filmov

tv

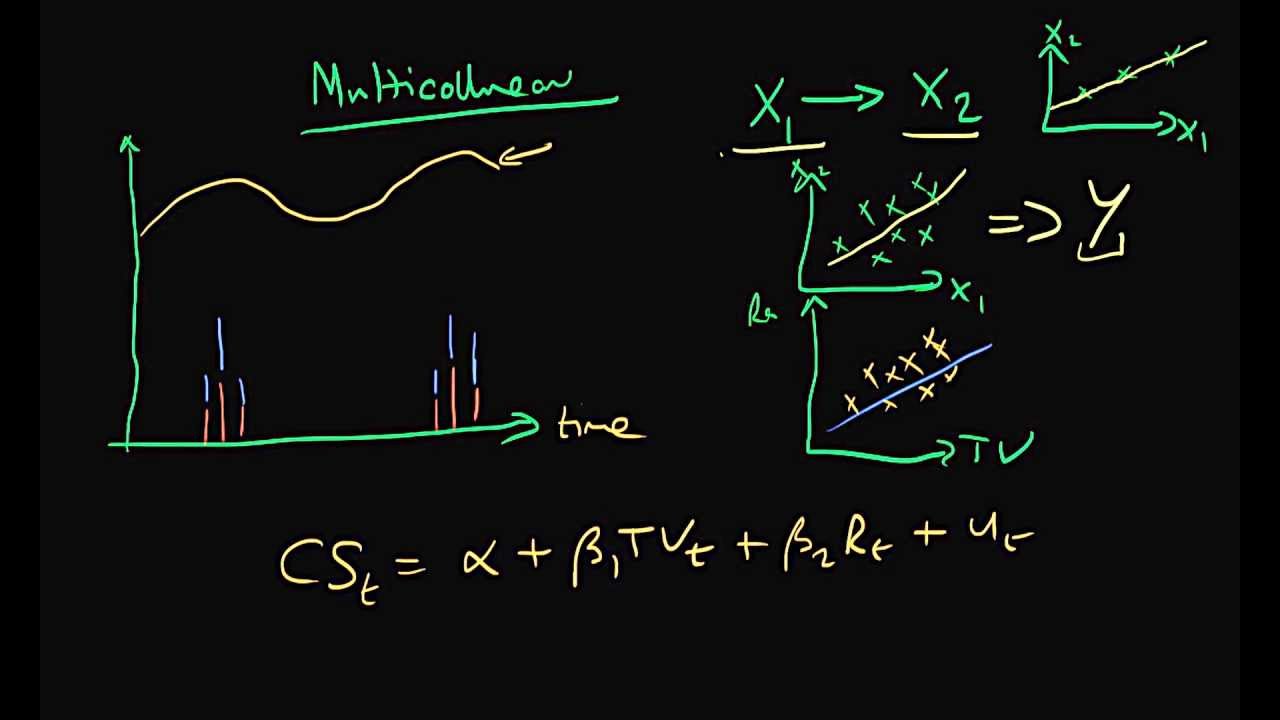

Multicollinearity

Показать описание

Multicollinearity

Multicollinearity (in Regression Analysis)

What is Multicollinearity? Extensive video + simulation!

Multicollinearity - Explained Simply (part 1)

Multicollinearity

Variance Inflation Factors: testing for multicollinearity

2.2.11 An Introduction to Linear Regression - Video 6: Correlation and Multicollinearity

Why multicollinearity is a problem | Why is multicollinearity bad | What is multicollinearity

Do we assume multicollinearity? No!

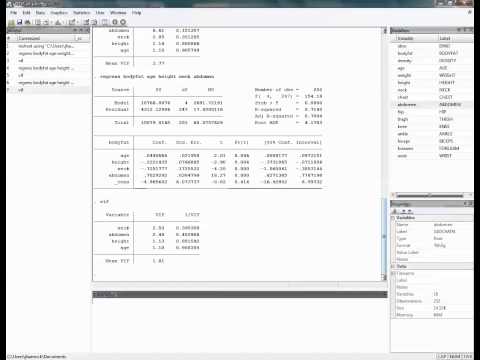

Understanding and Identifying Multicollinearity in Regression using SPSS

Multicollinearity (Playlist 1)

Multicollinearity in SPSS

Understanding Multicollinearity

Econometrics - Multicollinearity

Data Science Interview Questions- Multicollinearity In Linear And Logistic Regression

Multicollinearity and VIF (theory + R code)

Multicollinearity in SPSS

Multicollinearity | Heteroscedasticity | Autocorrelation | Ecoholics

Multicollinearity 1

Computing Multicollinearity Diagnostics in Stata

Multicollinearity and its detection methods

Lecture47 (Data2Decision) Multicollinearity

How Do You Handle Multicollinearity In Machine Learning-Asked In Interview

Variance Inflation Factor Simplified | Variance Inflation Factor in Multicollinearity | VIF

Комментарии

0:05:17

0:05:17

0:05:57

0:05:57

0:27:02

0:27:02

0:05:05

0:05:05

0:21:01

0:21:01

0:05:28

0:05:28

0:07:26

0:07:26

0:10:46

0:10:46

0:10:55

0:10:55

0:11:27

0:11:27

0:09:20

0:09:20

0:02:42

0:02:42

0:17:33

0:17:33

0:28:30

0:28:30

0:05:29

0:05:29

0:18:01

0:18:01

0:02:58

0:02:58

0:05:08

0:05:08

0:45:53

0:45:53

0:08:08

0:08:08

0:06:28

0:06:28

0:17:51

0:17:51

0:04:07

0:04:07

0:10:45

0:10:45