filmov

tv

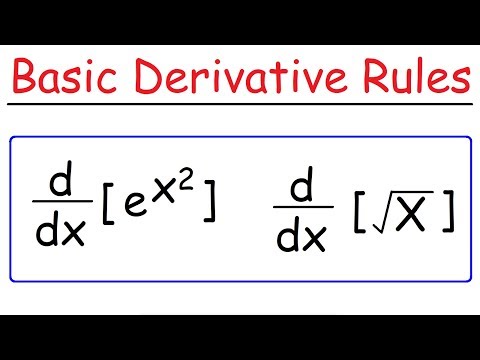

Derivatives Facts

Показать описание

Keywords: Derivatives market, notional value, financial instruments, risk management, investment strategies, global finance, market speculation, contract value, economic stability, financial contracts, hedging, leverage, financial markets, asset prices, market players, trading volume, financial speculation, complex securities, market risk, credit risk, interest rate risk, market size, financial innovation, global economy, financial trading, capital markets, financial system, economic implications, financial entities, investment risk, speculative trading, market dynamics, financial strategies, economic analysis.

Title: Navigating Complexity: The Derivatives Market's Staggering Notional Value of Over $1 Quadrillion

In the intricate world of global finance, the derivatives market holds a position of remarkable influence and complexity. This market, representing financial contracts that derive their value from the performance of underlying entities such as assets, interest rates, or indices, is estimated to have a notional value — or the total value of a leveraged position's assets — of over $1 quadrillion, a figure that dwarfs the size of the world economy.

Derivatives, including a vast array of financial instruments such as options, futures, and swaps, are utilized by market participants for a spectrum of purposes including risk management, hedging, arbitrage, and speculation. Their flexibility and diversity make them valuable tools for investors, financial institutions, and corporations alike.

One of the primary functions of derivatives is risk management. Investors and companies use derivatives to hedge against various risks such as fluctuations in asset prices, interest rates, or exchange rates. For example, a producer of goods can use futures contracts to lock in prices and stabilize revenue, while an international corporation might use currency swaps to mitigate the risk posed by volatile foreign exchange markets.

On the flip side, the very characteristics that make derivatives valuable also contribute to their complexity and potential risk. High leverage, where small movements in the underlying asset can result in significant gains or losses, combined with market speculation, can introduce substantial risk into the financial system. Notably, the notional value doesn't represent money directly at risk, but rather the aggregate value of the contracts based on underlying asset prices.

The vast size of the derivatives market — over ten times the global GDP — is indicative of these instruments' prevalence in modern finance and the high volume of trading activity they see. However, it's critical to understand that the market's notional value does not equate to actual wealth or market capitalization. Instead, it represents the aggregate value of contracts written, a figure that far exceeds the market value of the assets underlying those contracts.

The immense scale of the derivatives market underscores its importance to the global financial system but also highlights potential systemic risks. Events such as the 2008 financial crisis have illustrated how derivatives, when poorly understood or inadequately managed, can contribute to financial instability. As such, this market is subject to ongoing scrutiny and regulation aimed at mitigating systemic risk, enhancing transparency, and ensuring the integrity of global financial markets.

In conclusion, the derivatives market, with its notional value exceeding $1 quadrillion, is a behemoth in the global financial arena, playing a critical role in facilitating economic activity and enabling entities to manage risks effectively. However, its size and complexity necessitate prudent management, comprehensive understanding, and effective regulation to safeguard economic stability. For investors, financial professionals, and regulators, the derivatives market offers both profound opportunities and significant challenges, standing as a testament to the intricacies and interconnectedness of modern finance.

Title: Navigating Complexity: The Derivatives Market's Staggering Notional Value of Over $1 Quadrillion

In the intricate world of global finance, the derivatives market holds a position of remarkable influence and complexity. This market, representing financial contracts that derive their value from the performance of underlying entities such as assets, interest rates, or indices, is estimated to have a notional value — or the total value of a leveraged position's assets — of over $1 quadrillion, a figure that dwarfs the size of the world economy.

Derivatives, including a vast array of financial instruments such as options, futures, and swaps, are utilized by market participants for a spectrum of purposes including risk management, hedging, arbitrage, and speculation. Their flexibility and diversity make them valuable tools for investors, financial institutions, and corporations alike.

One of the primary functions of derivatives is risk management. Investors and companies use derivatives to hedge against various risks such as fluctuations in asset prices, interest rates, or exchange rates. For example, a producer of goods can use futures contracts to lock in prices and stabilize revenue, while an international corporation might use currency swaps to mitigate the risk posed by volatile foreign exchange markets.

On the flip side, the very characteristics that make derivatives valuable also contribute to their complexity and potential risk. High leverage, where small movements in the underlying asset can result in significant gains or losses, combined with market speculation, can introduce substantial risk into the financial system. Notably, the notional value doesn't represent money directly at risk, but rather the aggregate value of the contracts based on underlying asset prices.

The vast size of the derivatives market — over ten times the global GDP — is indicative of these instruments' prevalence in modern finance and the high volume of trading activity they see. However, it's critical to understand that the market's notional value does not equate to actual wealth or market capitalization. Instead, it represents the aggregate value of contracts written, a figure that far exceeds the market value of the assets underlying those contracts.

The immense scale of the derivatives market underscores its importance to the global financial system but also highlights potential systemic risks. Events such as the 2008 financial crisis have illustrated how derivatives, when poorly understood or inadequately managed, can contribute to financial instability. As such, this market is subject to ongoing scrutiny and regulation aimed at mitigating systemic risk, enhancing transparency, and ensuring the integrity of global financial markets.

In conclusion, the derivatives market, with its notional value exceeding $1 quadrillion, is a behemoth in the global financial arena, playing a critical role in facilitating economic activity and enabling entities to manage risks effectively. However, its size and complexity necessitate prudent management, comprehensive understanding, and effective regulation to safeguard economic stability. For investors, financial professionals, and regulators, the derivatives market offers both profound opportunities and significant challenges, standing as a testament to the intricacies and interconnectedness of modern finance.

0:01:30

0:01:30

0:06:01

0:06:01

0:07:16

0:07:16

0:00:08

0:00:08

0:17:05

0:17:05

0:05:52

0:05:52

0:07:15

0:07:15

0:09:01

0:09:01

1:28:54

1:28:54

0:09:51

0:09:51

0:00:35

0:00:35

0:01:44

0:01:44

0:03:34

0:03:34

0:06:19

0:06:19

0:20:44

0:20:44

0:00:45

0:00:45

0:00:48

0:00:48

0:08:04

0:08:04

0:58:04

0:58:04

0:07:36

0:07:36

0:00:59

0:00:59

0:00:39

0:00:39

0:00:58

0:00:58

0:00:50

0:00:50