filmov

tv

Predicting Stock Prices with LSTMs: One Mistake Everyone Makes (Episode 16)

Показать описание

VOTE for my next course (note: if you already got this survey, you don't have to do it again):

Predicting Stock Prices with LSTMs: One Mistake Everyone Makes (Episode 16)

LSTM Top Mistake In Price Movement Predictions For Trading

Stock Price Prediction & Forecasting with LSTM Neural Networks in Python

Using LSTMs to Predict Stock Prices

Recurrent Neural Networks | LSTM Price Movement Predictions For Trading Algorithms

Stock Price Prediction & Forecasting with LSTM Neural Networks in Python

Stock Price Prediction And Forecasting Using Stacked LSTM- Deep Learning

I Day Traded $1000 of Stocks using the LSTM Model

Long Short-Term Memory (LSTM), Clearly Explained

Stock Price prediction using LSTM | Time Series data for LSTMs

Neural Nets Robot is Learning to Trade

Amazon Stock Forecasting in PyTorch with LSTM Neural Network (Time Series Forecasting) | Tutorial 3

A machine learning approach to stock trading | Richard Craib and Lex Fridman

What is LSTM (Long Short Term Memory)?

Stock Price Prediction And Forecasting Using Stacked LSTM- Deep Learning

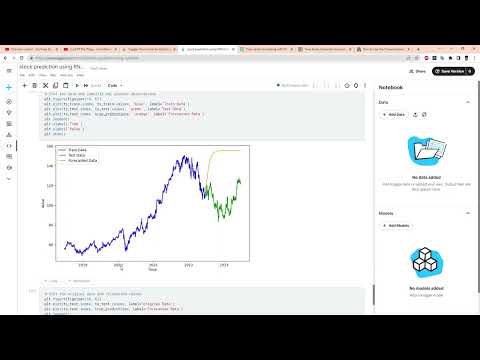

Stock price forecasting using LSTM

LSTM to forecast stock prices

Stock market prediction using Neural network (LSTM)

Stock Price Prediction Using Python | Machine Learning | LSTM

181 - Multivariate time series forecasting using LSTM

Predict The Stock Market With Machine Learning And Python

Stock Market Price Prediction using Machine Learning! Stacked LSTM Model

Simple Explanation of LSTM | Deep Learning Tutorial 36 (Tensorflow, Keras & Python)

Stock Price Prediction Using Python & Machine Learning

Комментарии

0:11:38

0:11:38

0:09:48

0:09:48

0:28:36

0:28:36

0:20:34

0:20:34

0:14:51

0:14:51

0:21:54

0:21:54

0:36:33

0:36:33

0:16:07

0:16:07

0:20:45

0:20:45

0:20:09

0:20:09

0:00:16

0:00:16

0:31:53

0:31:53

0:12:07

0:12:07

0:08:19

0:08:19

0:20:39

0:20:39

0:10:03

0:10:03

0:01:19

0:01:19

0:01:00

0:01:00

0:32:50

0:32:50

0:22:40

0:22:40

0:35:55

0:35:55

0:28:51

0:28:51

0:14:37

0:14:37

0:49:48

0:49:48