filmov

tv

Converting Nominal Interest Rates to Different Compounding Periods

Показать описание

Follow us:

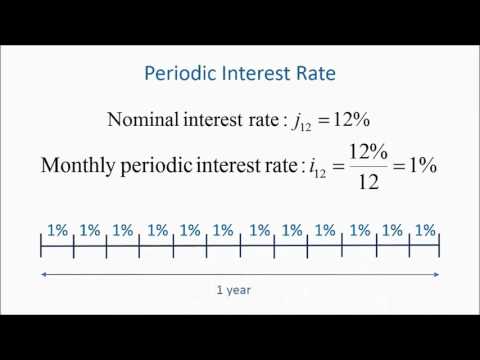

Sometimes the compounding period of the interest on a loan will not match the when deposits are expected to be made. For example, you are expected to make monthly mortgage payments, but the interest is compounded semi-annually. In cases like these, we must convert the nominal rate to an equivalent rate that matches the timing of the cash flows.

Q1. Find the equivalent rate of interest for a loan rated at 8% compounded semi-annually to interest compounded annually.

Note: When finding the equivalent annual rate, it is called the effective annual rate.

Q2. Find the equivalent rate of interest for a loan rated at 3.5% compounded monthly to interest compounded semi-annually.

Converting Nominal Interest Rates to Different Compounding Periods

Nominal interest, real interest, and inflation calculations | AP Macroeconomics | Khan Academy

How To Convert The Nominal Interest Rate To The Effective Interest Rate (With Formula) Explained

Financial Maths Grade 11 | Effective to Nominal

Converting nominal interest rate to effective interest rate

Nominal Interest Rates | Exam FM | Financial Mathematics Lesson 7 - JK Math

Nominal and Effective Interest Rates - Engineering Economics Lightboard

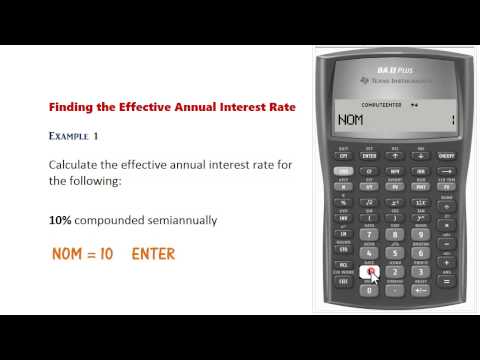

BA II Plus - Nominal & Effective Rate Conversions

The Son of Finance of the Great Age Manhua Part 5 ManhuaRecap|manhwa|comic|AUDIOBOOK|LIGHT NOVEL

How To Convert Effective Interest Rate To Nominal Interest Rate // SHARP EL-738XT Calculator

How to convert monthly interest rates to annual or yearly rates and back

Calculating Effective & Nominal Interest Rate using HP 10BII+ Financial Calculator

📚 How to calculate the effective interest rate

Nominal v. Real Interest Rates- Macro Topic 4.2

How to convert a negative effective rate into a nominal rate (you cannot use NOMINAL function)

Nominal vs effective interest calculations

Convert a nominal rate compounded monthly to an annual effective rate and convert an effective rate

Effective Interest Rate vs Nominal Interest Rate | (EAR vs APR) | Explained with Examples

Nominal Rates of Interest and Discounts and Their Relationship

CONVERTING NOMINAL RATE TO EFFECTIVE RATE

How To Convert (And Formula For) The Effective Interest Rate To The Nominal Interest Rate Explained

Ana's UBC Real Estate Math Course: Nominal and Periodic Interest Rates (Chapter 13, Video 3)

Converting interest rates

Calculating Nominal & Effective interest rates compounding using hp10bii+ financial calculator

Комментарии

0:06:05

0:06:05

0:03:34

0:03:34

0:01:36

0:01:36

0:03:39

0:03:39

0:04:55

0:04:55

0:13:36

0:13:36

0:10:54

0:10:54

0:05:51

0:05:51

9:05:46

9:05:46

0:01:29

0:01:29

0:02:43

0:02:43

0:08:32

0:08:32

0:03:22

0:03:22

0:02:35

0:02:35

0:01:35

0:01:35

0:05:13

0:05:13

0:07:03

0:07:03

0:11:45

0:11:45

0:05:28

0:05:28

0:00:56

0:00:56

0:01:31

0:01:31

0:05:24

0:05:24

0:02:19

0:02:19

0:07:41

0:07:41