filmov

tv

Abolishing Income Tax is the only way to fix the Economy: Subramanian Swamy

Показать описание

BJP Leader Subramaniam Swamy, who was the Minister of Commerce and Industry between 1990 and 1991, said that the only step to mitigate economic problems of India is to abolish income tax, in an exclusive interview with The Quint

Video: The Quint

To Stay Updated, Download The Quint App:

Follow The Quint here:

--------------------------------------------------------------------------------------------

Video: The Quint

To Stay Updated, Download The Quint App:

Follow The Quint here:

--------------------------------------------------------------------------------------------

Argentina is Abolishing Income Tax. Here's Why | Vantage with Palki Sharma

Abolishing Income Tax is the only way to fix the Economy: Subramanian Swamy

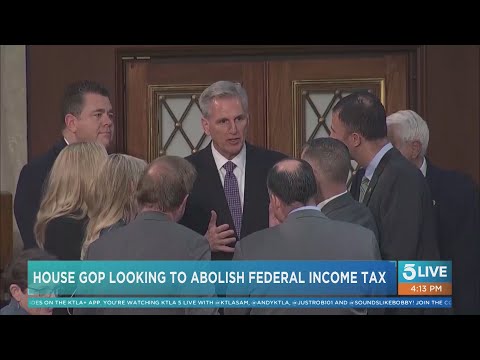

GOP leaders look to abolish the IRS and eliminate federal income tax

Trump to ABOLISH Income Taxes (if elected)? FULL DETAILS

Why states should abolish their state income tax

Why Inheritance Tax Should Be Abolished

House to vote on bill to abolish IRS and replace income tax with 'Fair Tax'

Need to abolish income tax completely for economy to boom: Subramanian Swamy

State Senators weigh in on bill which would abolish personal income tax

Subramanian Swamy: Government Should Abolish Income Tax System #BQ

How about abolishing the IRS?: David Asman

Republicans Propose Abolishing the IRS and Income Tax #shorts

Daniel Altman: It's Time to Abolish the Corporate Income Tax

Abolish income taxes?

What If Modi Government Abolishes Income Tax? 🇮🇳 | Union Budget 2024 | Charcha Jari Hai, Ep 22

Abolishing The IRS And Eliminating Income Tax? Is This True?

Abolishing NI as a tax

What happens if income tax is abolished in India 🇮🇳 #incometax #unionbudget2024

What Is Angel Tax And How Will Its Abolition Impact The Start Ups? | Union Budget 2024

S1: I Advised PM Rao & PM Modi to Abolish Income Tax | Subramanian Swamy ji

Ted Cruz on Passing a Flat Tax, Abolishing the IRS

Abolish The IRS

What if income tax is abolished? | Budget 2022 | Nutshell

Budget 2024: Angel tax abolished for startups; NPS for New Tax Regime

Комментарии

0:05:45

0:05:45

0:00:44

0:00:44

0:00:57

0:00:57

0:08:37

0:08:37

0:03:41

0:03:41

0:00:42

0:00:42

0:01:30

0:01:30

0:03:18

0:03:18

0:03:18

0:03:18

0:01:38

0:01:38

0:01:45

0:01:45

0:00:39

0:00:39

0:02:52

0:02:52

0:00:56

0:00:56

0:06:31

0:06:31

0:04:40

0:04:40

0:11:23

0:11:23

0:00:52

0:00:52

0:03:33

0:03:33

0:01:35

0:01:35

0:04:56

0:04:56

0:01:29

0:01:29

0:06:16

0:06:16

0:09:59

0:09:59