filmov

tv

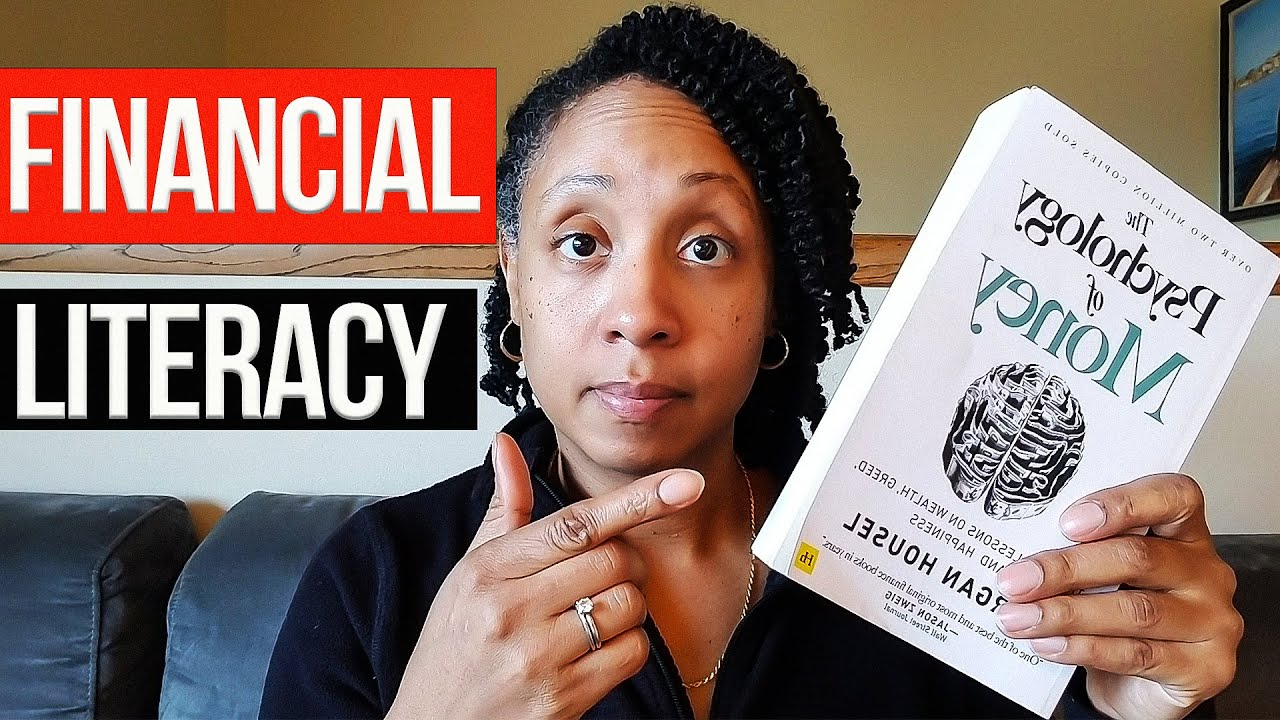

Financial Literacy: The Reasons Why You Need To Know The Rules

Показать описание

Financial Literacy: The Reasons Why You Need To Know The Rules. Financial education is very important because it can affect how much you earn, how much you spend, how much you invest and how much debt you get into. If you are concerned about reaching financial independence then you should learn financial literacy so that you can manage your money in a way to achieve your financial goals. Being financially literate is a life skill that once you learn it, can be life changing. Gain the knowledge and skills you need to improve your credit build wealth. The wealth twins are here to help you.

#financialliteracy #financialgoals #wealthtwins #moneytips #personalfinance #financialeducation

⬇️ Helpful Resources & Affiliate links ⬇️

◽️◽️◽️◽️◽️◽️

SAY HI ON SOCIAL:

👭🏿 About Us 👭🏿

We are Nadia and Nicole and on the Wealth Twins Channel we are dedicated to increasing your financial independence. We create videos that will potentially help you reach financial independence, build wealth, and create generational wealth. We teach others how to invest money in the stock market and wealth building through the accumulation of passive income producing assets.

Our goal is to teach you how to be rich by using financial tips, saving money tips, and personal finance for beginners. If you want to retire early, be debt free, and make passive income please hit the subscribe button.

DISCLAIMER: The Wealth Twins, including but not limited to any guests appearing in our videos, are not financial/investment advisors, brokers, or dealers. Our videos are for educational purposes only. They are solely sharing our personal experiences and opinions. There are financial risks associated with investing. All investments involve risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won't experience any loss when investing. Therefore, do not act or refrain from acting based on any information conveyed in this video, webpage, and/or external hyperlinks. In order to make the best financial decision for your own needs, you have to conduct your own research and due diligence.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at no additional cost to you, we may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact our opinions and comparisons.

Комментарии

0:11:41

0:11:41

0:12:21

0:12:21

0:13:07

0:13:07

0:05:16

0:05:16

0:17:51

0:17:51

0:12:11

0:12:11

0:03:37

0:03:37

0:06:00

0:06:00

0:00:40

0:00:40

0:06:14

0:06:14

0:02:41

0:02:41

0:08:06

0:08:06

0:09:02

0:09:02

0:16:17

0:16:17

0:00:31

0:00:31

0:04:28

0:04:28

0:00:23

0:00:23

0:08:33

0:08:33

0:14:19

0:14:19

0:04:38

0:04:38

0:28:57

0:28:57

0:08:35

0:08:35

0:05:53

0:05:53

0:10:42

0:10:42