filmov

tv

Foreign Remittance Lecture - 1

Показать описание

Learn - How foreign payments for service received from foreign vendors are made, what documents are used in these transactions and how to account for them.

Join Facebook Group - Passionate Commerce Graduates B.COm | BBA - Passion to Grow

Join Facebook Group - MULTIPLE ATTEMPT CA’S | CS | ICWA - PASSION TO GROW

Join Facebook Group - Passionate Commerce Graduates B.COm | BBA - Passion to Grow

Join Facebook Group - MULTIPLE ATTEMPT CA’S | CS | ICWA - PASSION TO GROW

Foreign Remittance Lecture - 1

Level 1 CFA Economics: Currency Exchange Rates-Lecture 1

Foreign exchange risk management (1) Part 1 - ACCA (AFM) lectures

About Foreign Exchange Remittance. Explained about T/T, M/T and D/D.

Foreign currency - Example 1 - ACCA (SBR) lectures

Limit of foreign remittance in one year?

Foreign Exchange| Banking Awareness | Important Banking Terminolgy | Lecture 1

JAIIB May 2023 | Module A | Class 16 | Foreign Exchange Remittance (Part 1) | PPB | Rasika Ma'...

Overseas Pakistani Remittance | Foreign Remittance | Legal Way of Foreign Remittance |Irfan Siddiqui

Lecture 29: Foreign Exchange, Foreign Exchange Market, Features, Participants

Gr 12 Tourism Foreign Exchange Lesson 1

Foreign exchange risk management (1) Part 3 - ACCA (AFM) lectures

CMA FINAL SFM| FOREX | CMA FINAL NEW EXAM PATTERN |BASICS | LECTURE 1 | FOREIGN EXCHANGE RATES

Foreign exchange risk management (1) Part 2 - ACCA (AFM) lectures

Foreign exchange risk management (1) Part 8 - ACCA (AFM) lectures

Imports, Exports, and Exchange Rates: Crash Course Economics #15

Income Tax on Foreign Income | Income Tax on Foreign Remittance | TCS on Foreign Remittance

RBI new rules for LRS | Liberalized remittance scheme limit | foreign investment by HNIs

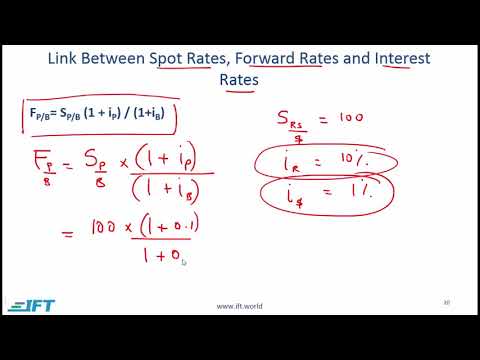

Level 1 CFA Economics: Currency Exchange Rates-Lecture 5

AIBB_TFFE [01]_Trade Finance and Foreign Exchange_Module-1(Part-1)

Level 1 CFA Economics: Currency Exchange Rates-Lecture 4

The International Monetary Fund (IMF) and the World Bank Explained in One Minute

Level 1 CFA Economics: Currency Exchange Rates-Lecture 6

Foreign exchange risk management (1) Part 6 - ACCA (AFM) lectures

Комментарии

0:05:09

0:05:09

0:19:44

0:19:44

0:37:58

0:37:58

0:04:50

0:04:50

0:10:04

0:10:04

0:03:00

0:03:00

0:05:07

0:05:07

0:24:40

0:24:40

0:06:44

0:06:44

0:27:24

0:27:24

0:51:54

0:51:54

0:17:04

0:17:04

0:40:12

0:40:12

0:18:46

0:18:46

0:20:44

0:20:44

0:10:11

0:10:11

0:06:33

0:06:33

0:01:00

0:01:00

0:13:59

0:13:59

![AIBB_TFFE [01]_Trade Finance](https://i.ytimg.com/vi/r7ovnhaKWFc/hqdefault.jpg) 0:30:01

0:30:01

0:18:32

0:18:32

0:01:24

0:01:24

0:32:53

0:32:53

0:24:26

0:24:26