filmov

tv

Calculating Log Returns

Показать описание

This video provides an overview of how to calculate log returns in Excel.

Calculating Log Returns

Calculating Log Returns (ENG) | Excel | Formula #logreturn #excel

MS Excel: Calculating, Comparing, and Visualizing Simple Returns and Log Returns

How To Calculate Stock Returns [Excel and in Python] - Returns, Cumulative Returns, Log returns

Calculating Log Returns with Python

Simple Returns vs Log Returns : WHAT TO CHOOSE?

Log Returns in Finance: Continuous Compounding and Euler's Number (e) Explained

Simple Return vs. Log Return in Stock Price Analysis

Log Returns

Why we use Ln returns in finance

Calculating Stock Returns with Excel!

Arithmetic (simple) Returns vs LN Returns (continuously compounded) for Portfolio Management

Py 65 Calculating Logarithmic Returns

Log Return Properties

Percent vs Log Returns

Calculate & Graph Simple / Logarithmic / Cumulative Stock Returns in Python

How to calculate Log return , daily return and Holding period return for stock market data

Logarithms, Explained - Steve Kelly

compute log return, skewness, kurtosis using Excel

Calculate n-period log returns in one shot. Get it right first time| xl8ml.com

Log Return Automation in RStudio

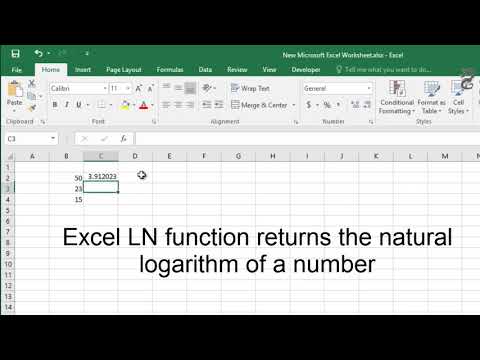

How to use LN Function in Excel: How to return the natural logarithm of a number

Returns the Logarithm of a number

How to Calculate Return on Stock in Excel

Комментарии

0:06:13

0:06:13

0:02:33

0:02:33

0:08:17

0:08:17

0:11:21

0:11:21

0:08:56

0:08:56

0:15:46

0:15:46

0:14:04

0:14:04

0:11:21

0:11:21

0:10:16

0:10:16

0:10:42

0:10:42

0:00:36

0:00:36

0:25:00

0:25:00

0:03:40

0:03:40

0:05:25

0:05:25

0:07:28

0:07:28

0:10:27

0:10:27

0:06:01

0:06:01

0:03:34

0:03:34

0:02:01

0:02:01

0:00:24

0:00:24

0:05:35

0:05:35

0:00:35

0:00:35

0:02:31

0:02:31

0:02:48

0:02:48