filmov

tv

5 BEST Moving Average Strategies (That beat buy and hold)

Показать описание

5 BEST Moving Average Strategies (That beat buy and hold)

Steve Burns and Holly Burns take us through 5 of their best moving average strategies during a 16 year period, covering bull, bear and sideways moving stock markets.

We also add the 2020 pandemic crash period to see how the trading strategies performed.

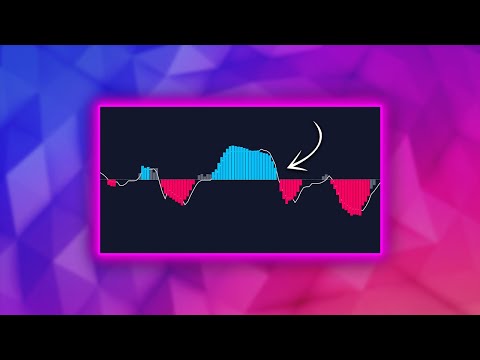

The strategies include the 20,50,100,200 and 250 day moving averages, and moving average crossovers.

The book provides evidence to the question of can you beat a stock market buy and hold strategy.

Links:-

Stock Trading videos:-

Investing videos:-

As a professional trader I have consumed hundreds of financial books and endured countless hours of self education. My hope is that this channel will reduce the learning curve duration of many aspiring traders by providing the key information in a concise and enjoyable manner.

Steve Burns and Holly Burns take us through 5 of their best moving average strategies during a 16 year period, covering bull, bear and sideways moving stock markets.

We also add the 2020 pandemic crash period to see how the trading strategies performed.

The strategies include the 20,50,100,200 and 250 day moving averages, and moving average crossovers.

The book provides evidence to the question of can you beat a stock market buy and hold strategy.

Links:-

Stock Trading videos:-

Investing videos:-

As a professional trader I have consumed hundreds of financial books and endured countless hours of self education. My hope is that this channel will reduce the learning curve duration of many aspiring traders by providing the key information in a concise and enjoyable manner.

5 BEST Moving Average Strategies (That beat buy and hold)

BEST Moving Average Strategy for Daytrading Forex (Easy Crossover Strategy)

I Found An AMAZING Trend Following Strategy #shorts

Best Moving Average Trading Strategy (MUST KNOW)

Moving Average Crossover: DONT DO IT

5 EMA + 8 EMA Trading Strategy | Moving Average Trading Strategy | Moving average crossover

BEST MACD Trading Strategy [86% Win Rate]

Best Moving Average Trading Strategy (Must Know) For Forex, Crypto, Stocks

BEST Moving Average (2MA) Signal Strength💪Indicator Dashboard in MQL5 [PART 601] #forexalgotrader

10 SMA + 20 SMA with 200 SMA | Swing Trading Strategy | Moving average Crossover

THE BEST MOVING AVERAGE CROSSOVER TRADING STRATEGY - 96% WIN RATE

EASY Scalping Strategy For Day Trading (High Win Rate Strategy)

5 Minute Scalping Strategy **HIGHEST WIN RATE**

MOVING AVERAGE Trading Strategy MASTERCLASS for Beginners | EMA Strategy

Best Scalping Strategy Period

After 8 Years Trading This Is My Favorite Strategy - Best Way To Trade Consistently And Profitably

Best Trading Indicator To Build A Strategy Upon (100 Year Back Test!)

How To Use A Moving Average Crossover To Buy Stocks (Swing Trading Strategy for Beginners)

My Moving Average Strategy will make you PROFITABLE INSTANTLY

These Ridiculously Simple Moving Averages that NEVER touch each other... Day Trading Strategies

I Tested This Trading Strategy & It Made 310%

🔴 5-8-13 EMA 'SCALPING' (FULL TUTORIAL for Beginners) - One of The Best Absolute Methods f...

The Only Moving Average Trading Video You Will Ever Need...

Best Candle Formation for 5 Minute Scalping

Комментарии

0:09:41

0:09:41

0:09:08

0:09:08

0:00:54

0:00:54

0:14:55

0:14:55

0:03:03

0:03:03

0:00:59

0:00:59

0:07:06

0:07:06

0:14:48

0:14:48

0:11:26

0:11:26

0:01:00

0:01:00

0:03:58

0:03:58

0:04:35

0:04:35

0:15:10

0:15:10

0:19:11

0:19:11

0:11:54

0:11:54

0:12:50

0:12:50

0:10:26

0:10:26

0:10:25

0:10:25

0:18:38

0:18:38

0:03:01

0:03:01

0:01:00

0:01:00

0:13:00

0:13:00

0:38:51

0:38:51

0:06:54

0:06:54