filmov

tv

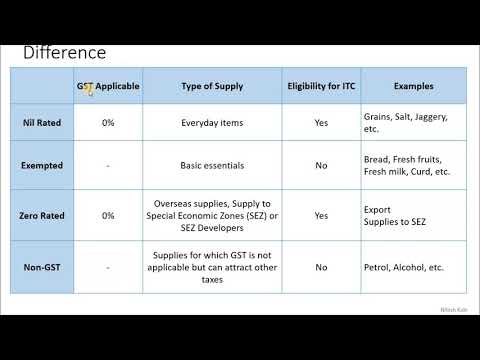

Nil Rated vs Exempt vs Zero Rated vs Non GST Supply.|| CA. pankaj Deshpande|| Indradhanu Academy ||

Показать описание

FREE course for business owners. Click below to enrol for free.

Business Owners ke 3 Chakravyuh

In my journey of last 21 years, I have observed some common problems with business owners.

1. Not able to withdraw sufficient money from business on regular basis.

2. Profit is on paper only and not in bank account

3. Not able to pay taxes on time.

These problems are the result of financial traps.

This course explains how a business owner is trapped into financial struggle and unable to manage the cash flow. This course also explains how to avoid these traps.

About Indradhanu Academy :

Indradhanu Academy is a premium academy in Nagpur providing training to two types of people,

a. Aspiring Accounting Professionals

b. SME Business Owners

Courses for becoming an Accounting Professional :

We have premium training course (online as well as offline) for those who wish to become accounting professionals and start earning within 60 days. Following is the link for two courses for becoming an accounting professional.

Course for Business Owners :

SME businesses are the backbone of economy of our country. It is generally seen than any SME owner has to face lot of challenges on many fronts. Ultimately this leads to overall dis-satisfaction in personal as well as professional life of any SME business owners.

At Indradhanu Academy, we provide peace of mind to business owners by providing practical workable solutions using “Power of Accounting”.

We have a unique course for SME Owners as “sme to SME”.

“sme” stands for small and medium enterprise

“SME” stands for Systematically Managed Enterprise.

This course is extremely useful for moving towards Systematically Managed Enterprise. This course is one stop solution for achieving overall peace of mind in professional as well as personal life.

Click below to know more and buy the course.

Accounting Friend Lecture Series :

This is a weekly lecture series, free of cost for inner circle members only. Not for all. CA. Pankaj Deshpande and other experts conduct sessions for variety of topics every week for 45 minutes. Click the link below to know more and apply for registration.

To connect with CA. Pankaj Deshpande on social media

Instagram : capankajd

Linkedin : capankajd

Facebook : capankajd

This video explains exact difference between Nil Rated vs Exempt vs Zero Rated vs Non GST Supply.

Explained by CA pankaj Deshpande.

Link for the registration of Accounting Friend Lecture Series.

Комментарии

0:04:55

0:04:55

0:10:51

0:10:51

0:02:22

0:02:22

0:01:56

0:01:56

0:05:10

0:05:10

0:03:03

0:03:03

0:03:33

0:03:33

0:03:39

0:03:39

0:53:26

0:53:26

0:01:00

0:01:00

0:02:37

0:02:37

0:11:43

0:11:43

0:03:57

0:03:57

0:05:28

0:05:28

0:11:20

0:11:20

0:29:17

0:29:17

0:07:39

0:07:39

0:11:28

0:11:28

0:01:19

0:01:19

0:10:20

0:10:20

0:01:18

0:01:18

0:05:58

0:05:58

0:13:35

0:13:35

0:05:17

0:05:17