filmov

tv

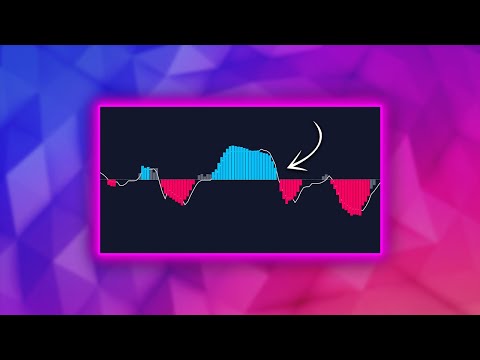

Backtesting Hundreds of Stocks at Once, in Python

Показать описание

Thanks for watching this part three of the backtesting tutorial.

Link to the Google Colab Notebook that is featured in this video:

Submit a strategy for me to backtest in a future video:

Simply save a copy into your own Google account

If you missed parts 1 and 2:

Part 1:

Part 2:

As always, nothing here is investment advice and I am not an investment advisor. Additionally, there is no guarantee of accuracy to the code presented.

Link to the Google Colab Notebook that is featured in this video:

Submit a strategy for me to backtest in a future video:

Simply save a copy into your own Google account

If you missed parts 1 and 2:

Part 1:

Part 2:

As always, nothing here is investment advice and I am not an investment advisor. Additionally, there is no guarantee of accuracy to the code presented.

Backtesting Hundreds of Stocks at Once, in Python

My New Code to Backtest on Every Stock at Once!

The BEST Way To Start Backtesting #trading #stocks #stocktrading #stockmarket #gme #shorts

Backtesting Every Stock at Once: Unveiling the Ultimate Trading Strategy 📊🚀 #tradingstrategies

Bar replay | breakout stock | trading view | backtesting

How to Backtest PROPERLY

Stock Alert Backtesting - ChartsWatcher Stock Scanner

Backtesting OVER 500 STOCKS with a Trading Strategy using Object Oriented Programming [OOP]

#mehnat#karo#bhai#treding/stock#market#. back#testing#..📊📝

I Tested This Trading Strategy & It Made 310%

Backtest Any Stock Strategy In thinkorswim

Backtest With HeatMaps. #bitcoin #coding #stock #automatedtrading #algorithmtrading

Easy way to backtest strategies! #stocks #stockmarket

Backtest My Strategy EMA Base #scalping #trending #stockmarket #stocks #trending

Morning backtesting sessions #forex #fundedtrading #stocks #daytrading

🔍 Revealing the Power of Back Testing: Mastering Stock Market Predictions 🚀

Stock Market Backtesting| Nifty 50| Indian Stock Market| Price Action | Candlesticks Chart patterns

Support + Engulfing #backtesting #shearmarket #stocks #stockmarket #nifty #trading #viral #tips

No backtesting? #stocks #investing #trading

How To Get Stock Data To Backtest Strategies #trading #backtesting #dataanalysis #excel #stocks

Trading strategy and Backtest in Python [Momentum of ALL S&P 500 stocks]

How To Know When To Buy And Sell Stocks #shorts

Did you know? Backtest stocks return pre and post result for historical years.

'Pro Tips: Stock Backtesting for Free – 60-Second Guide!' #banknifty #optionstrading #vira...

Комментарии

0:16:20

0:16:20

0:05:35

0:05:35

0:00:30

0:00:30

0:00:34

0:00:34

0:00:44

0:00:44

0:18:36

0:18:36

0:00:10

0:00:10

0:23:25

0:23:25

0:00:19

0:00:19

0:01:00

0:01:00

0:17:10

0:17:10

0:00:52

0:00:52

0:00:53

0:00:53

0:00:50

0:00:50

0:00:11

0:00:11

0:00:08

0:00:08

0:00:15

0:00:15

0:00:15

0:00:15

0:00:06

0:00:06

0:00:24

0:00:24

0:27:24

0:27:24

0:01:00

0:01:00

0:00:38

0:00:38

0:01:00

0:01:00