filmov

tv

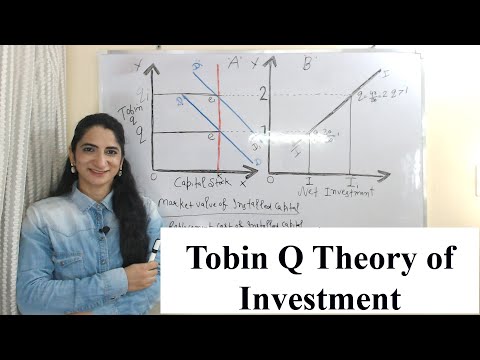

How to calculate Q Ratio ?

Показать описание

The Q ratio measures the market value of a company compared to the replacement value of the firm’s assets.

Nobel laureate James Tobin came up with the Q ratio. He based it on his theory that the combined market value of every company on a stock market should roughly equal their replacement costs. In other words, the value of a United States firm should be equal to what it would cost to start that same firm today.

A Q ratio is calculated by dividing the total market value of firms by their total asset value.

For example, say the firms on a stock market have a total value of $100 billion, and the cost to replace them is $100 billion. The Q ratio is 1.

A Q ratio above 1 means the market is overvalued and stocks might not be the best investment. A Q ratio below 1 means the market is undervalued.

When applied to an individual company, a Q ratio above 1 means it’s overvalued. Its stock is more expensive than the costs of its assets. When the total market value is below the cost of its assets, a firm’s Q ratio is less than 1. That means its stock is undervalued.

Historically, Q ratios have provided investors with valuable information to guide their decisions.

Nobel laureate James Tobin came up with the Q ratio. He based it on his theory that the combined market value of every company on a stock market should roughly equal their replacement costs. In other words, the value of a United States firm should be equal to what it would cost to start that same firm today.

A Q ratio is calculated by dividing the total market value of firms by their total asset value.

For example, say the firms on a stock market have a total value of $100 billion, and the cost to replace them is $100 billion. The Q ratio is 1.

A Q ratio above 1 means the market is overvalued and stocks might not be the best investment. A Q ratio below 1 means the market is undervalued.

When applied to an individual company, a Q ratio above 1 means it’s overvalued. Its stock is more expensive than the costs of its assets. When the total market value is below the cost of its assets, a firm’s Q ratio is less than 1. That means its stock is undervalued.

Historically, Q ratios have provided investors with valuable information to guide their decisions.

Комментарии

0:10:34

0:10:34

0:00:51

0:00:51

0:08:25

0:08:25

0:00:16

0:00:16

0:01:31

0:01:31

0:07:14

0:07:14

0:06:43

0:06:43

1:09:01

1:09:01

0:05:38

0:05:38

0:08:08

0:08:08

0:07:55

0:07:55

0:00:53

0:00:53

0:00:50

0:00:50

0:06:43

0:06:43

0:06:05

0:06:05

0:04:22

0:04:22

0:13:27

0:13:27

0:09:18

0:09:18

0:19:50

0:19:50

0:01:00

0:01:00

0:00:27

0:00:27

0:06:30

0:06:30

0:00:37

0:00:37