filmov

tv

Finding the Value of Two or More Equivalent Replacement Payments (2 Examples)

Показать описание

Follow us:

Q1. Marc is due to make a payment of $1000 now. Instead, he negotiated to make two equal payments, one year and two years from now. Determine the size of the equal payments if money is worth 8% compounded quarterly.

Q2. What is the size of the equal payments that must be made at the end of each of the next five years to settle a debt of $5000 due in five years, if money is worth 9% p.a. compounded annually?

Solving Two - Step Equations - How to Find the Value of X!

USA Olympiad Mathematics | Check the Two Methods | find the value of a=?

Finding the Value of Two or More Equivalent Replacement Payments (2 Examples)

Find the Value of k and the Two Roots for this Quadratic Equation | Easy Step-by-Step Explanation

Find the value of two numbers if their sum is 12 and their difference is 4

Finding of value of Two variables from Matrix Equation - CBSE Maths Class XII

Finding the Value of X to Prove Two Lines are Parallel

How to Find the Distance Between Two Numbers | Measuring Distance, Absolute Value

Physics Dimensions: How to Find the Dimension of a Physical Quantity in a Given Formula. #dimensions

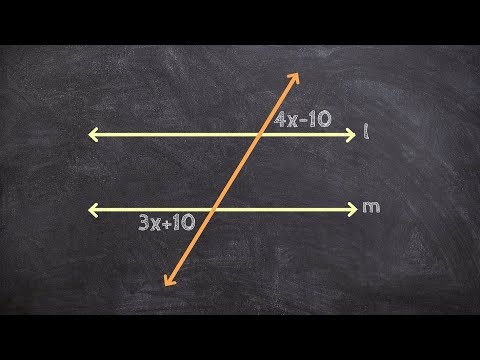

Find the Value of X to Prove Two Lines are Parallel Using Alternate Exterior Angles

How to Find Value of k when Two Linear Equations have Infinitely Many Solutions - Simple Tutorial

How to check if a value is between two values in Excel

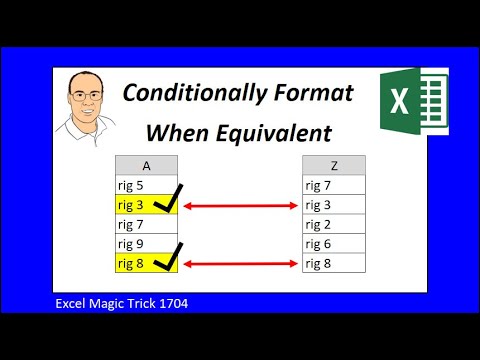

Conditionally Format When Two Columns have Same Value. Excel Magic Trick 1704.

Find the critical value associated with a two tailed test when testing a claim about a proportion

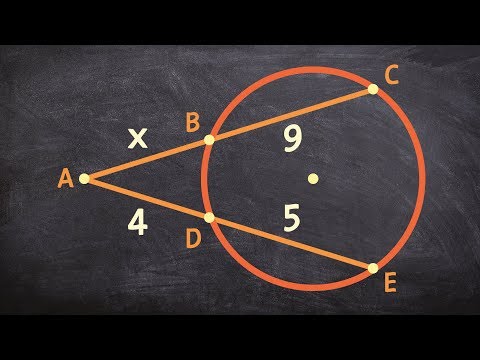

Find the missing value using two secant lines from a point outside of the circle

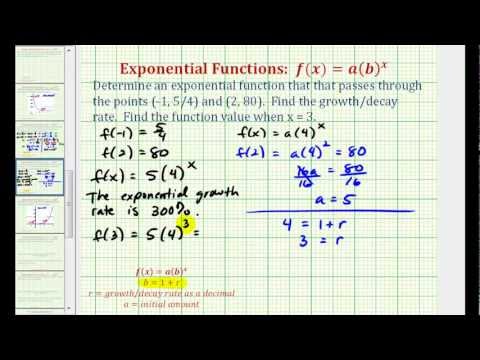

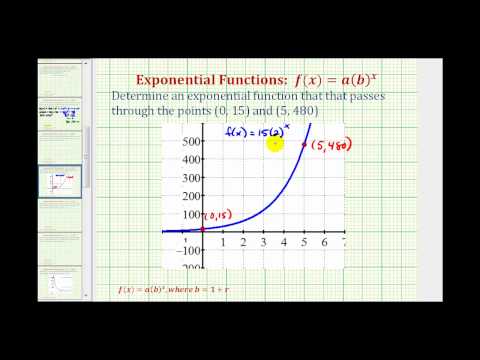

Ex: Find an Exponential Function Given Two Points - Initial Value Not Given

Find the value of x given Transversal intersects two parallel lines

How to evaluate for a value the product of two functions

Ex: Find an Exponential Growth Function Given Two Points - Initial Value Given

Finding a value of x that makes two lines perpendicular

Finding the p value in a two tailed test Standard

Find the Value of k when Two Quadratic Equations have ONE Common Root - Quick & Easy Explanation

Find the value of k such that the two lines do not intersect

Solving an Absolute Value Equation with Two Absolute Value Expressions (Example)

Комментарии

0:08:59

0:08:59

0:08:08

0:08:08

0:08:50

0:08:50

0:18:06

0:18:06

0:02:45

0:02:45

0:04:32

0:04:32

0:04:53

0:04:53

0:05:39

0:05:39

0:13:45

0:13:45

0:02:46

0:02:46

0:06:26

0:06:26

0:01:23

0:01:23

0:01:51

0:01:51

0:03:26

0:03:26

0:03:43

0:03:43

0:06:23

0:06:23

0:05:46

0:05:46

0:02:23

0:02:23

0:04:30

0:04:30

0:01:40

0:01:40

0:03:40

0:03:40

0:04:12

0:04:12

0:04:36

0:04:36

0:06:50

0:06:50