filmov

tv

Economic Value Added EVA

Показать описание

Economic Value Added explained! What does Economic Value Added mean? How to calculate Economic Value Added? Let’s introduce Economic Value Added step-by-step. Start with understanding the context first, and then get into the details of the calculation, including an example.

⏱️TIMESTAMPS⏱️

0:00 Introduction to Economic Value Added EVA

1:06 Accounting profit versus economic profit

1:49 ROIC vs WACC

2:26 Economic Value Added formula

3:24 Economic Value Added example

4:58 How to improve Economic Value Added EVA

To understand the need for a concept like Economic Value Added, let’s look at some profitability numbers. Which of these companies has the best profitability performance for the year? Exxon Mobil with a net income of $14B? Facebook with a net income of $18B? Johnson & Johnson with a net income of $15B? Or Walmart with a net income of $15B? Which one would you vote for?

I would imagine that most of you voted for the company with the highest net income number. The higher the net income, the better the financial performance, right? Not necessarily, it depends on how you look at it.

You can either look at a company from the perspective of accounting profit, or from the perspective of economic profit, and there are ways to convert numbers from one perspective to the other. With accounting profit, you look at metrics like GAAP-based net income. With economic profit, you look at the returns generated above the required rate of return. Economic profit is the “tougher” way to measure, it sets the bar higher. Economic Value Added is one of the ways to measure economic profit, and was developed and copyrighted by Stern Stewart and Company.

If you analyze the performance of a company from the economic profit perspective, you can choose between two approaches. The first one is comparing ratios. For example, ROIC (Return On Invested Capital) versus WACC (Weighted Average Cost of Capital). ROIC represents the returns generated, WACC represents the required rate of return. If ROIC is 12%, and WACC is 8%, then a company creates value. Only returns that exceed the required rate of return are good enough! The second approach is to adjust absolute amounts, this is where Economic Value Added comes in.

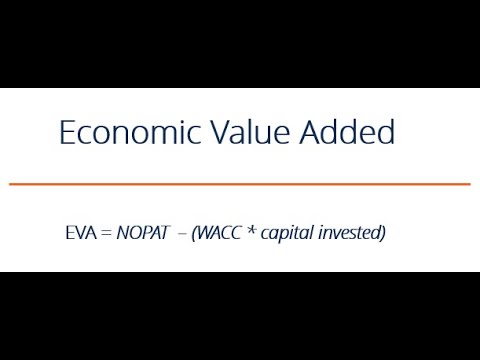

Here’s the Economic Value Added formula. This might look a bit cryptic at first. Fear not, we will go through each of the elements of the EVA formula, as well as illustrate Economic Value Added with a numerical example.

EVA equals NOPAT minus WACC times the invested capital. NOPAT is Net Operating Profit After Tax. WACC is the Weighted Average Cost of Capital. Invested Capital is interest-bearing debt + equity, or if you want to start off from the other side of the balance sheet net assets less non-interest-bearing current liabilities. Both of these definitions of invested capital should get you to the same number.

The second part of the formula is often summarized as the “capital charge”, the amount you deduct from NOPAT to get to the Economic Value Added, a variation on the idea of residual income.

Let’s fill in the #EVA formula with some more detail. To calculate NOPAT, we need to start from accounting profit in the income statement. This is the number we are looking for as a starting point: Operating Income, sometimes called EBIT (Earnings Before Interest and Tax). NOPAT equals Operating Income times 1 minus the effective tax rate. NOPAT measures the after-tax return generated for debt and equity holders combined, so it’s broader than net income which just measures the returns for the shareholders. If a company has an Operating Income of $20B, and an effective tax rate of only 10% (low, but certainly possible), then NOPAT is .9 times $20B equals $18B. If the company’s WACC is 8%, and its invested capital $150B, then we can start to fill in the Economic Value Added formula and see the result! $18 billion minus 8% times $150 billion, is $18 billion minus $12 billion, so $6 billion. Due to the “capital charge” of $12B (the dollar number representing the required rate of return on the invested capital), NOPAT of $18B shrinks to an EVA of $6B! This is the economic profit that is left over when adjusting for the cost of capital.

How can companies improve EVA? Increasing NOPAT, decreasing WACC, decreasing the invested capital.

Here’s a bonus tip to put EVA into perspective. If EVA is NOPAT minus WACC times invested capital, and ROIC is NOPAT divided by invested capital, then you can also write the EVA formula as (between brackets) ROIC minus WACC, times invested capital. With the same numbers we used before, 12% minus 8%, times $150B, equals 4% times $150B, is $6B of EVA.

Economic Value Added: a way to measure economic profit in absolute amounts, closely related to ROIC and WACC.

⏱️TIMESTAMPS⏱️

0:00 Introduction to Economic Value Added EVA

1:06 Accounting profit versus economic profit

1:49 ROIC vs WACC

2:26 Economic Value Added formula

3:24 Economic Value Added example

4:58 How to improve Economic Value Added EVA

To understand the need for a concept like Economic Value Added, let’s look at some profitability numbers. Which of these companies has the best profitability performance for the year? Exxon Mobil with a net income of $14B? Facebook with a net income of $18B? Johnson & Johnson with a net income of $15B? Or Walmart with a net income of $15B? Which one would you vote for?

I would imagine that most of you voted for the company with the highest net income number. The higher the net income, the better the financial performance, right? Not necessarily, it depends on how you look at it.

You can either look at a company from the perspective of accounting profit, or from the perspective of economic profit, and there are ways to convert numbers from one perspective to the other. With accounting profit, you look at metrics like GAAP-based net income. With economic profit, you look at the returns generated above the required rate of return. Economic profit is the “tougher” way to measure, it sets the bar higher. Economic Value Added is one of the ways to measure economic profit, and was developed and copyrighted by Stern Stewart and Company.

If you analyze the performance of a company from the economic profit perspective, you can choose between two approaches. The first one is comparing ratios. For example, ROIC (Return On Invested Capital) versus WACC (Weighted Average Cost of Capital). ROIC represents the returns generated, WACC represents the required rate of return. If ROIC is 12%, and WACC is 8%, then a company creates value. Only returns that exceed the required rate of return are good enough! The second approach is to adjust absolute amounts, this is where Economic Value Added comes in.

Here’s the Economic Value Added formula. This might look a bit cryptic at first. Fear not, we will go through each of the elements of the EVA formula, as well as illustrate Economic Value Added with a numerical example.

EVA equals NOPAT minus WACC times the invested capital. NOPAT is Net Operating Profit After Tax. WACC is the Weighted Average Cost of Capital. Invested Capital is interest-bearing debt + equity, or if you want to start off from the other side of the balance sheet net assets less non-interest-bearing current liabilities. Both of these definitions of invested capital should get you to the same number.

The second part of the formula is often summarized as the “capital charge”, the amount you deduct from NOPAT to get to the Economic Value Added, a variation on the idea of residual income.

Let’s fill in the #EVA formula with some more detail. To calculate NOPAT, we need to start from accounting profit in the income statement. This is the number we are looking for as a starting point: Operating Income, sometimes called EBIT (Earnings Before Interest and Tax). NOPAT equals Operating Income times 1 minus the effective tax rate. NOPAT measures the after-tax return generated for debt and equity holders combined, so it’s broader than net income which just measures the returns for the shareholders. If a company has an Operating Income of $20B, and an effective tax rate of only 10% (low, but certainly possible), then NOPAT is .9 times $20B equals $18B. If the company’s WACC is 8%, and its invested capital $150B, then we can start to fill in the Economic Value Added formula and see the result! $18 billion minus 8% times $150 billion, is $18 billion minus $12 billion, so $6 billion. Due to the “capital charge” of $12B (the dollar number representing the required rate of return on the invested capital), NOPAT of $18B shrinks to an EVA of $6B! This is the economic profit that is left over when adjusting for the cost of capital.

How can companies improve EVA? Increasing NOPAT, decreasing WACC, decreasing the invested capital.

Here’s a bonus tip to put EVA into perspective. If EVA is NOPAT minus WACC times invested capital, and ROIC is NOPAT divided by invested capital, then you can also write the EVA formula as (between brackets) ROIC minus WACC, times invested capital. With the same numbers we used before, 12% minus 8%, times $150B, equals 4% times $150B, is $6B of EVA.

Economic Value Added: a way to measure economic profit in absolute amounts, closely related to ROIC and WACC.

Комментарии

0:06:05

0:06:05

0:03:25

0:03:25

0:15:41

0:15:41

0:02:19

0:02:19

0:01:55

0:01:55

0:10:26

0:10:26

0:03:42

0:03:42

1:15:04

1:15:04

0:07:45

0:07:45

0:06:39

0:06:39

0:34:11

0:34:11

0:23:00

0:23:00

0:11:35

0:11:35

0:00:36

0:00:36

0:11:00

0:11:00

0:09:47

0:09:47

0:05:49

0:05:49

0:09:02

0:09:02

0:16:32

0:16:32

0:05:38

0:05:38

0:10:03

0:10:03

0:13:14

0:13:14

0:14:15

0:14:15

0:13:45

0:13:45