filmov

tv

4 Duopolies: Collusion, Cournot, Stackelberg, and Bertrand

Показать описание

This is a worked out problem in which I solve for firm quantity and market price in 4 different industry competitive structures: collusion, Cournot, Stackelberg, and Bertrand competition. This is appropriate for an Intermediate Microeconomics course without calculus, as well as for an Industrial Organization course.

4 Duopolies: Collusion, Cournot, Stackelberg, and Bertrand

Oligopoly Overview: Cournot, Bertrand, Stackelberg Oligopoly, Price Leadership

Oligopolies, duopolies, collusion, and cartels | Microeconomics | Khan Academy

Cournot and Stackelberg: How to Solve

How to Solve Cartel, Bertrand, Cournot, and Stackelberg Models

Cournot Model of Oligopoly by Vidhi Kalra Balana

4. Stackelberg Competition

Quantity Leadership (Stackelberg Oligopoly)

cournot vs stakelberg duopoly model.

oligopoly video 4 Stackelberg model analysis

3. Cournot Competition

Stackelberg Part 1: Stackelberg Duopoly

Stackelberg Competition | Microeconomics by Game Theory 101

Stackelberg Duopoly Practice Problem and how to solve Stackelberg

How to Solve Stackelberg in One Minute

Cournot Duopoly vs. Collusion

Introductory Microeconomics 63: Comparison of Collusive, Cournot, and Stackelberg Equilibria

Nash Equilibrium in 5 Minutes

Lecture 13D - Comparing Cournot and Stackelberg

Bertrand Oligopoly

36 Application to Collusion in Oligopolies

Game Theory and Oligopoly: Crash Course Economics #26

Cournot Oligopoly Problem

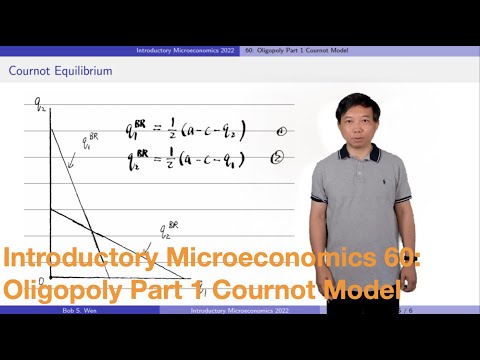

Introductory Microeconomics 60: Oligopoly Part 1 Cournot Model

Комментарии

0:17:57

0:17:57

0:06:54

0:06:54

0:08:26

0:08:26

0:09:22

0:09:22

0:09:39

0:09:39

0:11:43

0:11:43

0:10:32

0:10:32

0:07:43

0:07:43

0:18:08

0:18:08

0:30:04

0:30:04

0:10:51

0:10:51

0:09:19

0:09:19

0:10:42

0:10:42

0:11:28

0:11:28

0:01:00

0:01:00

0:14:07

0:14:07

0:09:17

0:09:17

0:05:17

0:05:17

0:05:28

0:05:28

0:09:44

0:09:44

0:12:03

0:12:03

0:09:56

0:09:56

0:05:26

0:05:26

0:09:39

0:09:39