filmov

tv

Risk management basics: What exactly is it?

Показать описание

David Hillson, The Risk Doctor, explains how to structure your risk process by asking (and answering) these six simple questions:

Q1. What am I trying to achieve? (Objective setting)

Q2. What might affect me? (Risk identification)

Q3. Which of these are most important? (Risk assessment)

Q4. What should we do about the most important ones? (Risk response development)

Q5. Did it work? (Risk review)

Q6. What has changed? (Risk updates, Learning lessons)

Q1. What am I trying to achieve? (Objective setting)

Q2. What might affect me? (Risk identification)

Q3. Which of these are most important? (Risk assessment)

Q4. What should we do about the most important ones? (Risk response development)

Q5. Did it work? (Risk review)

Q6. What has changed? (Risk updates, Learning lessons)

Risk management basics: What exactly is it?

Risk Management Basics: What Exactly Is It?

What is Risk Management? (With Real-World Examples) | From A Business Professor

Risk Management In Forex Was Hard.. Till I Discovered This Easy 3-Step Secret (Beginner To Advanced)

Risk Management Basics | Google Project Management Certificate

The Basics of Risk Management

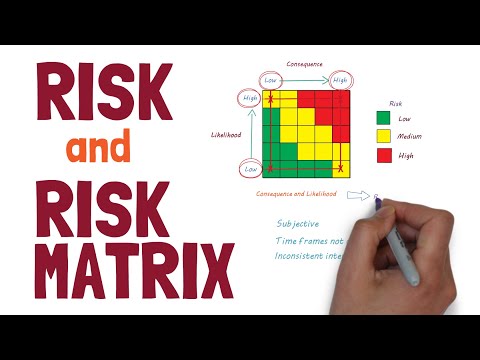

Risk and How to use a Risk Matrix

Derivatives Explained in One Minute

Basic Live Class

Risk Management Basics For Beginning Traders

Fundamentals of risk management course

Risk management for medical devices and ISO 14971 - Online introductory course

Project Risk Management - How to Manage Project Risk

Risk Identification | Reactive vs Proactive Risk Management |Types of Risks with real life examples

4 Step Risk Management Process

Enterprise Risk Management | Thomas H. Stanton | TEDxJHUDC

How to Perform Qualitative Risk Analysis for the First Time

6+1 Risk Management Strategies... in 60 seconds

Risk Management Basics|Careers and Jobs 2022

How to Manage Risks in Projects | Risk Management Basics | Tips and Tools for Managing Risks

Project Risk Management Overview | PMBOK Video Course

Introduction to risk management - IRM

Trading and Risk Management Basics

Risk Management at Banks

Комментарии

0:04:26

0:04:26

0:46:40

0:46:40

0:10:08

0:10:08

0:19:19

0:19:19

0:29:44

0:29:44

0:13:35

0:13:35

0:05:29

0:05:29

0:01:30

0:01:30

0:14:49

0:14:49

0:06:16

0:06:16

0:01:40

0:01:40

0:17:07

0:17:07

0:11:26

0:11:26

0:09:31

0:09:31

0:00:51

0:00:51

0:09:04

0:09:04

0:11:08

0:11:08

0:01:01

0:01:01

0:09:27

0:09:27

0:59:08

0:59:08

0:08:31

0:08:31

0:01:52

0:01:52

0:32:14

0:32:14

0:03:41

0:03:41