filmov

tv

Financial Ratios Analysis | Lecture#1 | Liquidity Ratios | Solvency Ratios | Profitability Ratios

Показать описание

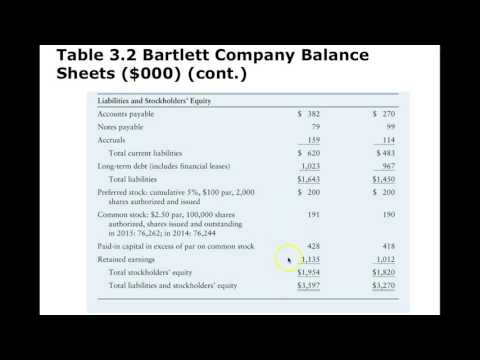

Financial ratios are mathematical expressions that are used to analyze a company's financial performance and health. They are calculated using financial statement data, such as balance sheets, income statements, and cash flow statements. Financial ratios provide insights into various aspects of a company's financial performance, such as profitability, solvency, liquidity, and efficiency.

The purpose of financial ratios is to simplify and summarize financial data in a meaningful and easy-to understand manner. By analyzing financial ratios, investors, creditors, and management can make informed decisions about a company's financial health, performance, and future prospects. Financial ratios can also be used to compare a company's performance with that of its competitors, industry averages, and historical performance.

Financial ratios are important tools for analyzing a company's financial performance and health. They provide valuable insights into various aspects of a company's operations, such as its liquidity, solvency, profitability, efficiency, and leverage. Financial ratios help investors, lenders, and managers make informed decisions about a company by allowing them to compare its performance with industry averages, track its trends over time, and identify strengths and weaknesses. By evaluating financial ratios, stakeholders can assess a company's ability to generate revenue, pay debts, maintain profitability, and make informed predictions about its future performance.

My Book on Financial Ratios Analysis

#financialratios #ratio #ratios #RatiosAnalysis #bank #banking #finance #financial #financialeducation #liquidity #solvencyratios #liquidityratios #leverage #leveragetrading #profitability #profitabilityratios #efficiencyratios #efficiency #marketvalueratios #currentratio #quickratio #cashratio #networking #debt #debttoequityratio #debttoincomeratios #asset #liabilities #interestcoverageratio #grossprofit #operatingprofit #returnonequity #returnoninvestment #returnonassets #ROA #ROE #returnonequity

@BankPortal

Follow me on Social Media:

Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in the favor of fair use

The purpose of financial ratios is to simplify and summarize financial data in a meaningful and easy-to understand manner. By analyzing financial ratios, investors, creditors, and management can make informed decisions about a company's financial health, performance, and future prospects. Financial ratios can also be used to compare a company's performance with that of its competitors, industry averages, and historical performance.

Financial ratios are important tools for analyzing a company's financial performance and health. They provide valuable insights into various aspects of a company's operations, such as its liquidity, solvency, profitability, efficiency, and leverage. Financial ratios help investors, lenders, and managers make informed decisions about a company by allowing them to compare its performance with industry averages, track its trends over time, and identify strengths and weaknesses. By evaluating financial ratios, stakeholders can assess a company's ability to generate revenue, pay debts, maintain profitability, and make informed predictions about its future performance.

My Book on Financial Ratios Analysis

#financialratios #ratio #ratios #RatiosAnalysis #bank #banking #finance #financial #financialeducation #liquidity #solvencyratios #liquidityratios #leverage #leveragetrading #profitability #profitabilityratios #efficiencyratios #efficiency #marketvalueratios #currentratio #quickratio #cashratio #networking #debt #debttoequityratio #debttoincomeratios #asset #liabilities #interestcoverageratio #grossprofit #operatingprofit #returnonequity #returnoninvestment #returnonassets #ROA #ROE #returnonequity

@BankPortal

Follow me on Social Media:

Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in the favor of fair use

Комментарии

0:23:57

0:23:57

0:10:09

0:10:09

0:19:55

0:19:55

0:44:03

0:44:03

0:09:19

0:09:19

0:06:30

0:06:30

0:53:07

0:53:07

0:24:27

0:24:27

1:10:34

1:10:34

0:36:25

0:36:25

1:49:16

1:49:16

0:38:45

0:38:45

1:16:37

1:16:37

0:50:04

0:50:04

0:36:22

0:36:22

0:07:03

0:07:03

0:42:01

0:42:01

0:08:17

0:08:17

1:10:58

1:10:58

0:24:20

0:24:20

0:45:11

0:45:11

0:46:12

0:46:12

0:04:46

0:04:46

1:35:45

1:35:45