow

payback period when cash flow unequal

Uneven Cash Flow | Pay Back Period | Numerical | Capital Budgeting | FM | BBA | MBA | B.Com | M.Com

Payback Period - Basics, Formula, Calculations in Excel (Step by Step)

Payback and Discounted Payback Period in Excel

How to Determine Cash Payback Period

How to calculate PAYBACK PERIOD in MS Excel Spreadsheet 2019

MANAGERIAL ECONOMICS AND ACCOUNTANCY HOW TO CALCULATE PAYBACK OF UNEVEN CASH FLOW

Discounted payback period - Example 1

Payback Period

Payback Calculation - How to Calculate Payback Period

Payback Period (PBP) Calculation - Selection/Decision Criteria of Project Management.

Payback calculation

Комментарии

0:06:54

0:06:54

0:04:14

0:04:14

0:11:34

0:11:34

0:04:24

0:04:24

0:05:07

0:05:07

0:01:24

0:01:24

0:08:26

0:08:26

0:06:54

0:06:54

0:13:37

0:13:37

0:04:52

0:04:52

0:01:41

0:01:41

0:03:42

0:03:42

0:05:42

0:05:42

0:08:12

0:08:12

0:15:59

0:15:59

0:09:18

0:09:18

0:04:38

0:04:38

0:02:50

0:02:50

0:03:01

0:03:01

0:12:42

0:12:42

0:00:16

0:00:16

0:06:56

0:06:56

0:10:07

0:10:07

0:08:23

0:08:23