filmov

tv

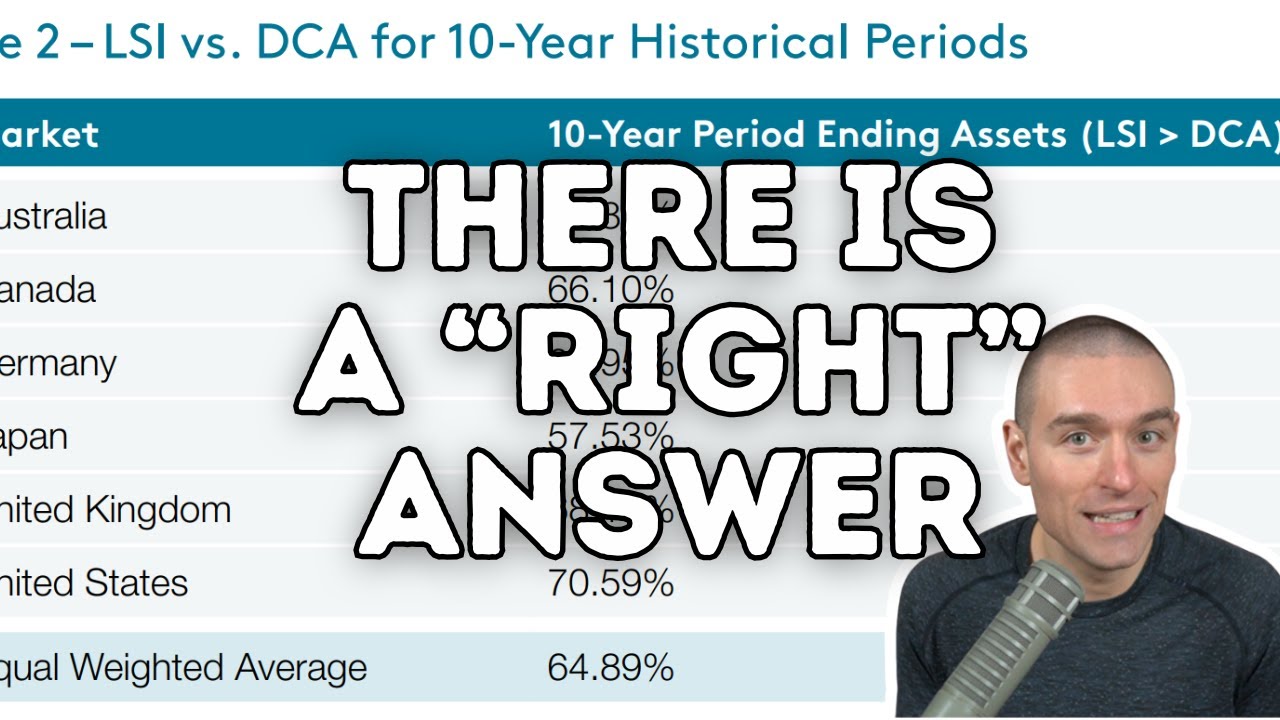

How to Invest New Cash: Dollar Cost Averaging vs. Lump Sum Investing

Показать описание

If you're sitting on cash that you plan to invest you have a few options:

1. Invest a lump sum.

2. Dollar cost average.

3. Wait for a "good time" to invest.

The optimal choice may surprise you.

------------------

Follow Ben Felix on

Follow the Rational Reminder on:

Follow PWL Capital on:

You can find the Rational Reminder podcast on

Google Podcasts:

Apple Podcasts:

Spotify Podcasts:

------------------

How to Invest New Cash: Dollar Cost Averaging vs. Lump Sum Investing

Nvidia: Cash Out or Ride Higher? 📉🤑

Invest young! Get rich young! #invest #money #young #wealth #savings #personalfinance #rich

How to Invest for Beginners (2024)

The BEST Way To Invest 💰#shorts

How To Invest In Stocks As A Beginner - Ali Abdaal

how to make money in your sleep (investing guide 2024)

Top 3 Things To Invest Your Money In 2023

Top Money Skills to Master by 2025!😲

How to Invest in Stocks For Beginners

If investing all money in one stock, which one will you invest❓

The 4 Type of Funds I Invest In

Warren Buffett | How To Invest For Beginners: 3 Simple Rules

Dave Ramsey: How To Invest For Beginners

Dollar Cost Averaging vs. Lump Sum Investing (This works best)

The Best Way to Invest Your Money

How To Invest on Robinhood For Beginners (In Under 5 Mins)

Can You Invest ₹10 in Stock Market? 📈

How to Invest in New Zealand (Beginner to Pro)

5 Best Ways to Invest $50,000

I asked a personal finance expert how to invest.

Episode 16: Where do I Invest my Money now? | #EffectiveLivingSeries 2023

How To Invest With NO MONEY Down: Turn $0 Into Infinite Returns -Robert Kiyosaki (Millennial Money)

How to Invest £100 (Investing for Beginners UK)

Комментарии

0:05:13

0:05:13

0:00:51

0:00:51

0:00:57

0:00:57

0:20:15

0:20:15

0:00:37

0:00:37

0:00:44

0:00:44

0:19:41

0:19:41

0:00:25

0:00:25

0:00:56

0:00:56

0:08:20

0:08:20

0:00:51

0:00:51

0:00:43

0:00:43

0:13:21

0:13:21

0:10:38

0:10:38

0:11:42

0:11:42

0:09:21

0:09:21

0:05:26

0:05:26

0:00:58

0:00:58

0:10:14

0:10:14

0:13:02

0:13:02

0:15:48

0:15:48

0:40:08

0:40:08

0:13:02

0:13:02

0:09:53

0:09:53