filmov

tv

Highest Profit Trading Strategy On The 1 Minute Chart - RSI + Stochastic + EMA

Показать описание

Thanks for watching! Check out my exchange affiliates, patreon page, and twitter down below!

Follow me on:

Follow me on:

HIGHEST PROFIT Trading Strategy On YouTube Proven 100 Trades - MTF Indicator + MACD

BEST MACD Trading Strategy [86% Win Rate]

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

I Found A Trading Strategy With a 225% Profit Rate #shorts

Highly Profitable DEMA + SuperTrend Trading Strategy

I Tested This Trading Strategy & It Made 310%

BEST Scalping Trading Strategy For Beginners (How To Scalp Forex, Stocks, and Crypto)

Top 5 Profitable Trading Strategies (THAT WORKS)

Hurry up to earn your dream with Crypto Arbitrage in 2024! Ripple and Binance Scheme

🟣 How to Make Money with Binary Options | Trading Strategy for Beginners

🟡 Pocket Option Signals - Live Trading Strategy & Tips for Beginners

How To Get PERFECT Take Profit Levels

ChatGPT Trading Strategy Made 19527% Profit ( FULL TUTORIAL )

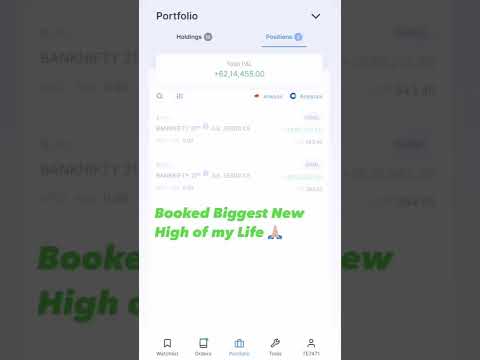

BIGGEST PROFIT OF MY LIFE!! || Read Description || Booming Bulls #shorts

NEW HIGHEST PROFIT TRADING STRATEGY WITH PROVEN RESULTS - Holy Grail Strategy

After 8 Years Trading This Is My Favorite Strategy - Best Way To Trade Consistently And Profitably

💰 98 LAKHS PROFIT from SCALPING? #shorts #trading #motivation #business #money #stockmarket #rich

3000% in 2 Weeks with this Options Strategy 🚀💰

How To Grow A Small Stock Account

5400$ PROFIT WITH THESE CRAZY TRADINGVIEW INDICATORS

Four Price Action Secrets (The Ultimate Guide To Price Action)

Highest profit of my trading career! ❤️ #optionstrading #bankniftyoptions #trader #tradingvideo

EASY Scalping Strategy For Daytrading Forex (High Winrate Strategy)

Live Binance Futures Trading | $2000 profit just in minutes #crypto #scalping

Комментарии

0:09:36

0:09:36

0:07:06

0:07:06

0:00:39

0:00:39

0:01:00

0:01:00

0:08:24

0:08:24

0:01:00

0:01:00

0:07:22

0:07:22

0:09:49

0:09:49

0:04:02

0:04:02

0:10:53

0:10:53

0:09:48

0:09:48

0:00:53

0:00:53

0:08:12

0:08:12

0:00:31

0:00:31

0:15:04

0:15:04

0:12:50

0:12:50

0:00:34

0:00:34

0:00:59

0:00:59

0:08:45

0:08:45

0:00:49

0:00:49

0:08:11

0:08:11

0:00:15

0:00:15

0:08:46

0:08:46

0:00:22

0:00:22