filmov

tv

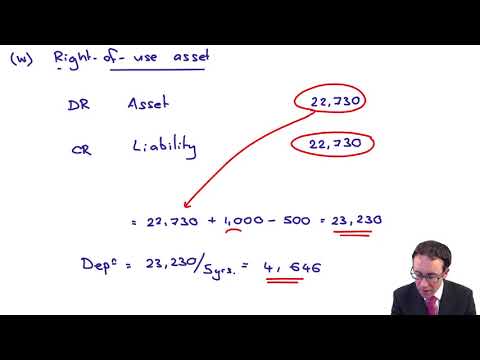

LESSEE ACCOUNTING - LEASE PAYMENTS MADE IN ADVANCE (IFRS 16)

Показать описание

In this tutorial video, I demonstrate how leases are accounted for in the financial statements of the lessee, where lease payments are made in advance (i.e. at the beginning of the year). I also illustrate how the concept of annuity applies to the determination of the initial lease liability at the commencement date.

LESSEE ACCOUNTING - LEASE PAYMENTS MADE IN ADVANCE (IFRS 16)

IFRS 16 - Lease Accounting - Accounting for leases in the lessee's books - Intro video - Video ...

How to Calculate Lease Payments

IFRS 16 LEASES - ACCOUNTING FOR LEASES( PART 1 ).

PwC's Analysing IFRS 16 Leases - 4. Variable lease payments

How to Calculate the Lease Liability | Lessee | IFRS 16

IFRS 16 LEASES - ACCOUNTING FOR LEASES. ( PART 2 ). LEASE PAYMENTS ARE MADE IN ADVANCE.#accounting.

Example: Lease accounting under IFRS 16

Lessee accounting - Simplified approach

IFRS 16 Leases [with EXAMPLE & accounting entries] ~ for lessees ~

Leases - Example - ACCA Financial Reporting (FR)

LESSEE ACCOUNTING - LEASE PAYMENTS MADE IN ARREARS (IFRS 16)

Free Cheat Sheet Included! Master Lease Accounting for the CPA Exam | Maxwell CPA Review

IFRS 16 Leases summary - applies in 2024

Lessee Accounting for Finance/Capital Lease with a Bargain Purchase Option: IFRS & ASPE (rev 202...

Lessee accounting - ACCA (SBR) lectures

IFRS 16 Lessee Accounting Example 2

IFRS 16 Lessee Accounting Example 1

Accounting for Finance Lease: Lessee's Perspective Example. CPA Exam

IFRS 16 LEASES | LESSORS and LESSEES with Journal Entries

ACCA P2 IFRS 16 Lessee accounting

IFRS 16 Lessor Accounting Example 1 | Finance Lease

IFRS 16 - Lease Accounting – Reassessments of lease liabilities – Example (1/2) - Video #34

The Effect of the Residual Value on the Lease Liability | Lessee | IFRS 16

Комментарии

0:28:56

0:28:56

0:03:26

0:03:26

0:03:48

0:03:48

0:29:58

0:29:58

0:05:02

0:05:02

0:09:27

0:09:27

0:41:16

0:41:16

0:08:06

0:08:06

0:29:03

0:29:03

0:06:36

0:06:36

0:21:32

0:21:32

0:28:52

0:28:52

0:13:51

0:13:51

0:10:48

0:10:48

0:17:14

0:17:14

0:22:14

0:22:14

0:09:28

0:09:28

0:13:25

0:13:25

0:14:20

0:14:20

0:27:37

0:27:37

0:22:16

0:22:16

0:11:10

0:11:10

0:09:10

0:09:10

0:06:39

0:06:39