filmov

tv

Types of Audit Procedures

Показать описание

Introduction to the principles and concepts of the audit as an attestation service offered by the accounting profession. Primary emphasis is placed on Generally Accepted Auditing Standards, the role of the CPA/auditor in evidence collection, analytical review procedures and reporting, the CPA/auditor's ethical and legal responsibilities, the role of the Securities and Exchange Commission as well as other constituencies. Audit testing, including statistical sampling, internal control issues, and audit programs are discussed. --

Description:

Management assertions about transactions include occurrence, completeness, accuracy, classification, and cutoff. Audit objectives (for the aforementioned management assertions) include occurrence, completeness, accuracy, posting and summarization, classification, and timing. Management assertions about account balances include existence, completeness, valuation & allocation, and rights & obligations. Audit objectives related to these assertions include existence, completeness, accuracy, classification, cutoff, detail tie in, realizable value, and rights & obligations. Management assertions about presentation and disclosure include occurrence, rights & obligations, completeness, accuracy & valuation, and classification & understandability Audit objectives related to these assertions are exactly the same as management's assertions.

Overall, PCAOB assertions include existence or occurrence, completeness, valuation & allocation, rights & obligations, and presentation & disclosure. This is similar to U.S. GAAS, given the first four assertions are applicable to balances and transactions. Presentation, however, is treated as a single assertion.

Reviewing the accounts receivable with the credit manager to evaluate their collectability will tell you the amount of receivables NOT collectible, therefore informing you of the balance that is needed for the allowance for doubtful accounts, which is a contra asset account to accounts receivable that is used to compute the NRV of the receivable. The assertion tested here is valuation.

Counting inventory items to verify the amount posted and recorded in the inventory account will allow you to confirm that the inventory the client claims to have is actually there and that the number of items is correct [or incorrect] that is used in the calculation of inventory value. Both the existence and valuation assertions are being tested here.

Obtaining a letter from management stating that there are no unrecorded liabilities will allow the auditor to know that management claims they have recorded all liabilities that exist and none are left off the statements. This audit procedure tests the assertion of completeness.

The audit plan is a comprehensive list of the specific audit procedures that the audit team needs to perform to gather sufficient appropriate evidence on which to base their opinion on the financial statements. When planning the engagement, the auditor needs to develop and document a plan that describes the procedures to be performed to assess the risk of material misstatement at the financial statement and assertion level. The auditor must then carefully plan the nature, timing, and extent of control tests and substantive tests that are designed to mitigate these risks to an acceptable level.

Audit procedures are used to gain an understanding of the client and the risks associated with the client (risk assessment procedures), to test the operating effectiveness of client of client internal control activities (test of controls), and to produce evidence about management's assertions related to the amounts and disclosures in the client's financial statements (substantive procedures).

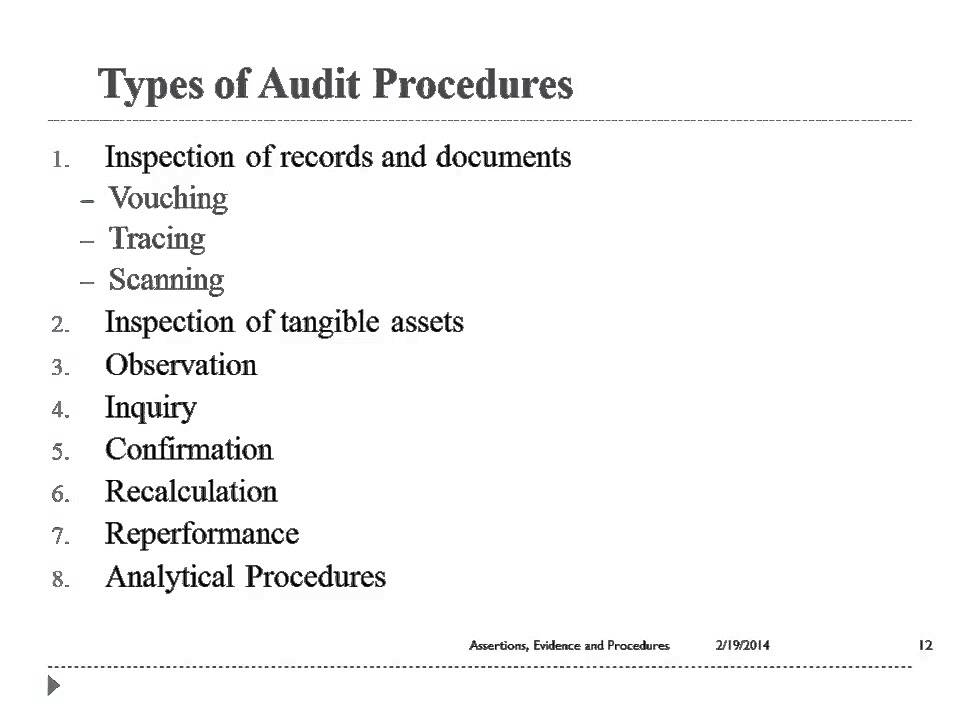

There are several types of audit procedures: inspection of records and documents includes vouching, tracing, and scanning. Other procedures include inspection of tangible assets, observation, inquiry, confirmation, recalculation, re performance, and analytical procedures.

Audit documentation is the written record of the basis for the auditor's conclusions that provides the support for the auditor's representations, whether those representations are contained in the auditor's report, or otherwise.

Documentation must be retained seven years from report release date (and if there is no report, from the last day of fieldwork). Documentation to be retained include those documenting discussion and subsequent resolution of differences in professional judgments among team members. All documentation must be finalized within 45 days of the audit reports' release date.

We've just uploaded brand-new "auditing" videos on our channel!

Make sure to check out our latest content. Don't forget to like, subscribe, and hit the bell icon to stay updated with all our future uploads. Thanks for watching!

Description:

Management assertions about transactions include occurrence, completeness, accuracy, classification, and cutoff. Audit objectives (for the aforementioned management assertions) include occurrence, completeness, accuracy, posting and summarization, classification, and timing. Management assertions about account balances include existence, completeness, valuation & allocation, and rights & obligations. Audit objectives related to these assertions include existence, completeness, accuracy, classification, cutoff, detail tie in, realizable value, and rights & obligations. Management assertions about presentation and disclosure include occurrence, rights & obligations, completeness, accuracy & valuation, and classification & understandability Audit objectives related to these assertions are exactly the same as management's assertions.

Overall, PCAOB assertions include existence or occurrence, completeness, valuation & allocation, rights & obligations, and presentation & disclosure. This is similar to U.S. GAAS, given the first four assertions are applicable to balances and transactions. Presentation, however, is treated as a single assertion.

Reviewing the accounts receivable with the credit manager to evaluate their collectability will tell you the amount of receivables NOT collectible, therefore informing you of the balance that is needed for the allowance for doubtful accounts, which is a contra asset account to accounts receivable that is used to compute the NRV of the receivable. The assertion tested here is valuation.

Counting inventory items to verify the amount posted and recorded in the inventory account will allow you to confirm that the inventory the client claims to have is actually there and that the number of items is correct [or incorrect] that is used in the calculation of inventory value. Both the existence and valuation assertions are being tested here.

Obtaining a letter from management stating that there are no unrecorded liabilities will allow the auditor to know that management claims they have recorded all liabilities that exist and none are left off the statements. This audit procedure tests the assertion of completeness.

The audit plan is a comprehensive list of the specific audit procedures that the audit team needs to perform to gather sufficient appropriate evidence on which to base their opinion on the financial statements. When planning the engagement, the auditor needs to develop and document a plan that describes the procedures to be performed to assess the risk of material misstatement at the financial statement and assertion level. The auditor must then carefully plan the nature, timing, and extent of control tests and substantive tests that are designed to mitigate these risks to an acceptable level.

Audit procedures are used to gain an understanding of the client and the risks associated with the client (risk assessment procedures), to test the operating effectiveness of client of client internal control activities (test of controls), and to produce evidence about management's assertions related to the amounts and disclosures in the client's financial statements (substantive procedures).

There are several types of audit procedures: inspection of records and documents includes vouching, tracing, and scanning. Other procedures include inspection of tangible assets, observation, inquiry, confirmation, recalculation, re performance, and analytical procedures.

Audit documentation is the written record of the basis for the auditor's conclusions that provides the support for the auditor's representations, whether those representations are contained in the auditor's report, or otherwise.

Documentation must be retained seven years from report release date (and if there is no report, from the last day of fieldwork). Documentation to be retained include those documenting discussion and subsequent resolution of differences in professional judgments among team members. All documentation must be finalized within 45 days of the audit reports' release date.

We've just uploaded brand-new "auditing" videos on our channel!

Make sure to check out our latest content. Don't forget to like, subscribe, and hit the bell icon to stay updated with all our future uploads. Thanks for watching!

Комментарии

0:06:39

0:06:39

0:04:55

0:04:55

0:06:42

0:06:42

0:13:14

0:13:14

0:06:42

0:06:42

0:11:55

0:11:55

0:14:40

0:14:40

0:11:35

0:11:35

0:11:43

0:11:43

0:20:48

0:20:48

0:08:16

0:08:16

0:14:18

0:14:18

0:12:49

0:12:49

0:11:25

0:11:25

0:08:45

0:08:45

0:17:30

0:17:30

0:23:43

0:23:43

0:13:42

0:13:42

0:05:42

0:05:42

0:14:16

0:14:16

0:07:47

0:07:47

0:11:04

0:11:04

0:22:48

0:22:48

0:02:38

0:02:38