filmov

tv

How to calculate your income tax, National Insurance & Student loans | UK Income tax explained 2023

Показать описание

#IncomeTax #StudentLoans #IncomeTax2021

0:00 - intro

1:18 - How the UK tax bands work

2:36 - How to calculate income tax

6:13 - How to calculate national insurance

8:30 - How to calculate your student loan

In this video I am going to explain how to easily work out your income tax, national insurance and student loans. If you are someone who just trusts their monthly payslip and hopes that they paid the correct amount of national insurance, income tax and student loans because the whole tax system is confusing to you, then this video is for you. In this video we will explore how much income tax, national insurance and student loans someone will pay on a gross salary of £60,000 in tax year 2020-2021.

In my opinion, everyone should be able to calculate their own income taxes, national insurance contributions and student loan repayments to ensure they haven't overpaid or underpaid.

------------------------

Follow me on Socials👇

Twitter: MoSalhan

Instagram: Mo_salhan

0:00 - intro

1:18 - How the UK tax bands work

2:36 - How to calculate income tax

6:13 - How to calculate national insurance

8:30 - How to calculate your student loan

In this video I am going to explain how to easily work out your income tax, national insurance and student loans. If you are someone who just trusts their monthly payslip and hopes that they paid the correct amount of national insurance, income tax and student loans because the whole tax system is confusing to you, then this video is for you. In this video we will explore how much income tax, national insurance and student loans someone will pay on a gross salary of £60,000 in tax year 2020-2021.

In my opinion, everyone should be able to calculate their own income taxes, national insurance contributions and student loan repayments to ensure they haven't overpaid or underpaid.

------------------------

Follow me on Socials👇

Twitter: MoSalhan

Instagram: Mo_salhan

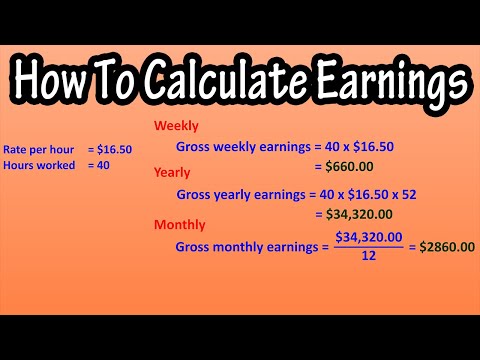

How To Calculate Gross Weekly, Yearly And Monthly Salary, Earnings Or Pay From Hourly Pay Rate

HOW TO CALCULATE YOUR YEARLY SALARY BASED ON YOUR HOURLY RATE. SUBSCRIBE AND LIKE FOR MORE!

How To Manage Your Money (50/30/20 Rule)

How do I calculate my gross income?

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation

How to Calculate Your Debt to Income Ratios (DTI) First Time Home Buyer Know this!

How to estimate your personal income taxes

The Three Types of Income Used for Mortgage Calculations - How to Calculate Your Income

Salary Calculation

Adjusted Gross Income, Explained in Four Minutes | WSJ

How Social Security benefits are calculated on a $50,000 salary

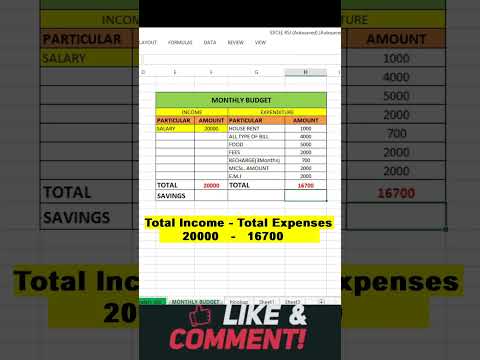

How to Calculate monthly income & Expenses । Excel #Shorts #computertipstrickshindi

Tithing: Should I Tithe off Gross Income or Net Income?

How To Calculate Net Income

How To Calculate Federal Income Taxes - Social Security & Medicare Included

How to Calculate Income (Calculating Income) - Mortgage Math (NMLS Test Tips)

ACCOUNTANT EXPLAINS: How I manage my money on payday: Income, Expenses & Savings

UK Income Tax Explained (UK Tax Bands & Calculating Tax)

How To Convert Yearly Salary, Pay, Income To Monthly Salary, Pay, Income Explained

How Social Security benefits are calculated on a $60,000 salary

HOW TO CALCULATE A DEBT-TO-INCOME RATIO | QUICK DTI CALCULATION

Budgeting For Beginners | How I Save 80% of My Income

Calculate 2023-24 UK Income Tax – Using VLOOKUP In Excel

How to calculate your Income Tax and Provisional Tax

Комментарии

0:01:36

0:01:36

0:01:46

0:01:46

0:07:08

0:07:08

0:01:44

0:01:44

0:07:37

0:07:37

0:08:02

0:08:02

0:04:49

0:04:49

0:09:39

0:09:39

0:00:40

0:00:40

0:04:23

0:04:23

0:02:56

0:02:56

0:00:40

0:00:40

0:05:35

0:05:35

0:02:27

0:02:27

0:25:05

0:25:05

0:04:19

0:04:19

0:11:23

0:11:23

0:09:54

0:09:54

0:00:44

0:00:44

0:02:52

0:02:52

0:02:59

0:02:59

0:16:53

0:16:53

0:10:24

0:10:24

0:10:58

0:10:58