filmov

tv

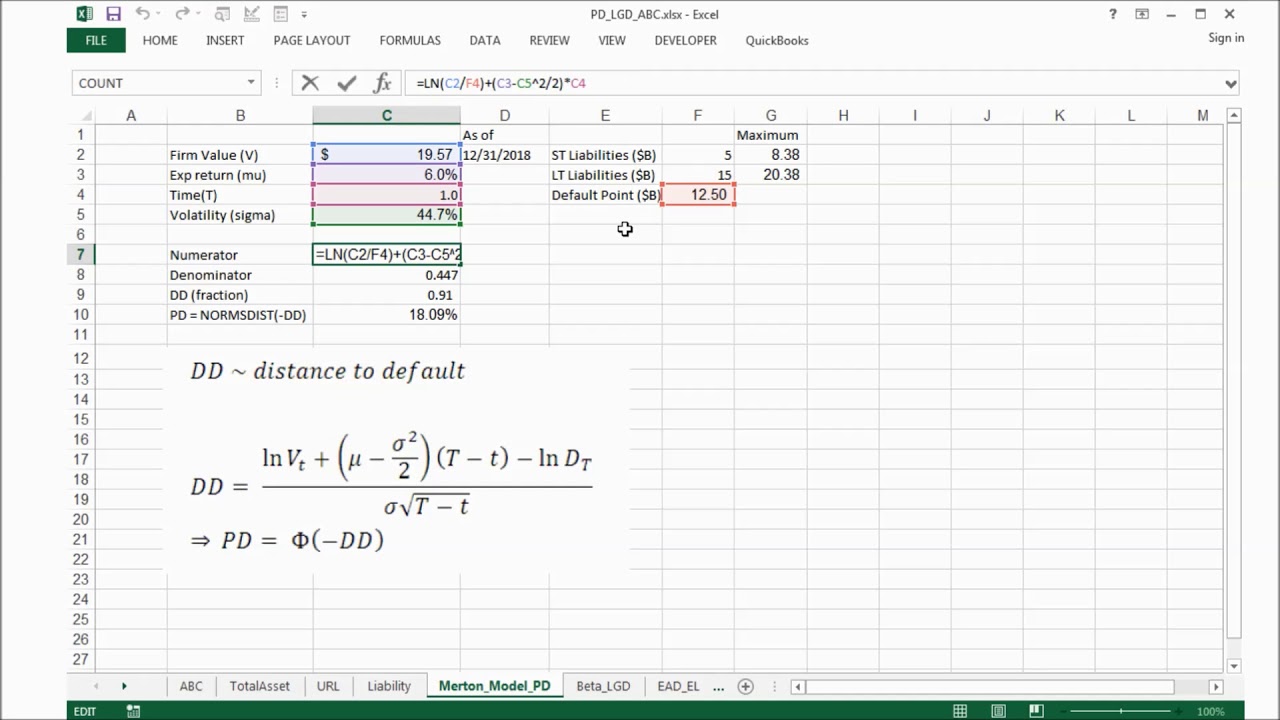

EAD, PD and LGD Modeling for EL Estimation

Показать описание

Calculated expected loss with actual financial data by modeling exposure at default, probability at default and loss given default.

3. Expected loss EL and its components PD LGD and EAD

EAD, PD and LGD Modeling for EL Estimation

Probability of Default (PD) and Loss Given Default (LGD) Explained

The Use of Loss Given Default (LGD) - Deloitte

Monitoring and Backtesting Credit Risk Models || PD, LGD, EAD || Basel || Risk Management

ECL Calculation Simplified / Practical Approach / IFRS 9

CREDIT RISK MODELLING - Scorecards | IFRS 9 | Basel | Stress Testing | Model Validation

Expected Credit Loss: Basel III vs IFRS 9

Credit Risk Analytics Study Pack: PD, LGD, EAD, Application Scorecard, Risk Model Validation

Stages in Probability of Default(PD) Model Development| Credit Risk Analytics(PD, LGD, EAD)

Steps in Probability of Default Model Development|Credit Risk Analytics- PD, LGD, EAD

Point in LGD using Jacob Frye Approach | IFRS 9 | ECL | Credit risk modelling

Credit Risk Modeling (For more information, see www.bluecourses.com )

Credit Risk Modelling PD LGD Introduction to BSM and ASRF Framework Day07

Credit Risk - Probability of Default, End-to-End Model Development | Beginner to Pro Level

Parâmetro de Perdas Esperadas Loss Given Default (#LGD).

International Basel IV-Channel, LGD Downturn Estimation, 05.10.2018

Credit Risk Modelling Introduction to PD LGD EAD Day04

IRB Approach_Probability of Default _SAS EM - 10

Calculating Expected Losses (EL) & loan loss provisioning under Basel with Excel example

Modeling Credit Risk - Part 2| Probability of Default | Loss Given Default | Expected Loss

Credit Risk Modelling Introduction to PD LGD EAD Variables Day05

Calculating LGD (Loss given default)

Survival Analysis (Part 1) - Advanced Credit Risk Management Course (Sample Video)

Комментарии

0:04:13

0:04:13

0:16:47

0:16:47

0:06:10

0:06:10

0:08:21

0:08:21

0:24:52

0:24:52

0:13:59

0:13:59

1:03:29

1:03:29

0:02:46

0:02:46

0:00:25

0:00:25

0:00:50

0:00:50

0:02:16

0:02:16

0:26:26

0:26:26

0:51:29

0:51:29

0:47:04

0:47:04

1:10:37

1:10:37

0:01:11

0:01:11

0:20:55

0:20:55

1:52:00

1:52:00

0:40:51

0:40:51

0:05:01

0:05:01

0:23:26

0:23:26

1:47:52

1:47:52

0:14:48

0:14:48

0:13:39

0:13:39