filmov

tv

China, the Fed, and the Middle East War - ALL Pushing Prices Higher

Показать описание

TIMECODES

0:00 Intro

0:37 China's Stimulus Package

2:58 War In the Middle East

6:36 How Important Cheap Oil is

7:53 Port Workers on Strike

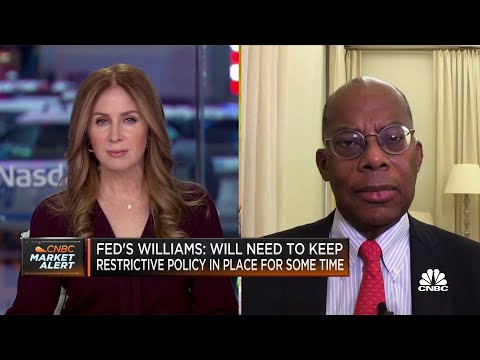

10:41 The Federal Reserve

12:33 Insane Deficits

Important Links:

Affiliates & Partners:

Socials @HeresyFinancial

My name is Joe Brown, and I'm a former stock broker who spent years advising the top 1% on how to manage their wealth. After making enough money to leave the corporate world behind, I turned my attention to teaching regular people financial strategies that exist outside the mainstream - things you'd never hear from your traditional fiancial advisor.

I am not a CPA, attorney, or licensed financial advisor and the information in these videos shall not be construed as tax, legal, or financial advice from a qualified perspective. Linked items may create a financial benefit for Heresy Financial.

China, the Fed, and the Middle East War - ALL Pushing Prices Higher

China Stocks Price-Action Is Terrible | Markets in 3 Minutes

Volatility Grips Chinese Stocks | Bloomberg: The China Show 10/10/2024

Does China Change Things for the FED? | The Big Conversation | Refinitiv

Kyle Bass talks China, markets and the Fed

DBS Chief Economist on China Slowdown, Fed

China and the Fed are the biggest sources of economic uncertainty, says Cashin

Mark Mobius on the Fed, Inflation, China’s Recovery

China Stocks Tumble Amid Stimulus Skepticism | Bloomberg: The China Show 10/9/2024

Trump talks China, the Fed Apple, the dollar and more

This Fed Official Sees More Rate Cuts This Year | Bloomberg Markets: Asia 10/10/2024

China could spoil the Fed Pivot party | The Big Conversation | Refinitiv

China rally loses steam as authorities disappoint markets

U.S. Listens to Fed Speakers as China Awaits Fiscal Policy Changes

China's Economy In Crisis: Desperate $850 Billion Stimulus Package Unveiled

Future of the Fed

Asian Stocks Advance After Fresh S&P 500 Record | Bloomberg: The Asia Trade 10/10/24

Covid unrest in China will not impact the Fed's moves against inflation, says Mohamed El-Erian

Trump: Our problem's with the Fed, not China

Chinese developer Kaisa pleads for help as Fed warns of risks

President Donald Trump on China, Mexico, tariffs and the Fed (Full Interview - 6/10/19)

The Markets in 3 Minutes: China's Rebound, Fed Fallout

Ongoing uncertainty in China is a double-edged sword for the Fed, says Roger Ferguson

State Street's Weis on China Economy, Fed Policy, Emerging Markets

Комментарии

0:15:37

0:15:37

0:03:12

0:03:12

1:31:07

1:31:07

0:06:24

0:06:24

0:11:01

0:11:01

0:10:09

0:10:09

0:06:03

0:06:03

0:05:58

0:05:58

1:33:12

1:33:12

0:10:33

0:10:33

0:48:58

0:48:58

0:19:28

0:19:28

0:06:42

0:06:42

0:06:23

0:06:23

0:02:42

0:02:42

0:06:45

0:06:45

1:33:21

1:33:21

0:04:20

0:04:20

0:01:17

0:01:17

0:01:41

0:01:41

0:27:08

0:27:08

0:03:11

0:03:11

0:04:55

0:04:55

0:06:45

0:06:45