filmov

tv

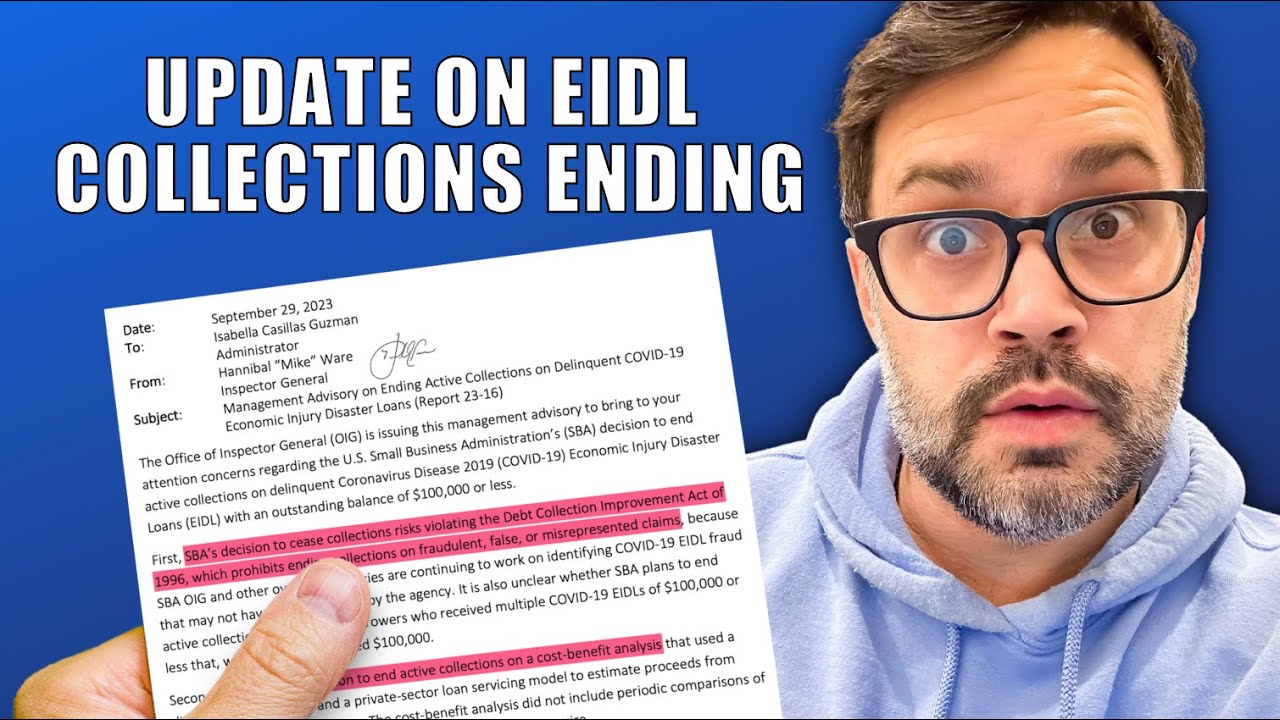

SBA EIDL Ending Collections Update and Clarifications

Показать описание

In this video Ryder talks about the new OIG report on SBA EIDL collections, SBA policy decisions from earlier this year to not actively pursue COVID EIDL collections when loans were under $100k and some of the changes that will now take place, based on the OIG recommendations. This includes annotated information directly from the SBA on EIDL loans and EIDL loan repayment.

CHECK OUT OUR FUNDING PARTNERS!

Our special funding partners and links:

Our special banking partners and links:

Want to stay up to date on the latest information? Be sure to follow us!

Disclaimer:

#grants #smallbusiness #funding

SBA EIDL Ending Collections Update and Clarifications

EIDL LOANS UPDATE on SBA Ending Collections Memorandum Under 100K Small Business Loans

SBA EIDL Collections Reversal For ALL

SBA Faces New EIDL Collection Struggles

US Treasury Update | Status of EIDL

EIDL UPDATE:SBA ENDS COLLECTIONS ON DELINQUENT DISASTER LOANS | SHE BOSS TALK

SBA EIDL Stopping Collections Update

#EIDL Loans: Tell The SBA You Can't Pay

SBA EIDL UPDATE April 2024 Update NEW COLLECTION METHODS #sba #sbaeidl #eidl #eidlloan

Charge Off vs Delinquent Status | EIDL Hardship | SBA Collection Efforts

All SBA EIDL Loans Leaving Treasury

SBA ends collections on EIDL loans

$100,000 SBA EIDL Loan Collections Ending (PLUS FREE Grants Document And EIDL Alternatives)

Why is my EIDL with a Collection Agency | Treasury Update

Hardship Requests Confound SBA

SBA Won't Sell EIDL Loans

What if I have to Close My Business | Subordination Request with SBA

EIDL UPDATE | SBA Could Have Done Better

New EIDL Hardship Available

Watch This! What To Do If You Can't Pay SBA EIDL

SBA EIDL Loan $100,000 or less collections Update 😮 #shorts

What Happens IF You IGNORE your EIDL Loan | Calling SBA about your EIDL LOAN

If You're Defaulting on EIDL

Shocking Reversal on SBA EIDL Forgiveness!

Комментарии

0:10:04

0:10:04

0:22:40

0:22:40

0:07:28

0:07:28

0:08:43

0:08:43

0:01:06

0:01:06

0:47:55

0:47:55

0:16:39

0:16:39

0:08:34

0:08:34

0:03:53

0:03:53

0:02:07

0:02:07

0:05:38

0:05:38

0:01:11

0:01:11

1:10:37

1:10:37

0:01:00

0:01:00

0:01:15

0:01:15

0:06:53

0:06:53

0:03:40

0:03:40

0:00:53

0:00:53

0:06:27

0:06:27

0:07:33

0:07:33

0:01:01

0:01:01

0:04:23

0:04:23

0:00:42

0:00:42

0:05:05

0:05:05