filmov

tv

6 Easy Steps On How To File A Consumer Proposal In Ontario

Показать описание

Large debt can be overwhelming and often requires outside help to get from under. In Canada, Consumer Proposals are the number one option for debt relief. In this video, Maureen Parent, a Licensed Insolvency Trustee with Hoyes, Michalos, & Associates, explains the simple steps of filing a Consumer Proposal in Ontario.

Or give us a call at; 310-PLAN

00:09 - Intro

00:38 - Step 1: Recognizing the Need for Help

01:26 - Step 2: Creating Your Personalized Proposal

01:58 - Step 3: Filing the Proposal and Stopping Interest

02:11 - Step 4: Creditor Voting Process

02:43 - Step 5: Making Payments and Financial Counseling

03:16 - Step 6: Completing Your Consumer Proposal

03:46 - Credit Score Concerns Answered

04:10 - Conclusion

#debt #debtfree #debtfreejourney #consumerproposal #ontario #consumerpropsalontario #canada #debtrelief #personalfinance

Or give us a call at; 310-PLAN

00:09 - Intro

00:38 - Step 1: Recognizing the Need for Help

01:26 - Step 2: Creating Your Personalized Proposal

01:58 - Step 3: Filing the Proposal and Stopping Interest

02:11 - Step 4: Creditor Voting Process

02:43 - Step 5: Making Payments and Financial Counseling

03:16 - Step 6: Completing Your Consumer Proposal

03:46 - Credit Score Concerns Answered

04:10 - Conclusion

#debt #debtfree #debtfreejourney #consumerproposal #ontario #consumerpropsalontario #canada #debtrelief #personalfinance

How to Get EVERY Dosage Calculations Problem RIGHT (6 EASY STEPS!)

ACE Dosage Calculations in 6 EASY Steps | Dosage Calculations Practice Problems

Film YouTube Videos On Your Smartphone By Yourself [6 Easy Steps]

6 EASY STEPS TO FIND YOUR INTERIOR DESIGN STYLE ✨

AMAZING FOCACCIA BREAD | How to Make it in 6 Easy Steps

How to Green Screen (6 Easy Steps)

MEAL PLANNING for Beginners | 6 Easy Steps

How to Bind a Quilt - 6 Simple Steps

Easy steps to Ride A Bicycle | Papa ne sikai 🚲in 2 days #trendingshorts #bicycle #ytshortsviral

How I dress up | Look BETTER in 6 easy steps

Ace Your IV Drip Rate Calculations in 6 EASY STEPS

How to Paint a Winter Landscape in 6 Easy Steps!

HOW TO MAKE YOUR EYES LOOK BIGGER IN 6 EASY STEPS | ALI ANDREEA

TRAVIS PICKING - The most useful fingerpicking pattern, 6 easy steps!

How To Make A Tote Bag - In Only 6 Easy Steps!

How To Be A Great Parent in 6 Easy Steps

How To Create Linkable Assets In 6 Easy Steps 🧲

How to Start a Room Makeover | 6 Easy Steps!

6 Easy Steps - Stenciling Instructions: Decorative Concrete - Creative Stencil Pattern Application

Make Your Videos LOOK CINEMATIC in Premiere Pro (6 Easy Steps)

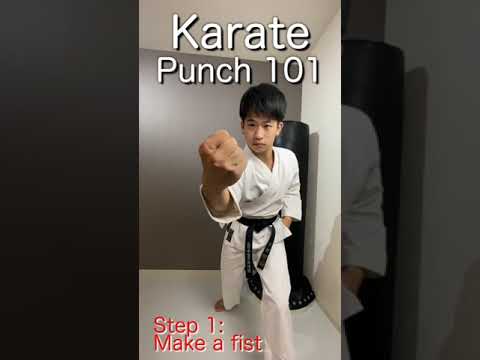

5 EASY STEPS FOR KARATE PUNCHES!!! #shorts

HOW TO GET THE PERFECT MANICURE AT HOME | 6 Easy Steps #shorts

Learn the Floor Kip-Up Safely in 6 Steps - GMB Fitness

How to Parallel Park - 6 Easy Steps

Комментарии

0:16:00

0:16:00

0:27:53

0:27:53

0:18:41

0:18:41

0:10:37

0:10:37

0:08:42

0:08:42

0:10:51

0:10:51

0:08:47

0:08:47

0:06:57

0:06:57

0:00:34

0:00:34

0:03:45

0:03:45

0:19:54

0:19:54

0:31:06

0:31:06

0:07:06

0:07:06

0:14:39

0:14:39

0:57:20

0:57:20

0:04:07

0:04:07

0:03:15

0:03:15

0:10:49

0:10:49

0:05:45

0:05:45

0:04:03

0:04:03

0:00:15

0:00:15

0:00:55

0:00:55

0:00:59

0:00:59

0:02:31

0:02:31