filmov

tv

Understanding Profitability Index, James Tompkins

Показать описание

This "Understanding Finance Nugget" not only shows you how to calculate the Profitability Index, but also provides an in-depth understanding of what it means and how to apply it when a company is deciding on a major asset investment or capital budgeting decision (e.g. Apple investing in a new iPhone.) In addition I discuss circumstances in which its application may be useful above and beyond a net present value analysis.

Understanding Profitability Index, James Tompkins

Introduction to the Profitability Index

What is the Asset Investment Decision (Capital Budgeting)? James Tompkins

Relevant Cash Flows for an Asset Investment, James Tompkins

The Asset Investment Decision (Capital Budgeting), James Tompkins

Understanding Payback Period, James Tompkins

Understanding Internal Rate of Return, James Tompkins

Understanding Net Present Value, James Tompkins

The Asset Investment Decision Capital Budgeting, James Tompkins

When is the Best Time for a Company to Make an Asset Investment? James Tompkins

Profitability Index

Comparing Profitability Index and Solver result under Capital Constraint

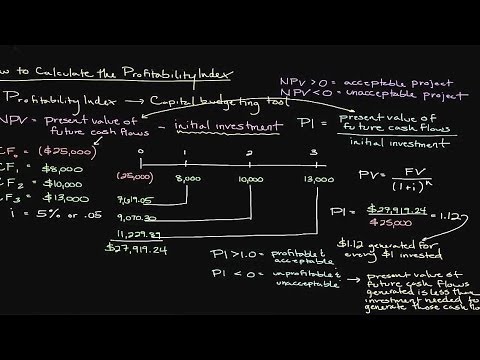

Episode 131: How to Calculate the Profitability Index

Profitability Index | Explained with Examples

Two Rates Commonly Used in Time Value of Money Equations, James Tompkins

(7 of 20) Ch.9 - Profitability Index approach: pros & cons

(5 of 20) Ch.9 - Profitability Index approach: explanation & example

(6 of 20) Ch.9 - Profitability Index approach: comparing 2 projects

Profitability Index - globalindexfund.net

Profitability Index | Financial Management |CA Raja Classes

Capital Budgeting: Profitability Index

Profitability index - Example 1

Profitability Index

Profitability Index

Комментарии

0:12:40

0:12:40

0:12:11

0:12:11

0:08:36

0:08:36

0:31:20

0:31:20

2:10:42

2:10:42

0:14:21

0:14:21

0:20:58

0:20:58

0:15:40

0:15:40

2:10:42

2:10:42

0:05:52

0:05:52

0:02:31

0:02:31

0:16:38

0:16:38

0:05:52

0:05:52

0:17:49

0:17:49

0:04:57

0:04:57

0:02:07

0:02:07

0:07:59

0:07:59

0:06:26

0:06:26

0:01:09

0:01:09

0:02:25

0:02:25

0:02:13

0:02:13

0:04:09

0:04:09

0:03:29

0:03:29

0:07:59

0:07:59