filmov

tv

YIELD Function in Excel | How to use Excel YIELD Function?

Показать описание

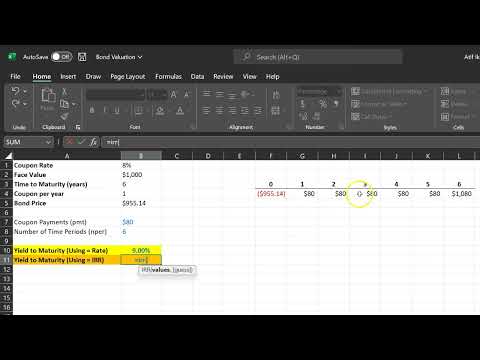

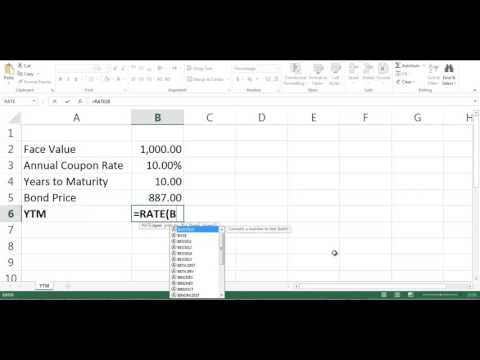

In this video, we are going to learn how to use YIELD function in excel using YIELD Formula.

𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐱𝐜𝐞𝐥

---------------------------------------------

Yield function is an advanced financial function in excel used to compute the amount of income produced every year from the investment amount.

𝐘𝐈𝐄𝐋𝐃 𝐄𝐱𝐜𝐞𝐥 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

---------------------------------------

Below is the formula of YIELD Function

= YIELD (sd, md, rate, pr, redemption, frequency, [basis])

𝐀𝐫𝐠𝐮𝐦𝐞𝐧𝐭𝐬

----------------------------

Settlement Date (sd) = Date on which the coupon is purchased by the buyer or the date on which bond is purchased or the settlement date of the security.

Maturity Date(md) = The security maturity date or the expiration date of the purchased coupon.

Rate = Rate is security's annual coupon rate.

Pr = Pr is the security price for the value of $ 100.

Redemption = Redemption is the security redemption value for the stated value of $ 100.

Frequency = Frequency means a number of coupons paid per year i.e. 1 for annual payment and 2 for semiannual and 4 for quarterly payment.

[ Basis ]= Base is an optional integer parameter that states the security's day count basis.

𝐓𝐡𝐢𝐧𝐠𝐬 𝐭𝐨 𝐑𝐞𝐦𝐞𝐦𝐛𝐞𝐫 𝐰𝐡𝐢𝐥𝐞 𝐮𝐬𝐢𝐧𝐠 𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐱𝐜𝐞𝐥

----------------------------------------------------------------------------------------------------

Below are the information of the error that can be found in the function Bond Yield Excel due to mismatch type:

#1 - NUM!: The bond yield in Excel may have two possibilities for this error.

a) If the date of settlement in Excel yield is greater than or equal to the date of maturity, # NUM! Error occurs.

b) Rate, pr, and redemption, frequency, or [ base ] parameters are provided invalid numbers.

2) VALUE!

a)If any of the variables given are non-numbers.

b)Dates are not in the correct format.

𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐱𝐜𝐞𝐥

---------------------------------------------

Yield function is an advanced financial function in excel used to compute the amount of income produced every year from the investment amount.

𝐘𝐈𝐄𝐋𝐃 𝐄𝐱𝐜𝐞𝐥 𝐅𝐨𝐫𝐦𝐮𝐥𝐚

---------------------------------------

Below is the formula of YIELD Function

= YIELD (sd, md, rate, pr, redemption, frequency, [basis])

𝐀𝐫𝐠𝐮𝐦𝐞𝐧𝐭𝐬

----------------------------

Settlement Date (sd) = Date on which the coupon is purchased by the buyer or the date on which bond is purchased or the settlement date of the security.

Maturity Date(md) = The security maturity date or the expiration date of the purchased coupon.

Rate = Rate is security's annual coupon rate.

Pr = Pr is the security price for the value of $ 100.

Redemption = Redemption is the security redemption value for the stated value of $ 100.

Frequency = Frequency means a number of coupons paid per year i.e. 1 for annual payment and 2 for semiannual and 4 for quarterly payment.

[ Basis ]= Base is an optional integer parameter that states the security's day count basis.

𝐓𝐡𝐢𝐧𝐠𝐬 𝐭𝐨 𝐑𝐞𝐦𝐞𝐦𝐛𝐞𝐫 𝐰𝐡𝐢𝐥𝐞 𝐮𝐬𝐢𝐧𝐠 𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧 𝐄𝐱𝐜𝐞𝐥

----------------------------------------------------------------------------------------------------

Below are the information of the error that can be found in the function Bond Yield Excel due to mismatch type:

#1 - NUM!: The bond yield in Excel may have two possibilities for this error.

a) If the date of settlement in Excel yield is greater than or equal to the date of maturity, # NUM! Error occurs.

b) Rate, pr, and redemption, frequency, or [ base ] parameters are provided invalid numbers.

2) VALUE!

a)If any of the variables given are non-numbers.

b)Dates are not in the correct format.

Комментарии

0:00:17

0:00:17

0:04:27

0:04:27

0:03:00

0:03:00

0:00:24

0:00:24

0:08:36

0:08:36

0:05:34

0:05:34

0:03:29

0:03:29

0:00:16

0:00:16

0:02:35

0:02:35

0:09:35

0:09:35

0:09:48

0:09:48

0:09:14

0:09:14

0:02:32

0:02:32

0:01:43

0:01:43

0:00:53

0:00:53

0:01:08

0:01:08

0:00:19

0:00:19

0:04:48

0:04:48

0:03:43

0:03:43

0:00:16

0:00:16

0:00:34

0:00:34

0:02:13

0:02:13

0:10:58

0:10:58

0:08:19

0:08:19