filmov

tv

GCC VAT - Purchase of Capital Goods for GCC VAT in Tally ERP 9

Показать описание

When capital goods are purchased, the input tax is adjusted based on the actual use of the goods during the specified period. You can record the input credit claim using a journal voucher.

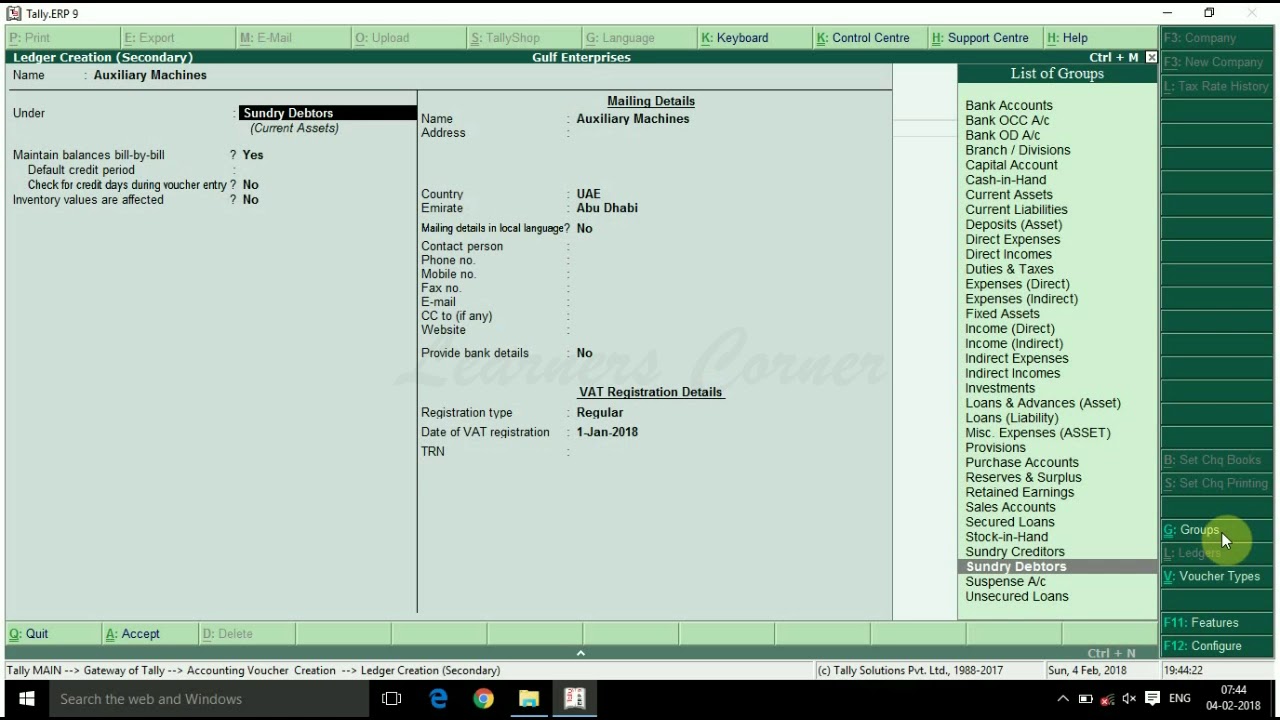

Record purchases of capital goods

1. Go to Gateway of Tally - Accounting Vouchers - F9: Purchases.

2. Press Ctrl+V to switch to voucher mode.

3. Press F12: Configure twice, set the option Allow expenses/fixed assets in purchase vouchers? to Yes.

4. Press Ctrl+A to return to voucher screen.

5. Enter Supplier Invoice No. and Date.

6. Credit the party ledger and enter the amount.

7. Debit the fixed assets ledger (grouped under Fixed Assets and with Domestic Taxable Purchase - Capital Goods selected as the Nature of transaction) and enter the taxable value.

8. Enter the VAT Rate and Taxable Value in the VAT Details screen displayed.

9. Press Crtl+A to return to the voucher.

10. Debit current assets ledger created under Current Assets.

11. Press Ctrl+A to accept the voucher.

Record purchases of capital goods

1. Go to Gateway of Tally - Accounting Vouchers - F9: Purchases.

2. Press Ctrl+V to switch to voucher mode.

3. Press F12: Configure twice, set the option Allow expenses/fixed assets in purchase vouchers? to Yes.

4. Press Ctrl+A to return to voucher screen.

5. Enter Supplier Invoice No. and Date.

6. Credit the party ledger and enter the amount.

7. Debit the fixed assets ledger (grouped under Fixed Assets and with Domestic Taxable Purchase - Capital Goods selected as the Nature of transaction) and enter the taxable value.

8. Enter the VAT Rate and Taxable Value in the VAT Details screen displayed.

9. Press Crtl+A to return to the voucher.

10. Debit current assets ledger created under Current Assets.

11. Press Ctrl+A to accept the voucher.

0:05:22

0:05:22

0:06:05

0:06:05

0:02:54

0:02:54

0:02:59

0:02:59

0:02:03

0:02:03

0:04:22

0:04:22

0:08:08

0:08:08

0:01:24

0:01:24

0:11:28

0:11:28

0:35:17

0:35:17

0:07:23

0:07:23

0:26:11

0:26:11

0:00:24

0:00:24

0:11:04

0:11:04

0:41:39

0:41:39

0:08:29

0:08:29

0:01:27

0:01:27

0:01:59

0:01:59

0:13:12

0:13:12

0:01:49

0:01:49

0:07:09

0:07:09

0:06:51

0:06:51

0:07:38

0:07:38

0:14:37

0:14:37