filmov

tv

Are There Any Legit Tax Relief Companies?

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

Should we tax the rich more?

How Big Earners Reduce their Taxes to Zero

Fine Art: the world’s most secret tax scam

Tax Tips in Germany that seem too good to be true

Here's how to pay 0% tax on capital gains

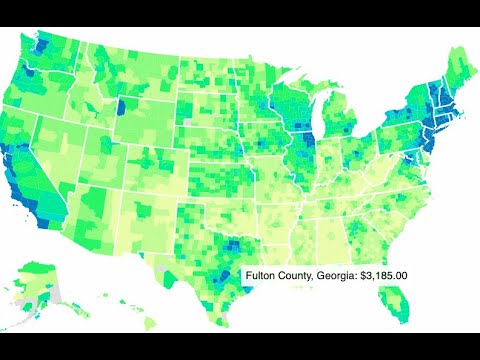

States with NO State Income Tax!!!! Tax Friendly States

PROOF Property Taxes Are A GIANT SCAM!

THE 401K SCAM | Deferring Taxes is an Awful Retirement Strategy

How Wealthy Individuals Legally Avoid Taxes (The Buy Borrow Die Method) #rich #taxsavingtips #money

Wake Up!! Politicians Don't Care About Tax Payers

Tax Brackets Explained For Beginners in The USA

How I Got a $10,000 Tax Refund (& How YOU Can Too!)

Can You Avoid a State's Taxes by Moving?

0% Long Term Capital Gains Tax--Is it Legit?

7 Tax Loopholes Only Rich People Understand

IRS Tax Scam Explained - You're Not Under Arrest

States With NO Property Tax For Retirees

How Do Large Corporations Avoid Paying Tax?

9 HUGE Tax Write Offs for Individuals (EVERYONE can use these)

Why debt is tax free - Robert Kiyosaki

Where Is Our Tax Money Going? | The Problem with Jon Stewart

What This Woman Learned About Taxes Will Leave You SPEECHLESS!

5 State RETIREMENT Tax Considerations You're Likely Not Considering... (State Taxes Explained)

Tax Heaven In India || Wealth Secret Podcast #tax . . . .

Комментарии

0:02:25

0:02:25

0:13:37

0:13:37

0:10:45

0:10:45

0:11:41

0:11:41

0:02:05

0:02:05

0:09:05

0:09:05

0:48:10

0:48:10

0:12:19

0:12:19

0:00:35

0:00:35

0:00:58

0:00:58

0:04:29

0:04:29

0:09:36

0:09:36

0:00:53

0:00:53

0:19:52

0:19:52

0:24:00

0:24:00

0:07:36

0:07:36

0:11:39

0:11:39

0:00:59

0:00:59

0:17:22

0:17:22

0:00:37

0:00:37

0:01:00

0:01:00

0:01:00

0:01:00

0:12:32

0:12:32

0:00:59

0:00:59