filmov

tv

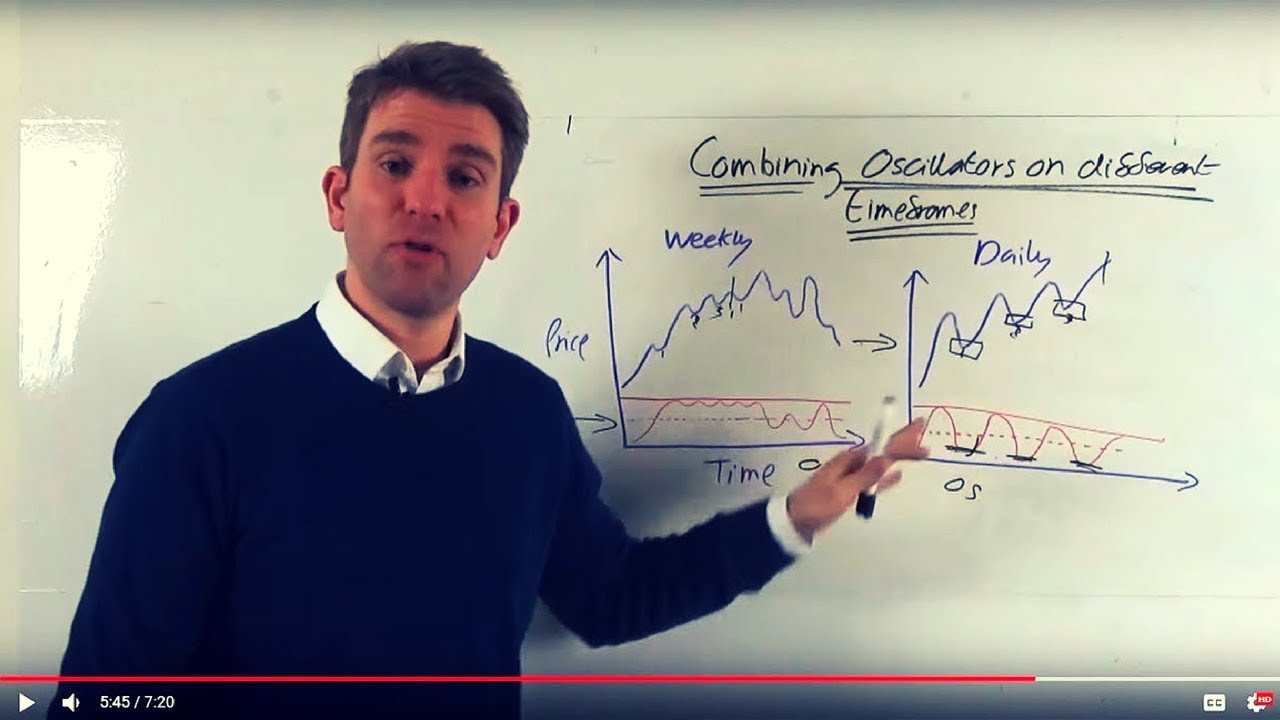

How to Combine two Oscillators Indicators for Trading? Multi Time Frame Analysis With Oscillators 👊

Показать описание

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

Related Videos

How To Best Use RSI (Relative Strength Index)

How to Profit from using the RSI (Relative Strength Index)? Part 1 📈

RSI Indicator Trading Strategy Part 2 📈

How To Filter Out RSI Indicator Fake Signals

6 Ways to Use the RSI (Relative Strength Index) 📈

The Stochastic Indicator: When it Works, When it Doesn't & Why - Part 1 📈

Stochastics Trading Strategy Part 2 📈

How to Combine two Oscillators Indicators for Trading? Multi Time Frame Analysis With Oscillators 👊

Using Price Oscillators in a Trending Market 💡

How to Get On Board a Trade You Initially Missed 👍

Related Videos

How To Best Use RSI (Relative Strength Index)

How to Profit from using the RSI (Relative Strength Index)? Part 1 📈

RSI Indicator Trading Strategy Part 2 📈

How To Filter Out RSI Indicator Fake Signals

6 Ways to Use the RSI (Relative Strength Index) 📈

The Stochastic Indicator: When it Works, When it Doesn't & Why - Part 1 📈

Stochastics Trading Strategy Part 2 📈

How to Combine two Oscillators Indicators for Trading? Multi Time Frame Analysis With Oscillators 👊

Using Price Oscillators in a Trending Market 💡

How to Get On Board a Trade You Initially Missed 👍

How to Combine two Oscillators Indicators for Trading? Multi Time Frame Analysis With Oscillators 👊...

How to merge indicators On TradingView | Awesome Oscillator + MACD | Multiple indicators

Combining Timeframes for Momentum Scalping Using Oscillators 💡

How to combine two indicators in TradingView pine script v5 [2023]💹

How To Combine Price Action And Momentum Oscillators Like A Pro

EEVblog 1614 - Circuit Design TIP: Crystal Oscillators

This FREE Indicator Has The Power Of 30 Oscillators! 😱

Trading Strategies using Multiple Oscillators

How To Use Technical Oscillators

Using Price Oscillators in a Trending Market 💡

How to Use Volume Oscillators and Trend Indicators to Make You Money

Stochastic RSI Trading Strategy

How Best to Use Oscillators and Momentum Indicators 📈

These Two Oscillators Made Me $28,000 (Step-by-step guide)

27) Build Algorithmic Trading Strategies by Combining Oscillators and Trend Following Indicators

Electronic Basics #17: Oscillators || RC, LC, Crystal

How to Use Volume Oscillators and Trend Indicators to Make You Money #Shorts

Coupled oscillators | Lecture 46 | Differential Equations for Engineers

Trading Strategies using Multiple Oscillators

Trading Using Oscillators and Indicators

Things To Do With Oscillators

Introduction To Forex Oscillators and Indicators

Frequency Modulation: Discover how two oscillators interact

How To Combine Price & Volume Using This LEADING Indicator (TSV Trading Strategies)

Комментарии

0:07:21

0:07:21

0:05:02

0:05:02

0:07:45

0:07:45

0:14:10

0:14:10

0:12:56

0:12:56

0:08:08

0:08:08

0:00:38

0:00:38

0:59:25

0:59:25

0:17:12

0:17:12

0:05:39

0:05:39

0:02:47

0:02:47

0:07:44

0:07:44

0:09:37

0:09:37

0:09:57

0:09:57

0:11:18

0:11:18

0:06:02

0:06:02

0:00:51

0:00:51

0:09:43

0:09:43

0:56:41

0:56:41

1:32:39

1:32:39

0:09:27

0:09:27

0:15:59

0:15:59

0:01:16

0:01:16

0:12:51

0:12:51